Mars/Neptune ... the highs and lows

Week beginning February 4, 2013

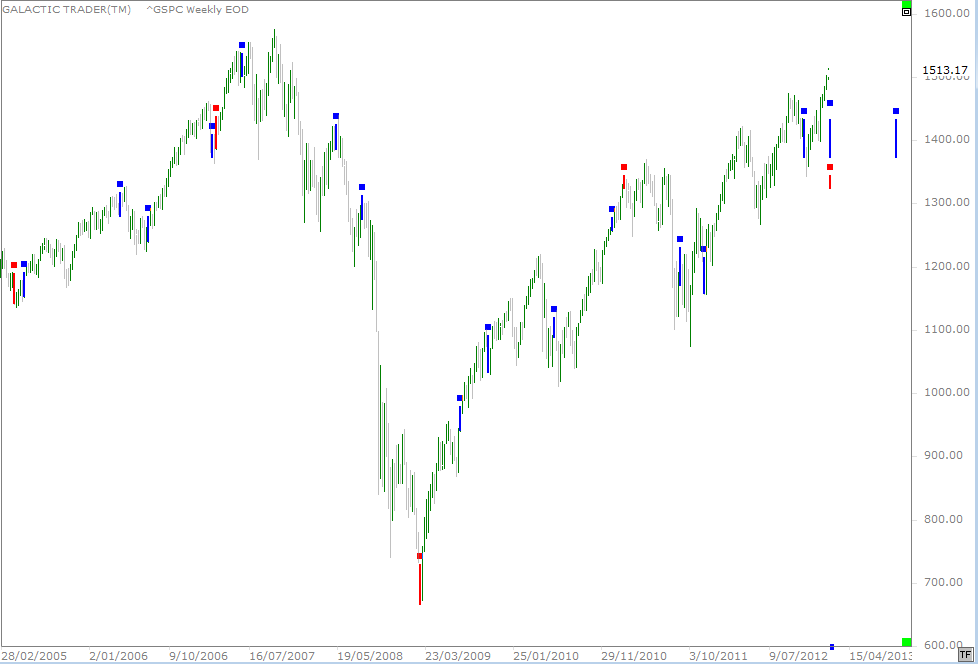

Wall Street's broad-based SP500 ... the Pollyanna index ... is now only a fistful of dollars away from contact with a planetary price line which topped out the two previous Bull peaks.

Copyright: Randall Ashbourne - 2011-2013

However, we also discussed the lunar phase in effect last week - FM-3Q - and I said: "So, expecting a major trend change to develop here does fly in the face of the 'normal' statistical tendency for many markets to rise strongly during this lunar phase. Last year, this phase was negative only 3 of the 12 times for the SP500."

This week's phase - 3Q-NM - was also strong last year, though the strength of the rallies varied dramatically between various world indices.

There are also two important astrological aspects this week which have a reasonably reliable track record of bringing on a shift in the market mood.

Mars changes signs to Pisces this weekend and will conjunct the sign's ruler, Neptune, as the trading week gets underway ... and there is a trine between the two benefics, Venus and Jupiter.

This week's phase - 3Q-NM - was also strong last year, though the strength of the rallies varied dramatically between various world indices.

There are also two important astrological aspects this week which have a reasonably reliable track record of bringing on a shift in the market mood.

Mars changes signs to Pisces this weekend and will conjunct the sign's ruler, Neptune, as the trading week gets underway ... and there is a trine between the two benefics, Venus and Jupiter.

Chicken Little is in the wings, ready to take centre stage.

Last weekend, we looked at the potential for Sun square Saturn and Jupiter turning Direct to trigger the first major trend change date of 2013.

Last weekend, we looked at the potential for Sun square Saturn and Jupiter turning Direct to trigger the first major trend change date of 2013.

Safe trading - RA

(Disclaimer: This article is not advice or a recommendation to trade stocks; it is merely educational material.)

There is a general rule in astrological interpretation that the more infrequent the aspect, the stronger its impact will tend to be. Venus trines Jupiter a couple of times a year, but Mars conjuncts Neptune only once every couple of years.

The chart below shows the recent impacts of the two aspects ... with the Venus/Jupiter trines marked by the blue bars and the Mars/Neptune conjunctions displayed as red bars.

The chart below shows the recent impacts of the two aspects ... with the Venus/Jupiter trines marked by the blue bars and the Mars/Neptune conjunctions displayed as red bars.

As we can see, the Mars/Neptune conjunctions are significant. Of the four previous instances shown on this chart, one occurred at the bottom of the Bear and two coincided, within a week, of a countertrend low during the Bull run into the 2007 top; with the 4th instance producing a temporary peak early in 2011.

The Venus/Jupiter trines are not quite as reliable as specific turn markers, but the impact is fairly regular - 8 of the 14 instances shown coincided closely with interim lows or highs.

Given the level the Pollyanna index is now approaching (details are within the Forecast 2013 document) and the statistical tendency for markets to produce a high heading into New Moon (next weekend), the two key astro aspects for the week may be enough to cue Chicken Little for a return to centre stage.

The Venus/Jupiter trines are not quite as reliable as specific turn markers, but the impact is fairly regular - 8 of the 14 instances shown coincided closely with interim lows or highs.

Given the level the Pollyanna index is now approaching (details are within the Forecast 2013 document) and the statistical tendency for markets to produce a high heading into New Moon (next weekend), the two key astro aspects for the week may be enough to cue Chicken Little for a return to centre stage.

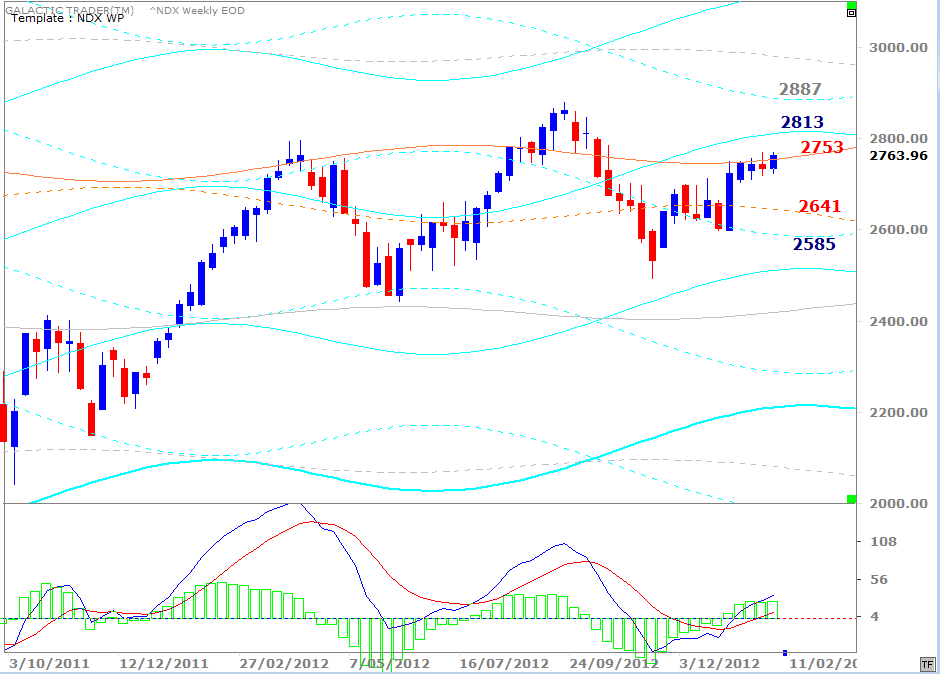

The positive pop on Friday finally managed to get the Nasdaq 100, NDX, closing above the Uranus line which has stalled its advance for the past month. It is not yet enough, however, to rule out the possibility the index is forming the right shoulder of a negative pattern with considerable downside in the intermediate term.

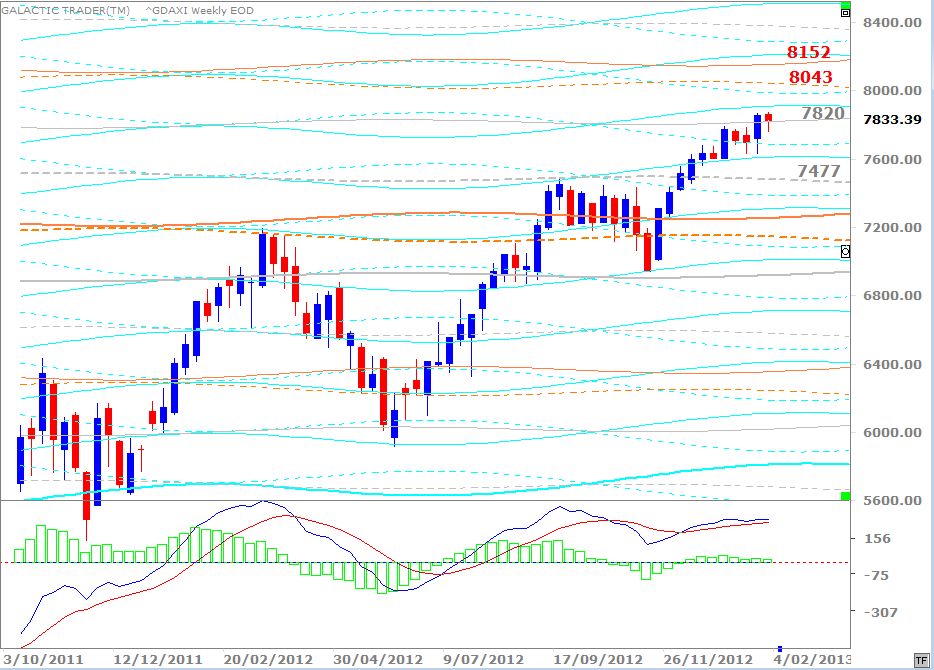

Germany's DAX is attempting to consolidate on top of the Neptune line it finally broke above the previous week. Weakness continues to build in the fast MACD. The peaks of both the signal lines and the histograms are falling as price continues to rise.

Forecast 2013 is now available for sale and download.

Click the button on the right for more details.

Click the button on the right for more details.

NEW:

Forecast 2013 is now available for sale and download.

Click the button on the right for more details.

Click the button on the right for more details.

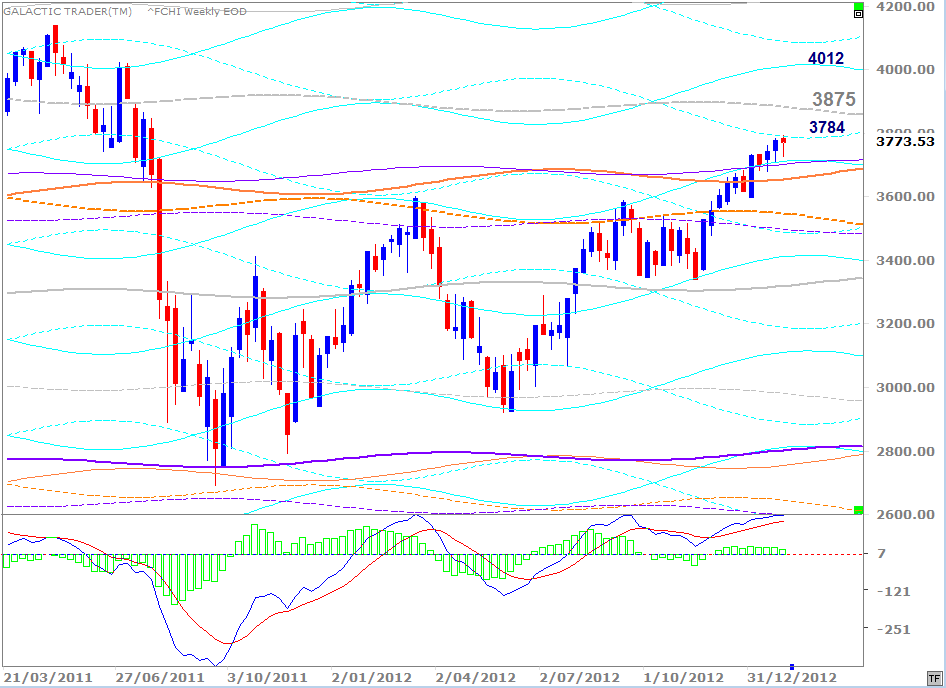

France's CAC40, above, remains stalled at a weekly Saturn level. Those of you who have the Forecast might want to consult the table on Page 20 and consider how this index varied from some others last year in terms of its 3Q-NM performance.

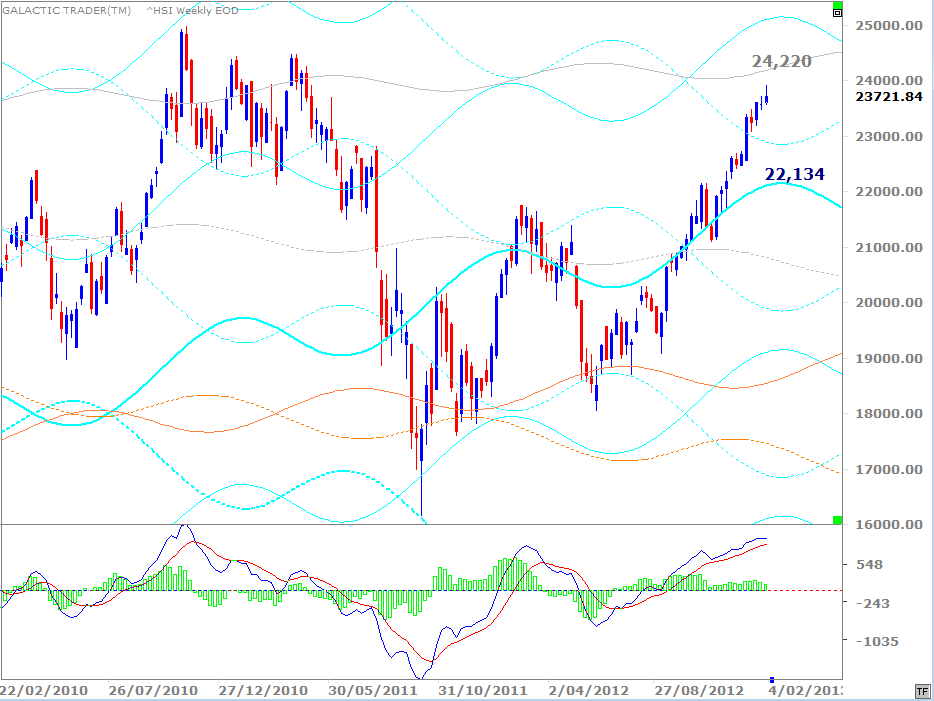

Hong Kong hasn't made a lot of progress in the past couple of weeks, but is still heading for the Neptune line at 24,220. There is negative divergence in the height of the MACD histograms, but not in the peak of the signal lines.

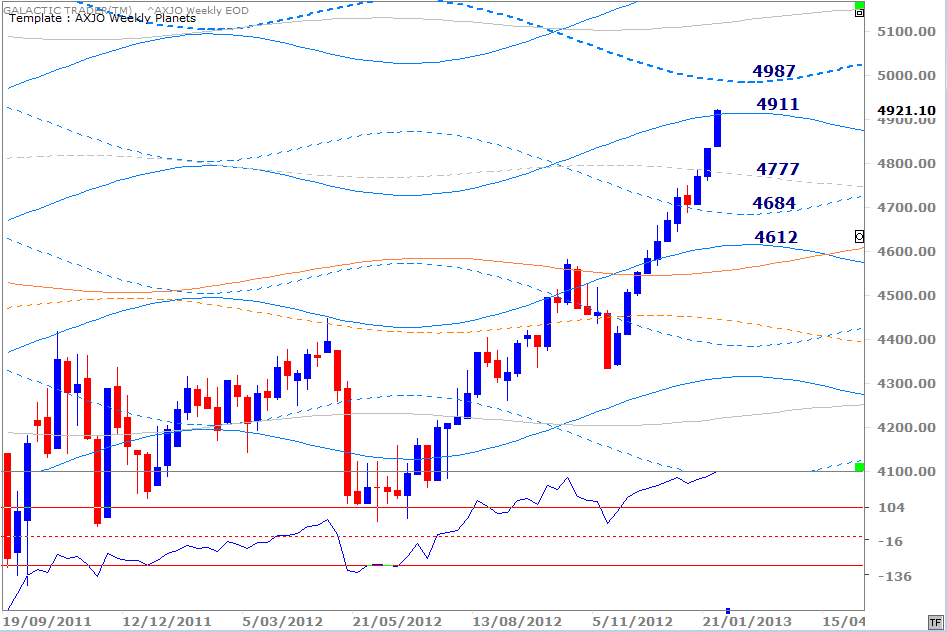

The ASX 200 had a couple of strong days within its shortened week, closing slightly above the weekly planetary barrier at 4911ish. There is no negative divergence current in the state of the oscillator, so the probability is we have not seen the 2013 peak in this index yet, either.

Overall then ... we have the potential for weakness to start developing as indices begin pushing against major, long-term resistance, but at this stage there are no alarm bells suggesting anything other than a pause or intermediate-level correction is coming due.

Overall then ... we have the potential for weakness to start developing as indices begin pushing against major, long-term resistance, but at this stage there are no alarm bells suggesting anything other than a pause or intermediate-level correction is coming due.