The Year of Trading Less Dangerously

Week beginning January 7, 2013

Hello and welcome to the first weekend report for 2013.

Copyright: Randall Ashbourne - 2011-2013

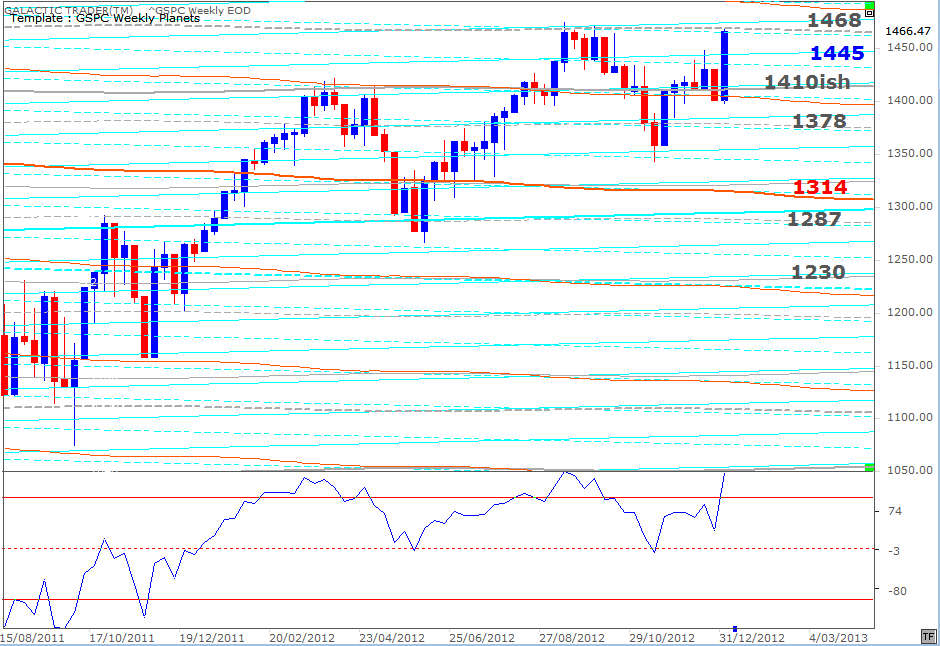

As you know from the long-range planetary charts I published at various intervals last year, it's an important level and a strong breakout above it opens the strong probability the index will hit other predetermined levels.

I won't be publishing any of those long-range charts until at least the second half of the year. And that's because I put a lot of time over the past few weeks, researching and creating those charts and tailoring them to individual stock indices across the world. They're all in Forecast 2013, along with the technical condition of the indices ... and a close examination of how they varied in relation to Moon Trading over the past year.

The Forecast also contains the full list of critical reversal dates likely to be important during 2013 and a month-by-month breakdown of the astrological weather.

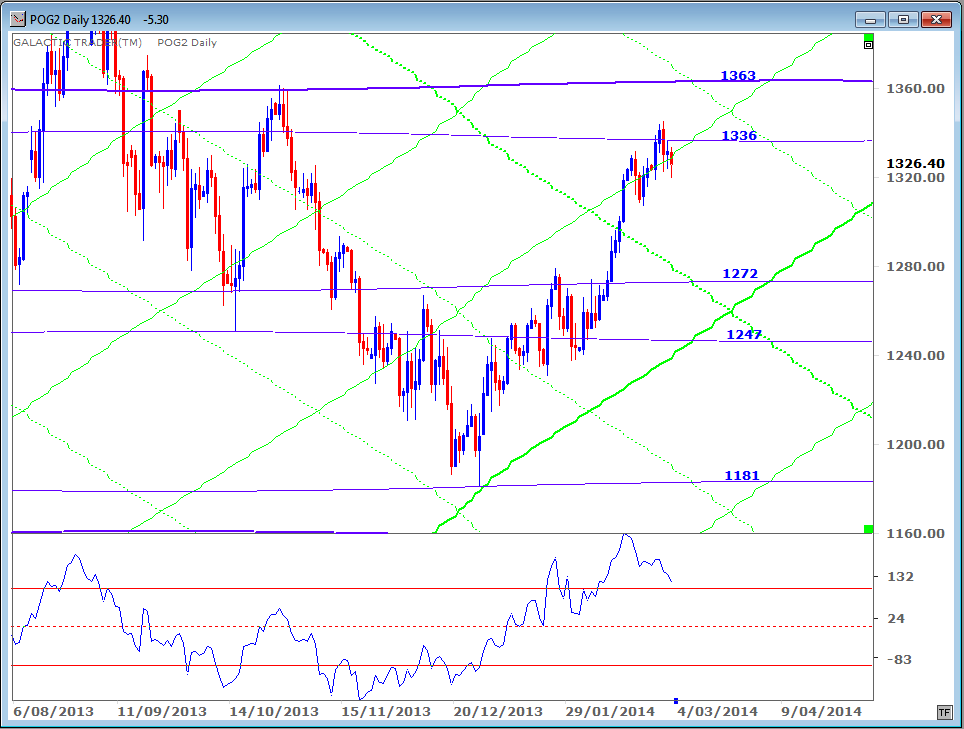

For those of you interested in trading gold, there's a chapter I think is both exciting and informative. And I rarely get excited these days!

I won't be publishing any of those long-range charts until at least the second half of the year. And that's because I put a lot of time over the past few weeks, researching and creating those charts and tailoring them to individual stock indices across the world. They're all in Forecast 2013, along with the technical condition of the indices ... and a close examination of how they varied in relation to Moon Trading over the past year.

The Forecast also contains the full list of critical reversal dates likely to be important during 2013 and a month-by-month breakdown of the astrological weather.

For those of you interested in trading gold, there's a chapter I think is both exciting and informative. And I rarely get excited these days!

Well, the fiscal cliff morphed into a mirage and all those wavering lemmings lurking at the edge suddenly sprouted wings.

The SP500 is now back at the long-range 1468 level it flirted with last September/October, riding a wave of relief and optimism ... and doing it during the "good mood" period between Full Moon and New.

The SP500 is now back at the long-range 1468 level it flirted with last September/October, riding a wave of relief and optimism ... and doing it during the "good mood" period between Full Moon and New.

Safe trading - RA

(Disclaimer: This article is not advice or a recommendation to trade stocks; it is merely educational material.)

I confess I've been too busy to keep up with all of the indices since Christmas, but I will get back to them over the next couple of weekends.

Let's begin this weekend by having a look at Pollyanna's Weekly Planets chart. Most of you are already familiar with it from previous Eye of Ra reports and any newbies popping in for a peek inside the fortune teller's tent can find some research material in the Archives.

Let's begin this weekend by having a look at Pollyanna's Weekly Planets chart. Most of you are already familiar with it from previous Eye of Ra reports and any newbies popping in for a peek inside the fortune teller's tent can find some research material in the Archives.

I think I'm inclined to call this the second attempt by the 500 to breakout above the primary Neptune line at 1468, rather than the third, since October's effort was so close to the September timeframe.

The oscillator confirms the legitimacy of the rally, regardless of whether it was caused by relief that Congress and the Senate managed to do a deal. There is no negative divergence in the oscillator, so I wouldn't be prepared to view this as a double-top.

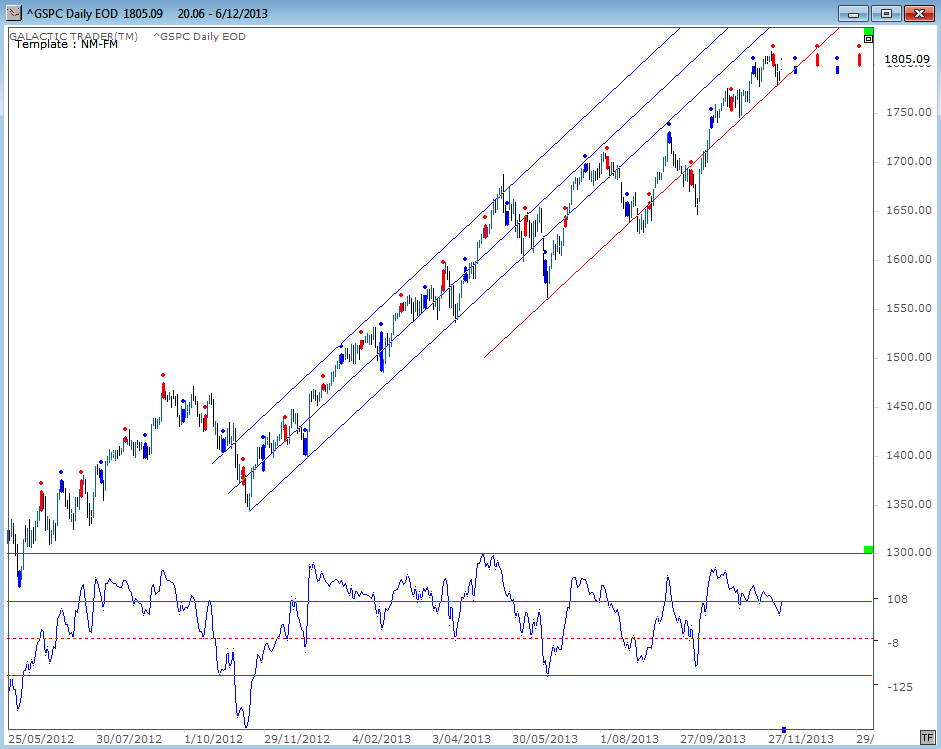

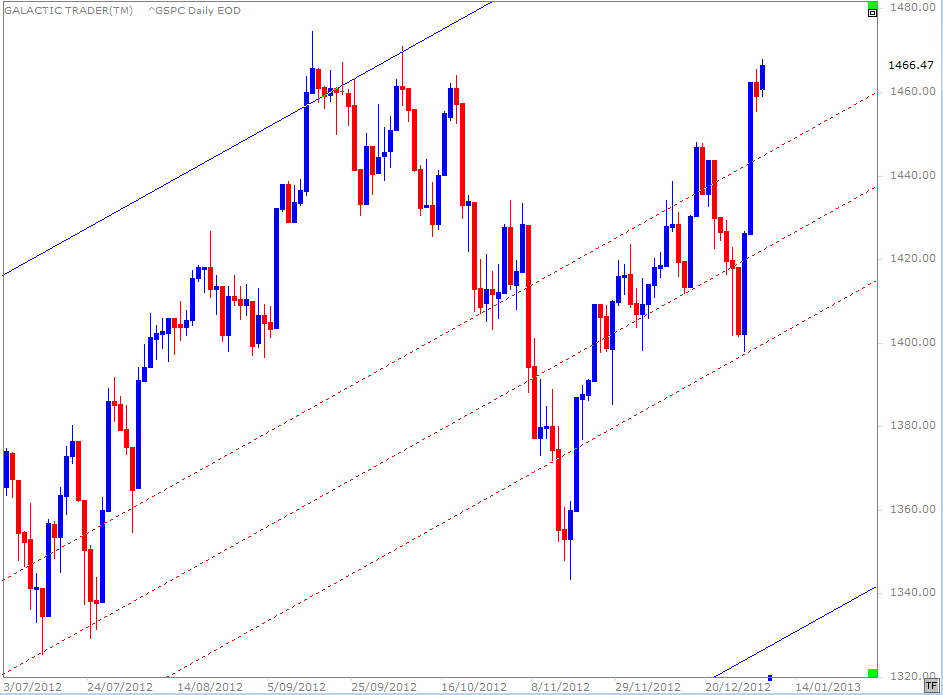

As I indicated in last weekend's report, the simple fact of life is that the SP500 remains in an uptrend defined by a rising pitchfork anchored at important highs and lows.

The oscillator confirms the legitimacy of the rally, regardless of whether it was caused by relief that Congress and the Senate managed to do a deal. There is no negative divergence in the oscillator, so I wouldn't be prepared to view this as a double-top.

As I indicated in last weekend's report, the simple fact of life is that the SP500 remains in an uptrend defined by a rising pitchfork anchored at important highs and lows.

I said last weekend, while discussing the importance of the red, internal Fibonacci angle of the fork:

"The 500 is approaching that layer once again, with traders unsure whether US politicians can compromise on the tax increases and spending cuts due to start taking effect in January.

While hope remains alive, there's a chance the lower red level will continue to provide support for the rally angle."

Let's go to the close-up ...

"The 500 is approaching that layer once again, with traders unsure whether US politicians can compromise on the tax increases and spending cuts due to start taking effect in January.

While hope remains alive, there's a chance the lower red level will continue to provide support for the rally angle."

Let's go to the close-up ...

And hope did remain alive and the lower red level did provide support for the rally angle.

It will be necessary now to monitor the price performance over the next few weeks because the media will dine out on one of those interminable Wall Street cliches ... as goes January, so goes the year.

We need to monitor whether and how decisively the Neptune barrier gets broken, as well as watching for signs of divergence developing in the oscillator.

Those of you interested in gold might consider closely monitoring prices for a developing low around the price levels hit on Friday.

I'm going to give you a little tease about the stuff in the Forecast ... gold bounced on Friday after making a hit on a line which should have caused the reaction it did.

It will be necessary now to monitor the price performance over the next few weeks because the media will dine out on one of those interminable Wall Street cliches ... as goes January, so goes the year.

We need to monitor whether and how decisively the Neptune barrier gets broken, as well as watching for signs of divergence developing in the oscillator.

Those of you interested in gold might consider closely monitoring prices for a developing low around the price levels hit on Friday.

I'm going to give you a little tease about the stuff in the Forecast ... gold bounced on Friday after making a hit on a line which should have caused the reaction it did.

Forecast 2013 is now available for sale and download.

Click the button on the right for more details.

Click the button on the right for more details.

NEW:

Forecast 2013 is now available for sale and download.

Click the button on the right for more details.

Click the button on the right for more details.

No, no, no ... I'm not going to explain what they are or why I'd have expected that reaction. Forecast 2013 will tell you ... and give you the exact price levels to watch, upside and downside! If you want to know, you'll have to fork up the twenty bucks.

Okay, just a quick look this weekend ... and, yes, indeed, a totally shameless commercial plug!

If I can outlast the heatwave we're having, I'll begin returning to more normal mode next weekend and take a look at some of the other indices.

At the end of this year's Forecast, there's a review of how my critical trend change dates for last year worked out. I'll try to put that review up as a separate article on the website in the next few days.

Okay, just a quick look this weekend ... and, yes, indeed, a totally shameless commercial plug!

If I can outlast the heatwave we're having, I'll begin returning to more normal mode next weekend and take a look at some of the other indices.

At the end of this year's Forecast, there's a review of how my critical trend change dates for last year worked out. I'll try to put that review up as a separate article on the website in the next few days.