Jupiter in Leo ... gold and gambling

Week beginning January 20, 2014

For the moment, from an Earthly perspective, the head honcho of the Old Gods - Jupiter - is still heading backwards in the sign of Cancer.

Copyright: Randall Ashbourne - 2011-2014

Leo is the sign which rules gold and gambling ... and Jupiter almost invariably has a very strong impact on the sectors ruled by the sign through which he's travelling.

And, simply, the impact is that he either exaggerates the supply OR the demand.

Since it's unlikely that Newmont is about to discover a billion tonnes of gold in a low-cost, high-grade deposit 50 metres from a railway line, next to a port, in a politically-stable country, we can probably assume that the demand for gold will spike in the next year or so.

That's an astrological expectation. And our rule-of-thumb is that they NEVER over-ride technical conditions.

So, we'll spend a little time this edition looking at a few long-range charts of the biggest gold miners ... most of which have been whacked hard since hitting record peaks late in 2011.

Short story: They're starting to look like a damn fine Buy.

BUT! The charts are indicating the need for caution, since the final Low in gold - and some gold miners - might not yet be locked into place.

And, simply, the impact is that he either exaggerates the supply OR the demand.

Since it's unlikely that Newmont is about to discover a billion tonnes of gold in a low-cost, high-grade deposit 50 metres from a railway line, next to a port, in a politically-stable country, we can probably assume that the demand for gold will spike in the next year or so.

That's an astrological expectation. And our rule-of-thumb is that they NEVER over-ride technical conditions.

So, we'll spend a little time this edition looking at a few long-range charts of the biggest gold miners ... most of which have been whacked hard since hitting record peaks late in 2011.

Short story: They're starting to look like a damn fine Buy.

BUT! The charts are indicating the need for caution, since the final Low in gold - and some gold miners - might not yet be locked into place.

Early in March, the FatBoy will change direction ... putting him on a run towards a year-long journey through the Fire sign, Leo.

Warm regards, best wishes and ... Safe trading - RA

(Disclaimer: This article is not advice or a recommendation to trade stocks; it is merely educational material.)

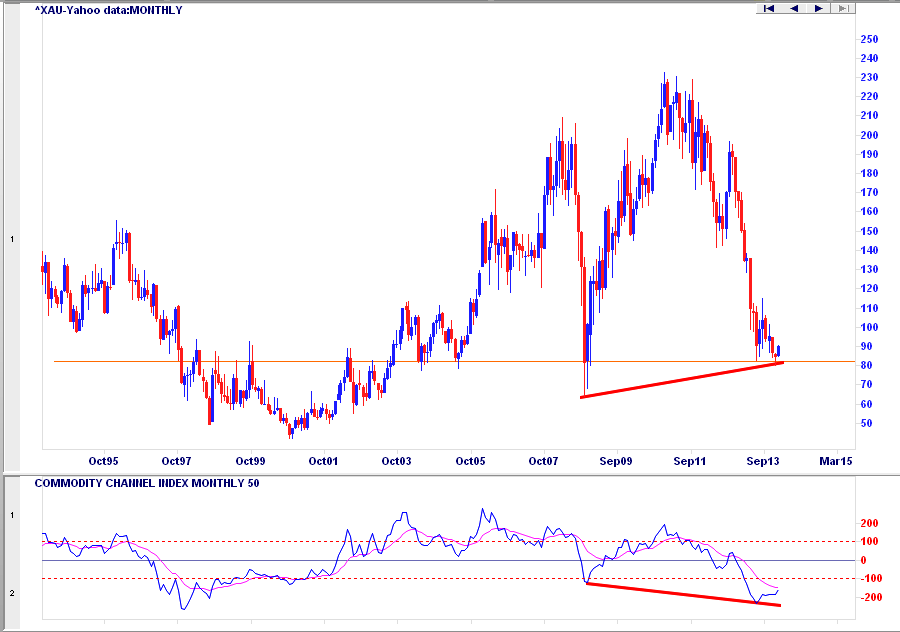

We'll begin by looking at the XAU, the Philadelphia gold and silver index which tracks the performance of 16 of the world's biggest producers, including Newmont, Barrick and Goldcorp.

And we'll also look at those three individual companies.

Firstly, the XAU is bouncing from an "obvious" technical level. Now the problem with all bounces from the "obvious" is that they can be purely technical and relatively short-lived.

And there is some danger that this is exactly the case with the current bounce in the index. This latest double-bottom has happened at a price level which we can see has stopped rises and declines in the past.

The worry is that our Big Bird oscillator is recording long-range negative divergence by plunging below its 2008 trough.

And we'll also look at those three individual companies.

Firstly, the XAU is bouncing from an "obvious" technical level. Now the problem with all bounces from the "obvious" is that they can be purely technical and relatively short-lived.

And there is some danger that this is exactly the case with the current bounce in the index. This latest double-bottom has happened at a price level which we can see has stopped rises and declines in the past.

The worry is that our Big Bird oscillator is recording long-range negative divergence by plunging below its 2008 trough.

If we look at Big Bird's performance while the price of the XAU was grinding out a multi-year bottom in the late 1990s, we can see the slow build-up of positive divergence. Simply, Big Bird started to make higher troughs while price continued to make lower ones.

For the moment what we have is long-range negative divergence, but short-range positive divergence. So we can't be certain this bounce will last more than a few weeks.

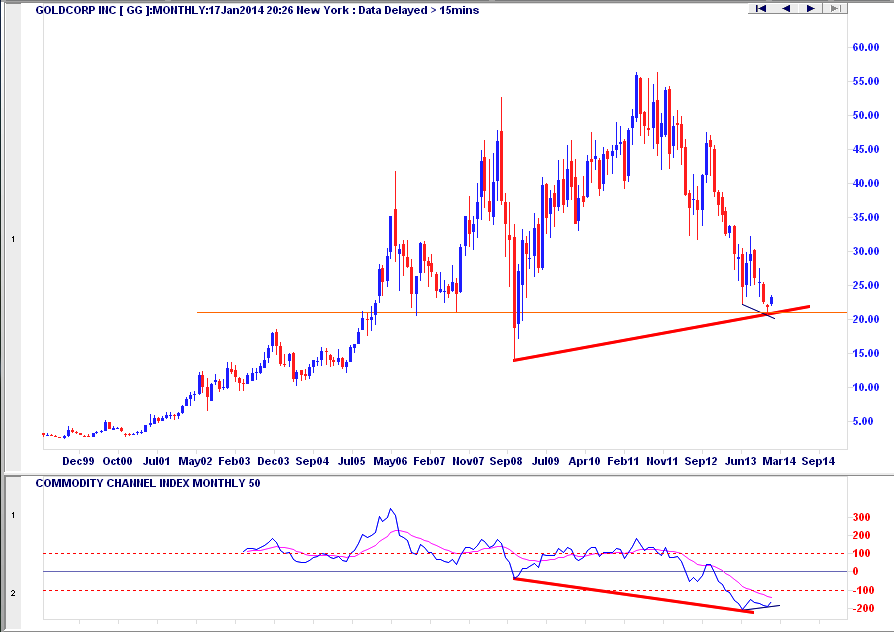

Goldcorp is showing a very similar pattern. If anything, the warning signal is even stronger. While the price bottom has come in at a higher level than late 2008, Big Bird has dropped a lot lower. A LOT lower.

That negative divergence is marked with the thick red trendlines. However, we can see the situation starting to improve with the opposite condition in recent-term, thin blue trendlines.

For the moment what we have is long-range negative divergence, but short-range positive divergence. So we can't be certain this bounce will last more than a few weeks.

Goldcorp is showing a very similar pattern. If anything, the warning signal is even stronger. While the price bottom has come in at a higher level than late 2008, Big Bird has dropped a lot lower. A LOT lower.

That negative divergence is marked with the thick red trendlines. However, we can see the situation starting to improve with the opposite condition in recent-term, thin blue trendlines.

NEW:

Forecast 2014 is now available for sale and download.

Click the button on the right for more details.

Click the button on the right for more details.

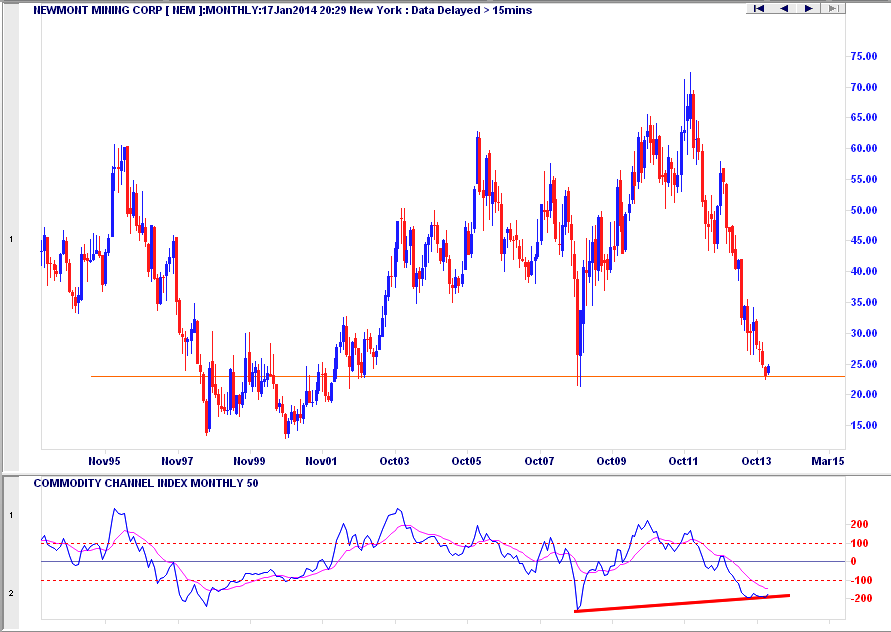

The Newmont chart is next and it is actually looking a tad stronger than the XAU chart. With Newmont, the bounce is also from the obvious, but it is a lower closing price trough ... with a distinctly higher trough occurring in the oscillator.

Simply, NEM is indicating that it may well be one of the first gold miners to recover - and probably strongly.

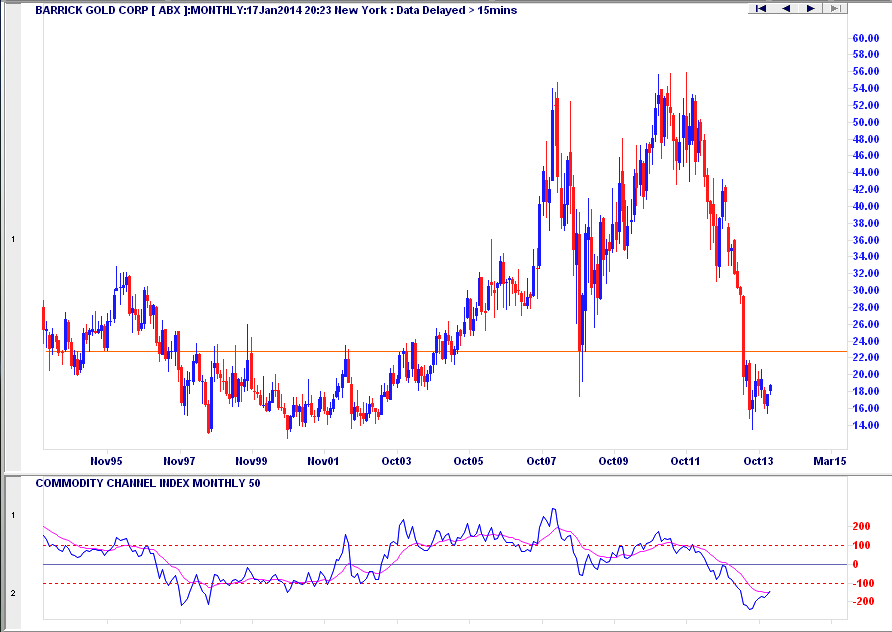

Barrick is our next contender and the one that got whacked the hardest. Its share price plunged well below the 2008 trough and just as low as it did while grinding out that multi-year bottom going into the turn of the century.

Two schools of thought ... There's something seriously wrong with the company's cost/profit structure or it has been ridiculously over-sold by an over-emotive market.

Two schools of thought ... There's something seriously wrong with the company's cost/profit structure or it has been ridiculously over-sold by an over-emotive market.

Barrick's Big Bird is showing distinct signs of climbing back from the grave into a happier position on his perch, with a preliminary cross of his signal line.

Overall, we can sense that conditions in the gold and silver markets are starting to improve on the technical level. We have no screaming Buy signals it would be foolish to ignore. That would require all four charts to be showing very marked positive divergence between Big Bird and the price level.

So technically, we can't yet rule out another price plunge. But we are now much closer to putting in a strong, multi-year Low. Jupiter's travels give us an indication of when we might "expect" a change in the astrological weather. For the safety of our capital base, we need to see strong technical confirmation.

Since Leo also rules gambling, you might want to check the technical condition of stocks in that sector ... casinos, poker machines manufacturers etc.

I haven't yet organised an Archives page for 2014, so I'll put the links to the last two editions here.

The planetary price targets for gold are contained in Forecast 2014 - as are the targets for the major stock indices. At some stage in the next 8 weeks or so, I'll compile a special report on gold which includes the exact timing of its most important transits for the year ahead. I'll email it to everyone who has bought a copy of Forecast 2014. But, it won't be published in the free weekend reports.

Overall, we can sense that conditions in the gold and silver markets are starting to improve on the technical level. We have no screaming Buy signals it would be foolish to ignore. That would require all four charts to be showing very marked positive divergence between Big Bird and the price level.

So technically, we can't yet rule out another price plunge. But we are now much closer to putting in a strong, multi-year Low. Jupiter's travels give us an indication of when we might "expect" a change in the astrological weather. For the safety of our capital base, we need to see strong technical confirmation.

Since Leo also rules gambling, you might want to check the technical condition of stocks in that sector ... casinos, poker machines manufacturers etc.

I haven't yet organised an Archives page for 2014, so I'll put the links to the last two editions here.

The planetary price targets for gold are contained in Forecast 2014 - as are the targets for the major stock indices. At some stage in the next 8 weeks or so, I'll compile a special report on gold which includes the exact timing of its most important transits for the year ahead. I'll email it to everyone who has bought a copy of Forecast 2014. But, it won't be published in the free weekend reports.