Unexpected danger signals in gold

Week beginning September 16, 2013

The hardest thing for a trader to admit ... to himself ... is that he got it wrong.

Copyright: Randall Ashbourne - 2011-2013

He might not like it ... but he has to accept the reality that if the bank account gets bashed too badly, he's going to end up feeling bruised and battered anyway.

So, this weekend we will be taking a brief look at stocks and a much closer look at gold.

Many gold traders have been operating under the assumption that a large-scale, long-term Low was posted late in June when the price of gold spiked down into the 1180 Pluto zone and began bouncing strongly.

And there's still a chance that assumption is correct. But it's now open to question and until the question is clearly resolved, one way or the other, my prissy 2nd House Virgo Moon is waving her broomstick at my unaspected 5th House Sagittarian Sun.

I call her Miss Prissy - and she's a dreadful nag. No fun at all. But, she's also my only Earth planet and, as such, the rest of "us" rely on her to keep us grounded. We all have Virgo somewhere in our charts ... and should be eternally gratefull that we do!

So, this weekend we will be taking a brief look at stocks and a much closer look at gold.

Many gold traders have been operating under the assumption that a large-scale, long-term Low was posted late in June when the price of gold spiked down into the 1180 Pluto zone and began bouncing strongly.

And there's still a chance that assumption is correct. But it's now open to question and until the question is clearly resolved, one way or the other, my prissy 2nd House Virgo Moon is waving her broomstick at my unaspected 5th House Sagittarian Sun.

I call her Miss Prissy - and she's a dreadful nag. No fun at all. But, she's also my only Earth planet and, as such, the rest of "us" rely on her to keep us grounded. We all have Virgo somewhere in our charts ... and should be eternally gratefull that we do!

So here I am this week, face covered in egg, having to bash my Ego into submission and accept the evidence of the charts that gold is not doing what it should be doing if it's now in the first upleg of a new multi-year Bull run.

It may yet turn out that way. However, when it comes to a choice between protecting my Ego, or protecting my capital, I'm afraid E-boy needs to be whacked with an iron bar and forced back into his box.

It may yet turn out that way. However, when it comes to a choice between protecting my Ego, or protecting my capital, I'm afraid E-boy needs to be whacked with an iron bar and forced back into his box.

Safe trading - RA

(Disclaimer: This article is not advice or a recommendation to trade stocks; it is merely educational material.)

This may seem like a digression. In fact, it IS going to be a digression! Loath as I am to cite Miley Cyrus, of all people, "it's my mouth and I'll say what I want to!"

Often, I chat about The Spooky Stuff and the potential impact of current transits on stock markets or world politics. That's a branch called "mundane" astrology.

Personal astrology is more intimate. Basically, our Sun sign has a lot to say about what sort of Ego we have; the Moon deals with our emotional needs; Mercury by sign and aspect can give us insights into how our brain operates differently from others; Mars, what level of energy we have and where we're most likely to be most active. And so on.

It can actually be very useful to get to know the individual personalities within our overall persona. Even those who know nothing about astrology would probably recognise this sort of statement: "Sometimes, I get a feeling that ..."

For those who DO know about astrology, they'll probably recognise exactly who is responsible for the "feeling".

"Sometimes, I get a feeling that I'd like to punch his head in!" ... is probably your Mars telling you it's in open conflict with someone's else's Mars. If your Mars happens to be in an aggressive sign, with hard aspects to Uranus or Pluto, you may well punch first and feel later! If it's in Libra, conjunct Neptune, you'd like to punch his head in, but you're very unlikely to, because the natural tendency of your Mars is to act diplomatically and try to find common ground.

If your Sun is in one of the Fire signs - Aries, Leo, or Sagittarius - you're more likely to take risks. Sagittarian Suns take BIG risks. And, since an unaspected planet is a very pure form of the basic energy, an unaspected 5th House Sagittarian Sun will sometimes take enormous risks, specifically related to financial speculation.

I'm really lucky. Because I have a Cancer Ascendant, my chart "ruler" is the Moon ... the nagging Virgo bitch who lives in the 2nd House (of money!) screeching about how that idiot Sagittarian gambler is going to bankrupt us all. So, when I "sometimes get a feeling that ..." my wildly optimistic outlook might need to be tempered and toned down, I know exactly who is talking ... the eminently sensible and practical Miss Prissy is telling me to shut-up, sit down and look very carefully at the charts. Miss Prissy and "I" have reached an accord.

"She" tries to stay off the smelling salts when "I" take risks ... and I try not to take silly risks, and consult closely with Prissy about where to put the loss stops so we don't both end up in the poor house because my Ego is off on a romp.

I go through this exercise just to give you an inkling of how individual components of our personality can co-operate with each other, or fight against each other, in everything we do - including our approach to the risk and reward ratios of stock market trading.

There's a good website which provides free charts and readings - http://www.astro.com/ - without also subjecting you to a barrage of ongoing emails. If you "sometimes get a feeling that ...", knowing the personality of which of your planets is wanting to be heard can be very useful.

Okay. Now, let's get down to what we're really here for ...

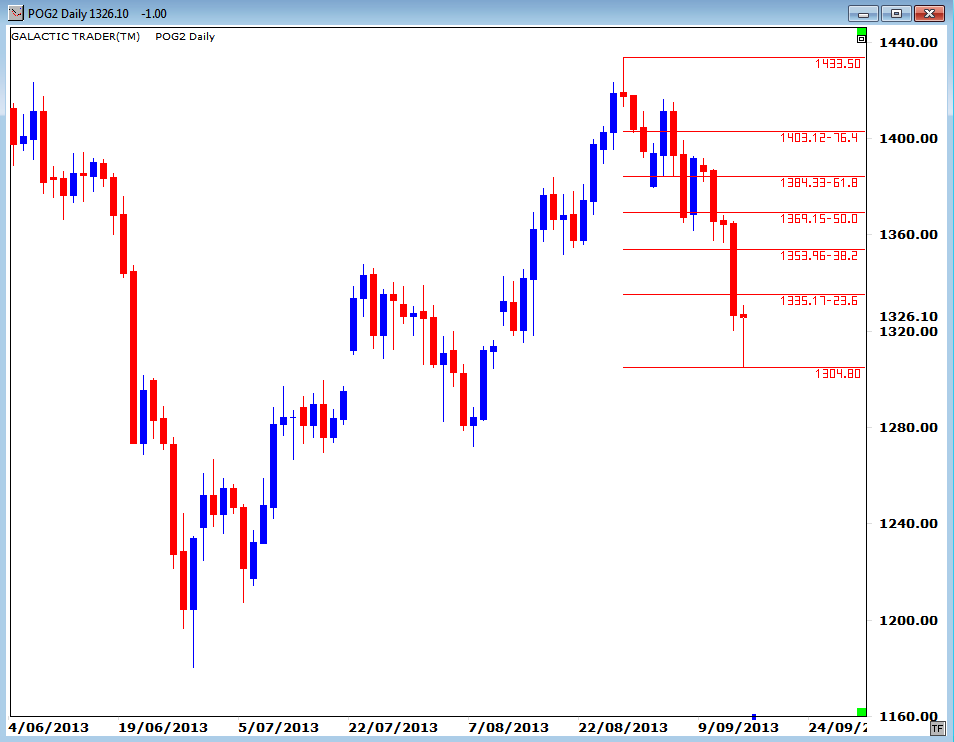

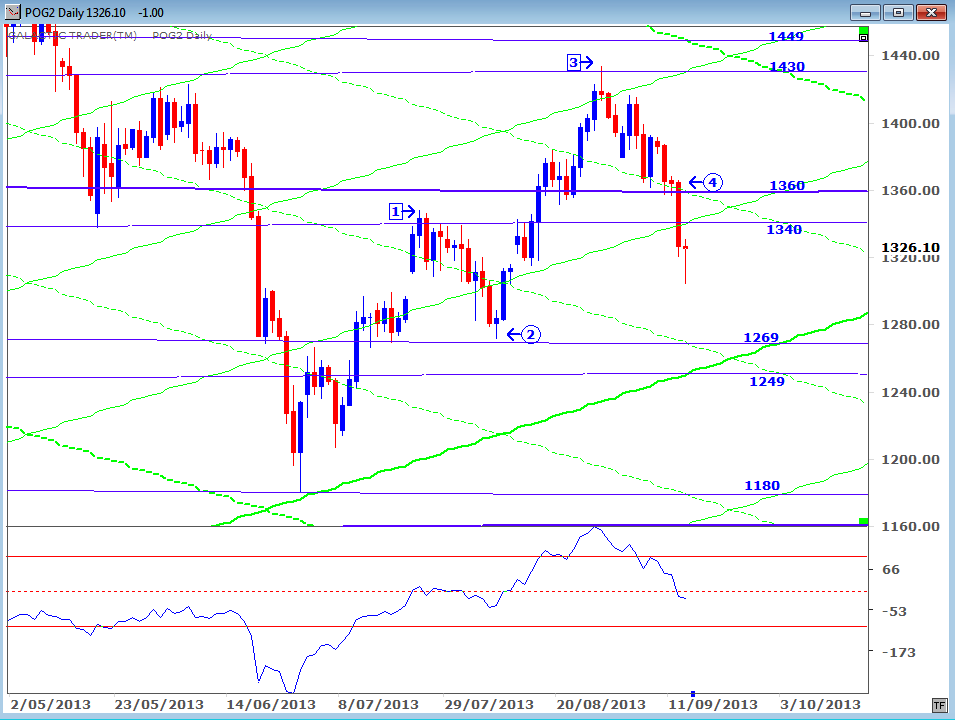

I indicated last weekend I thought gold was about to launch into a rally which would confirm that a major, multi-year Low in the gold price was posted at $1180 in late June.

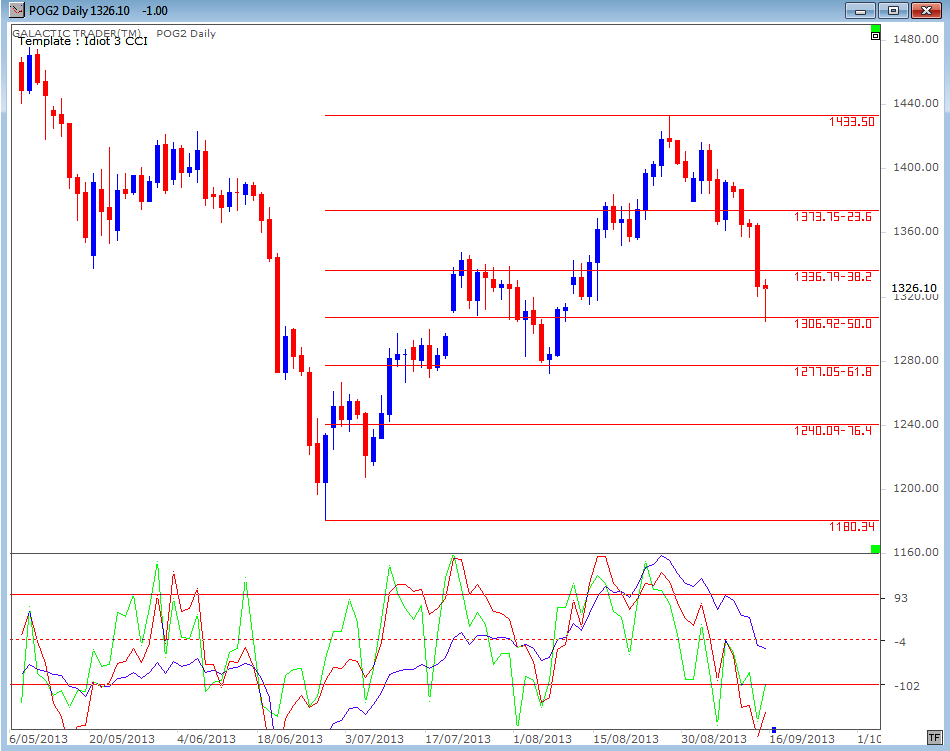

However, the slump in gold prices last week indicates that scenario might be very, very wrong. Let's start with a update of the daily Sun/Pluto chart from last weekend.

I believed gold was about to launch higher in an Elliott 5-wave Bullish pattern. In Elliott Wave theory, a corrective Wave 4 cannot decline into the territory of the Wave 1 peak. That Wave 1 peak was where Miss Prissy and I decided to put our loss stop, having taken a fairly large Long position during the bounce on September 6.

The Bullish count on the chart below is now severely broken. There's a chance this could morph into one of those EW patterns that only expert acolytes can count. I'm not one of them.

Often, I chat about The Spooky Stuff and the potential impact of current transits on stock markets or world politics. That's a branch called "mundane" astrology.

Personal astrology is more intimate. Basically, our Sun sign has a lot to say about what sort of Ego we have; the Moon deals with our emotional needs; Mercury by sign and aspect can give us insights into how our brain operates differently from others; Mars, what level of energy we have and where we're most likely to be most active. And so on.

It can actually be very useful to get to know the individual personalities within our overall persona. Even those who know nothing about astrology would probably recognise this sort of statement: "Sometimes, I get a feeling that ..."

For those who DO know about astrology, they'll probably recognise exactly who is responsible for the "feeling".

"Sometimes, I get a feeling that I'd like to punch his head in!" ... is probably your Mars telling you it's in open conflict with someone's else's Mars. If your Mars happens to be in an aggressive sign, with hard aspects to Uranus or Pluto, you may well punch first and feel later! If it's in Libra, conjunct Neptune, you'd like to punch his head in, but you're very unlikely to, because the natural tendency of your Mars is to act diplomatically and try to find common ground.

If your Sun is in one of the Fire signs - Aries, Leo, or Sagittarius - you're more likely to take risks. Sagittarian Suns take BIG risks. And, since an unaspected planet is a very pure form of the basic energy, an unaspected 5th House Sagittarian Sun will sometimes take enormous risks, specifically related to financial speculation.

I'm really lucky. Because I have a Cancer Ascendant, my chart "ruler" is the Moon ... the nagging Virgo bitch who lives in the 2nd House (of money!) screeching about how that idiot Sagittarian gambler is going to bankrupt us all. So, when I "sometimes get a feeling that ..." my wildly optimistic outlook might need to be tempered and toned down, I know exactly who is talking ... the eminently sensible and practical Miss Prissy is telling me to shut-up, sit down and look very carefully at the charts. Miss Prissy and "I" have reached an accord.

"She" tries to stay off the smelling salts when "I" take risks ... and I try not to take silly risks, and consult closely with Prissy about where to put the loss stops so we don't both end up in the poor house because my Ego is off on a romp.

I go through this exercise just to give you an inkling of how individual components of our personality can co-operate with each other, or fight against each other, in everything we do - including our approach to the risk and reward ratios of stock market trading.

There's a good website which provides free charts and readings - http://www.astro.com/ - without also subjecting you to a barrage of ongoing emails. If you "sometimes get a feeling that ...", knowing the personality of which of your planets is wanting to be heard can be very useful.

Okay. Now, let's get down to what we're really here for ...

I indicated last weekend I thought gold was about to launch into a rally which would confirm that a major, multi-year Low in the gold price was posted at $1180 in late June.

However, the slump in gold prices last week indicates that scenario might be very, very wrong. Let's start with a update of the daily Sun/Pluto chart from last weekend.

I believed gold was about to launch higher in an Elliott 5-wave Bullish pattern. In Elliott Wave theory, a corrective Wave 4 cannot decline into the territory of the Wave 1 peak. That Wave 1 peak was where Miss Prissy and I decided to put our loss stop, having taken a fairly large Long position during the bounce on September 6.

The Bullish count on the chart below is now severely broken. There's a chance this could morph into one of those EW patterns that only expert acolytes can count. I'm not one of them.

The recovery in the fast MACD mirrors the improved condition of the Canary oscillators on the earlier chart. There's almost no doubt at all that it's going to be possible to make a lot of money from being Long on gold and gold stocks ... if we can get the timing right!

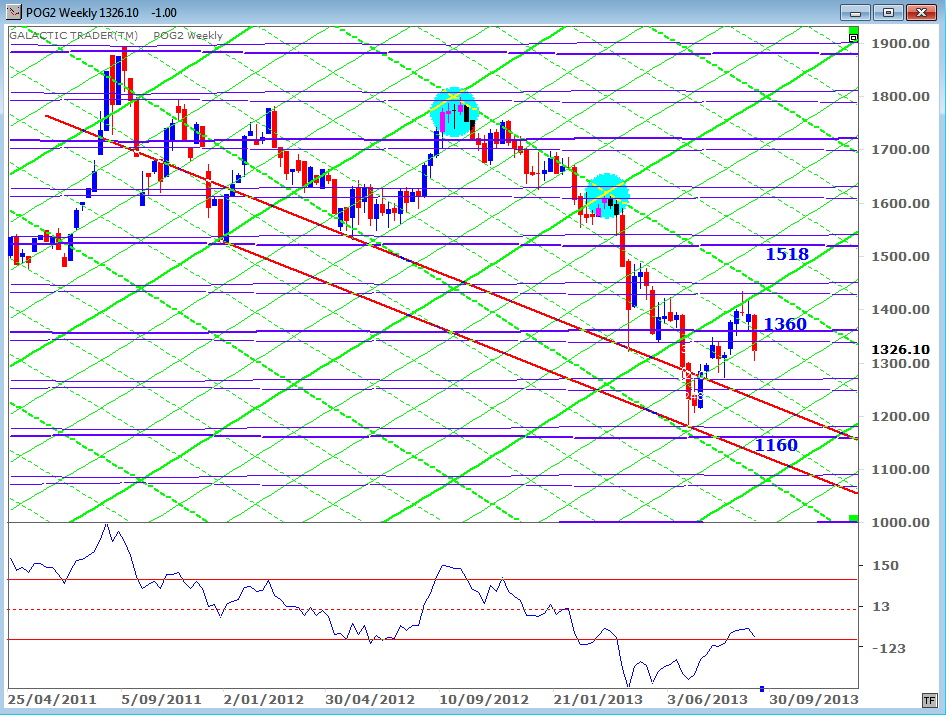

Normally, I don't worry too much about technical charts for gold, relying on the Sun/Pluto mechanisms I revealed in this year's Forecast. I had expected this to rise into the mid 1400s or even early 1500s before a substantial pullback occurred. Now, we're probably trying to find a reliable downside price point to stop the drop.

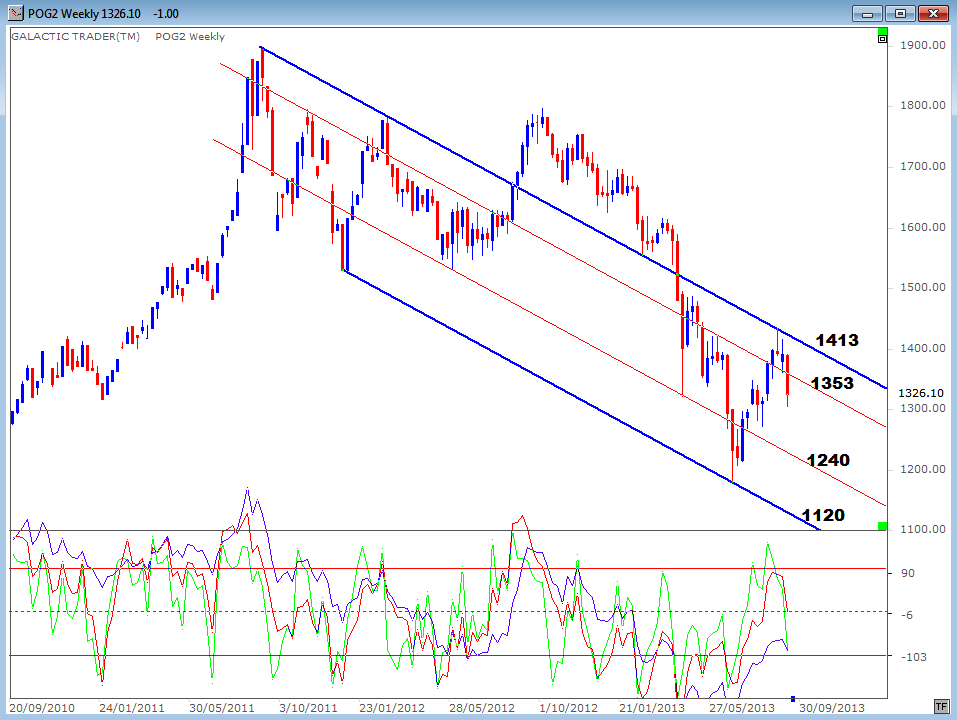

I've added a couple of the channel lines from the earlier chart to the weekly Sun/Pluto chart to see where the purely technical levels line up with planetary prices, especially if gold is now locked into another significant downleg.

Normally, I don't worry too much about technical charts for gold, relying on the Sun/Pluto mechanisms I revealed in this year's Forecast. I had expected this to rise into the mid 1400s or even early 1500s before a substantial pullback occurred. Now, we're probably trying to find a reliable downside price point to stop the drop.

I've added a couple of the channel lines from the earlier chart to the weekly Sun/Pluto chart to see where the purely technical levels line up with planetary prices, especially if gold is now locked into another significant downleg.

What seemed clear and obvious last weekend is no longer so. Maybe this is a "blip" caused by the unlikely apparition of Vlad The Peacemaker; maybe it's more manipulation by those esteemed folk who can't seem to find exactly where they stored Germany's several hundred tons of gold; and maybe the leprechauns are just ticked off about how much it costs to fill those rainbow-end pots.

What is clear is that the "certainty" factor just got pulled out from under us. When an ABC corrective downleg completes, there is only one option in Elliott Wave terms - a new Bull run. If that Bull run stalls at exactly the point it should not stall, we really need to put our expectations off to one side and have another look at whether the ABC correction is actually finished.

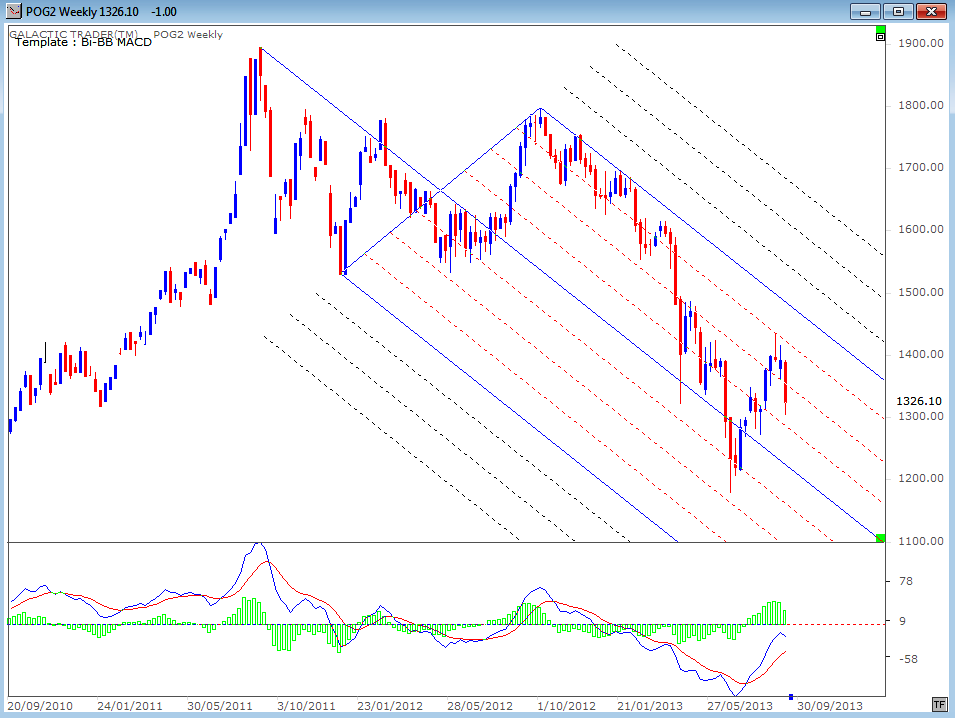

And that's what we'll do. The chart below is a weekly, dealing primarily with the large-scale correction which got underway after gold made its High around $1900 in early September, 2011.

The dramatic pick-up in the state of the oscillators since the Low in late June certainly suggests The Low is in place. But having price turned down so swiftly and sharply after contact with a falling overhead trendline means it would be foolish to ignore the alternative scenario.

What is clear is that the "certainty" factor just got pulled out from under us. When an ABC corrective downleg completes, there is only one option in Elliott Wave terms - a new Bull run. If that Bull run stalls at exactly the point it should not stall, we really need to put our expectations off to one side and have another look at whether the ABC correction is actually finished.

And that's what we'll do. The chart below is a weekly, dealing primarily with the large-scale correction which got underway after gold made its High around $1900 in early September, 2011.

The dramatic pick-up in the state of the oscillators since the Low in late June certainly suggests The Low is in place. But having price turned down so swiftly and sharply after contact with a falling overhead trendline means it would be foolish to ignore the alternative scenario.

There are some ardent gold traders who believe the market is being manipulated down once again. And, apparently, Goldman Sachs is tipping a $1000 price tag for gold in the next few months.

If we use an Andrew's Pitchfork, it also shows fairly strong evidence that the hardline optimists among us may have got it wrong sticking a C count on the June bottom.

If we use an Andrew's Pitchfork, it also shows fairly strong evidence that the hardline optimists among us may have got it wrong sticking a C count on the June bottom.

Even if that's what is now happening, it'll take some time to get there. In the meantime, until the overall position becomes more certain, we'll have to rely on short-term charts. We've had a Friday bounce from the 50% marker of the post-June upleg. If it occurs in the right place, a bounce from that marker can indicate the uptrend is still intact.

This one appears not to be in the right place, so I'm very cautious about just how strongly it's likely to bounce.

This one appears not to be in the right place, so I'm very cautious about just how strongly it's likely to bounce.

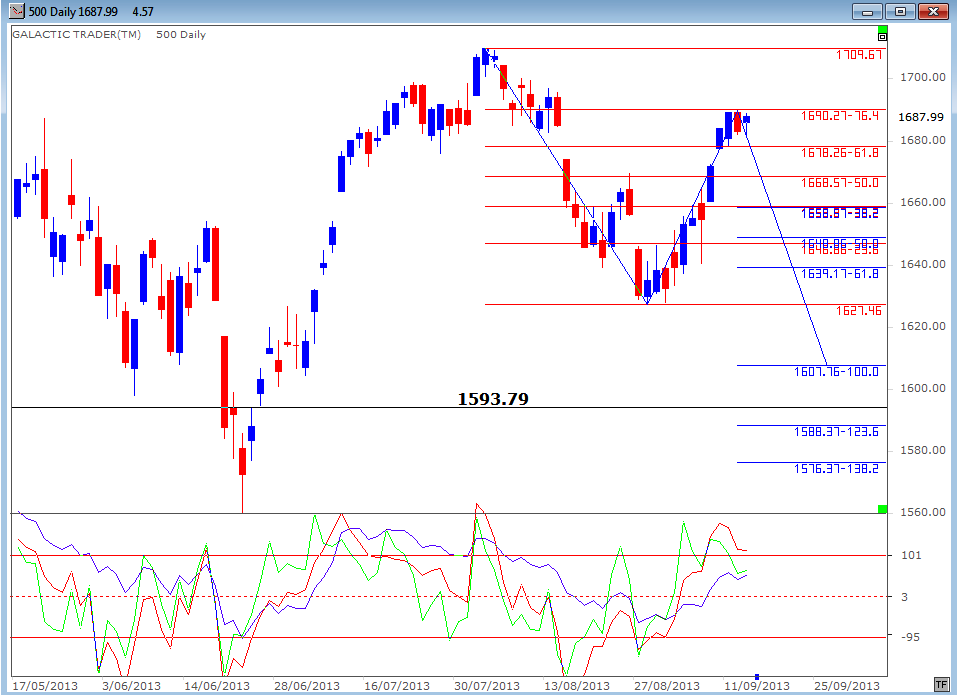

Finally, a quick look at Pollyanna - the SP500. I indicated in the past couple of weeks I thought Polly was in temporary bounce mode within a larger-scale correction - with a bounce target ranging from 1658 to 1690. The index has stalled at the upside of the range. If that's it for the bounce and another downleg is due to complete the corrective pattern, the most likely targets remain 1580 to the early 1600s, as we discussed last weekend.

The long tail on Friday's bar indicates some buying support at that low. But, it may only be temporary ... especially with the Fed due to make a statement on tapering this week; options expiration; and the Syrian sarin issue.