Uranus square Pluto ... the middle hit

Week beginning October 28, 2013

This week brings the 4th exact hit of Uranus square Pluto ... and with it, an increased danger of turning the tide.

Copyright: Randall Ashbourne - 2011-2013

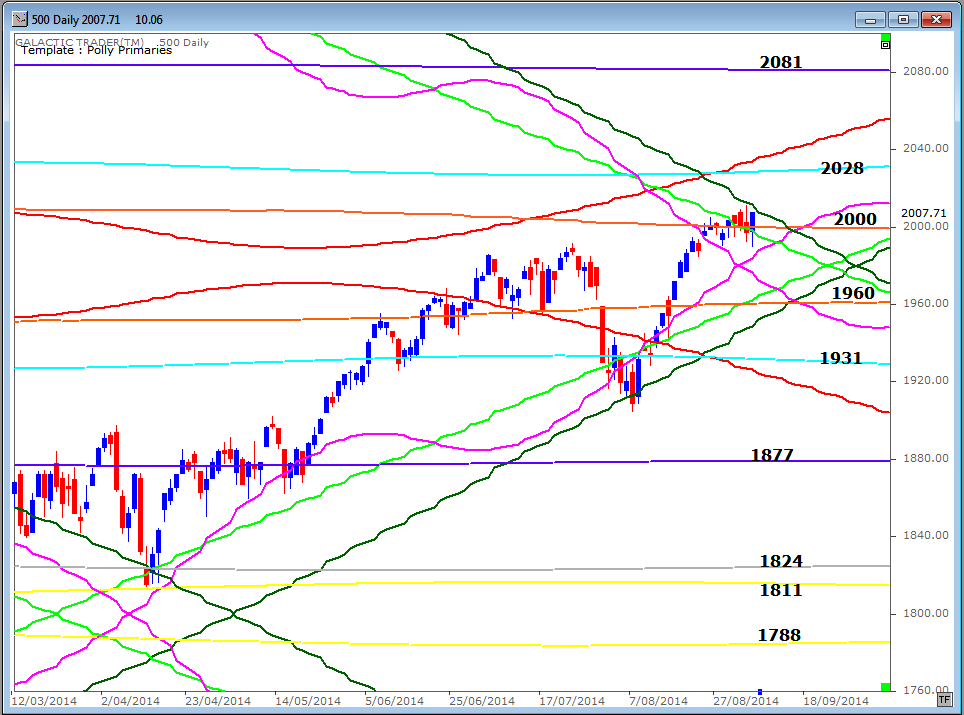

Miss Pollyanna, the 500, has been hitting new, all-time highs while the Dow has been lagging. It's a divergence which has to be resolved, probably sooner rather than later.

Germany's DAX index has also hit new records, along with Argentina. However, it's a very small list. And there's the worry, because the old adage insists that a rising tide lifts all boats.

That simply hasn't been true of most world stock indices since the last Bear bottom in 2009.

This week's Uranus square Pluto aspect, the 4th exact hit in a rare series of 7, is likely to mark the start of an important turning point, though it might not become obvious for a few months.

In a moment, we'll have a quick look at its impact so far ... and then examine the current, long-range state of both Pollyanna and the Dow.

Germany's DAX index has also hit new records, along with Argentina. However, it's a very small list. And there's the worry, because the old adage insists that a rising tide lifts all boats.

That simply hasn't been true of most world stock indices since the last Bear bottom in 2009.

This week's Uranus square Pluto aspect, the 4th exact hit in a rare series of 7, is likely to mark the start of an important turning point, though it might not become obvious for a few months.

In a moment, we'll have a quick look at its impact so far ... and then examine the current, long-range state of both Pollyanna and the Dow.

It's not the only astro show in town over the next couple of weeks. The Mercury Retrograde phase has another 2 weeks to run; there'll be a solar eclipse New Moon next weekend; and Jupiter goes Rx in the following week.

We'll concentrate this weekend on a comparison between the SP500 and the Dow Jones Industrials.

We'll concentrate this weekend on a comparison between the SP500 and the Dow Jones Industrials.

Safe trading - RA

(Disclaimer: This article is not advice or a recommendation to trade stocks; it is merely educational material.)

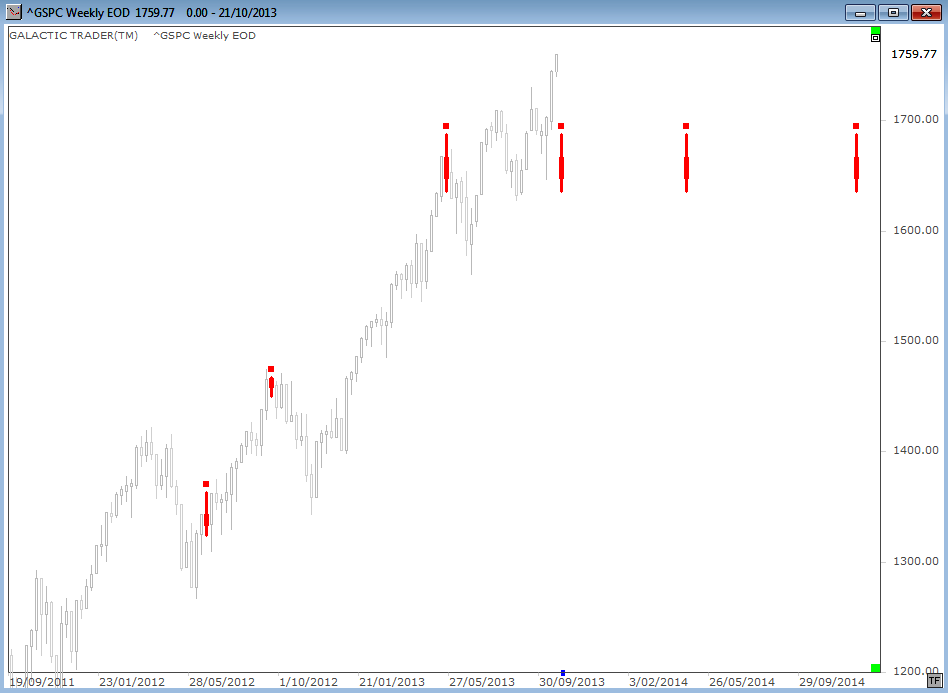

In the chart below, I've marked the weeks of the three previous Uranus/Pluto squares with thick red bars. The last two coincided with peaks before the 500 went into significant declines.

However, that's not the case for Miss Polly!

So, with the potential for a top of some significance to form this week or next, let's look at the big picture technical position, starting with a weekly of the Dow.

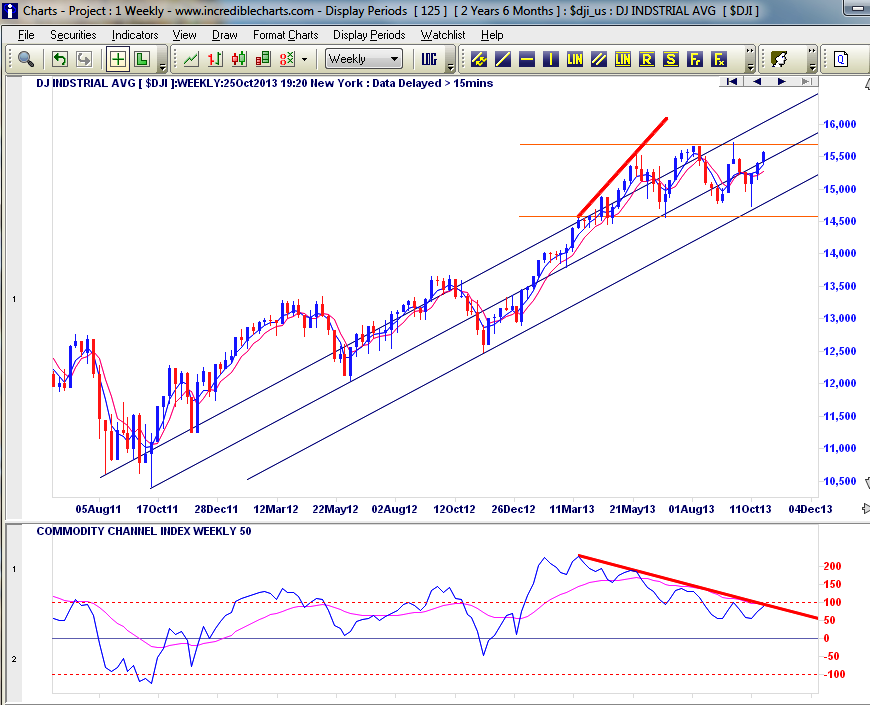

It has remained trapped within a horizontal band since earlier in the year. What began as severe negative divergence building between price and the falling peaks of the Big Bird oscillator, could resolve itself in a breakout northwards.

It doesn't seem likely, but! We should always assume normalcy. And what normally happens if Big Bird unwinds, while price tracks sideways, is that it develops into a continuation pattern, rather than a divergence pattern.

It has remained trapped within a horizontal band since earlier in the year. What began as severe negative divergence building between price and the falling peaks of the Big Bird oscillator, could resolve itself in a breakout northwards.

It doesn't seem likely, but! We should always assume normalcy. And what normally happens if Big Bird unwinds, while price tracks sideways, is that it develops into a continuation pattern, rather than a divergence pattern.

It looks as if the decision is now extremely close. Either the price and the oscillator need to turn down - sharply - in the next week or so, or the Dow should break northwards out of the box.

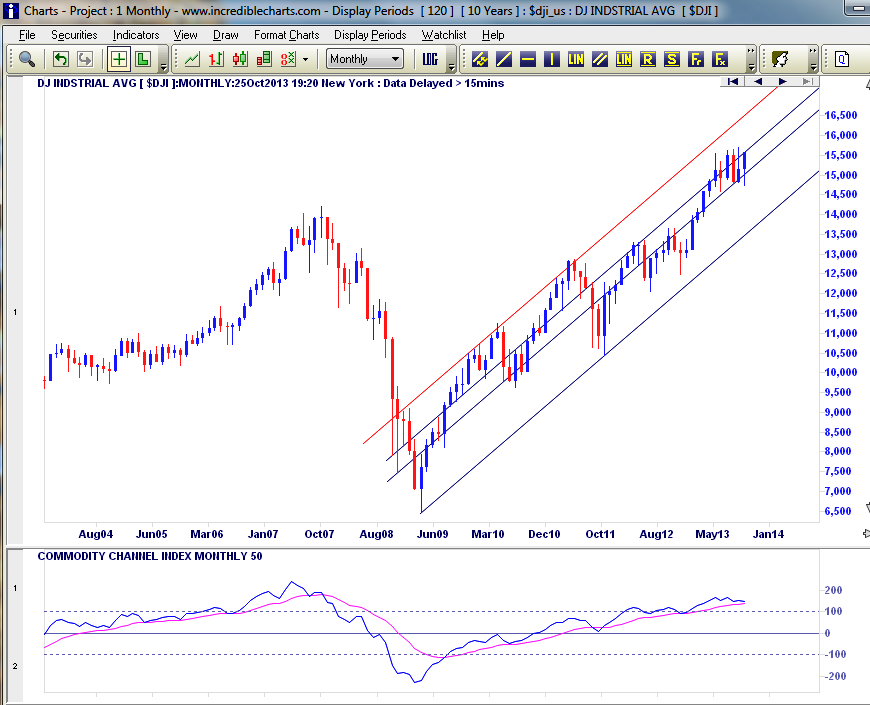

Now let's turn our attention to how the Dow is performing within its monthly Bull channel. I've marked the top of the channel with a red parallel, just to make it obvious.

And what is obvious is that the Dow is a long way short of it.

Now let's turn our attention to how the Dow is performing within its monthly Bull channel. I've marked the top of the channel with a red parallel, just to make it obvious.

And what is obvious is that the Dow is a long way short of it.

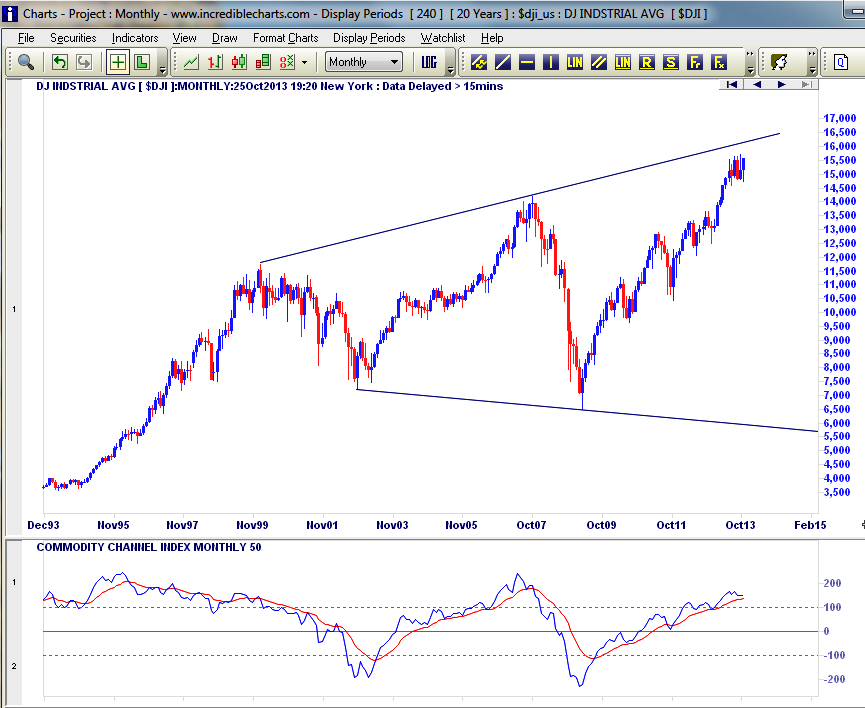

Broadening out the picture even further, we get a sense of why the Dow might be stalling. All the professional players know exactly what the next chart means ... IF it plays out "normally".

It is a disastrous crash scenario. It's a pattern called, moderately, a megaphone; or perjoratively, the "jaws of death". Megaphone ... because the market is screaming at you to get the hell out of Dodge real fast.

The professionals know that price must break through that top trendline decisively and unambiguously if the crash scenario is to be negated.

So the question becomes ... is the Dow gathering for a decisive breakout, or is the fear of being crunched by the jaws of death already starting to weigh?

It is a disastrous crash scenario. It's a pattern called, moderately, a megaphone; or perjoratively, the "jaws of death". Megaphone ... because the market is screaming at you to get the hell out of Dodge real fast.

The professionals know that price must break through that top trendline decisively and unambiguously if the crash scenario is to be negated.

So the question becomes ... is the Dow gathering for a decisive breakout, or is the fear of being crunched by the jaws of death already starting to weigh?

The same pattern cannot be applied to the SP500, which double-topped in 1999 and 2007, but has broken out higher on this Bull run.

Still, the Pollyanna chart is not without its own warning signals. There have been only a couple of times since the 2009 Low that Miss Polly's monthly has breached the barrier of the upper Bollinger Band, as it's currently doing in what is normally one of the year's weakest months.

We'll leave it there for this weekend. Planetary prices for Pollyanna and various other indices were published last weekend and are still valid. You can check those charts in the Archives.

I'd intended to update a few more Weekly Planets charts for other indices this weekend, but have run out of time. Hopefully, I'll be able to do it next weekend.

We'll leave it there for this weekend. Planetary prices for Pollyanna and various other indices were published last weekend and are still valid. You can check those charts in the Archives.

I'd intended to update a few more Weekly Planets charts for other indices this weekend, but have run out of time. Hopefully, I'll be able to do it next weekend.