Stock bounce may be topping out

Week beginning October 27, 2014

The stock market bounceback, which appears to be irrationally exuberant on Wall Street and decidedly timid in other Western indices, could start to fail in the next couple of days.

Copyright: Randall Ashbourne - 2011-2014

If that is the case, markets could top as early as Monday or Tuesday when the Sun and Venus make a trine to Neptune.

And my reasons for thinking that are not just the intermarket technical divergence. Mars leaves the Fire sign, Sagittarius, this weekend and moves into Capricorn where it will soon conjunct Pluto and square Uranus.

We've discussed this many times. Mars is drive and energy. It will add "power" to the symbolism of Pluto in Capricorn and to Uranus in Aries.

In short, the God of War is about to stir up both the plutocrats and the armed rebels.

And my reasons for thinking that are not just the intermarket technical divergence. Mars leaves the Fire sign, Sagittarius, this weekend and moves into Capricorn where it will soon conjunct Pluto and square Uranus.

We've discussed this many times. Mars is drive and energy. It will add "power" to the symbolism of Pluto in Capricorn and to Uranus in Aries.

In short, the God of War is about to stir up both the plutocrats and the armed rebels.

There is a chance the steep dive into mid-October was a Mercury Retrograde head fake, which I mentioned a couple of weeks ago.

However, the level of technical damage and the apparent caution almost everywhere but on Wall Street do suggest there is more downside just ahead.

However, the level of technical damage and the apparent caution almost everywhere but on Wall Street do suggest there is more downside just ahead.

Safe trading - RA

(Disclaimer: This article is not advice or a recommendation to trade stocks; it is merely educational material.)

So, that's why I'm still inclined to think we are facing the two main scenarios I've been chatting with you about over the past couple of weeks ... either that we are in a major three-legged correction to the overall Bull trend, or that we are in the early stages of an emerging Bear.

The next down phase will probably help us to define exactly which one it is. We'll be looking this weekend at the SP500, the FTSE, the ASX200 and India's Nifty.

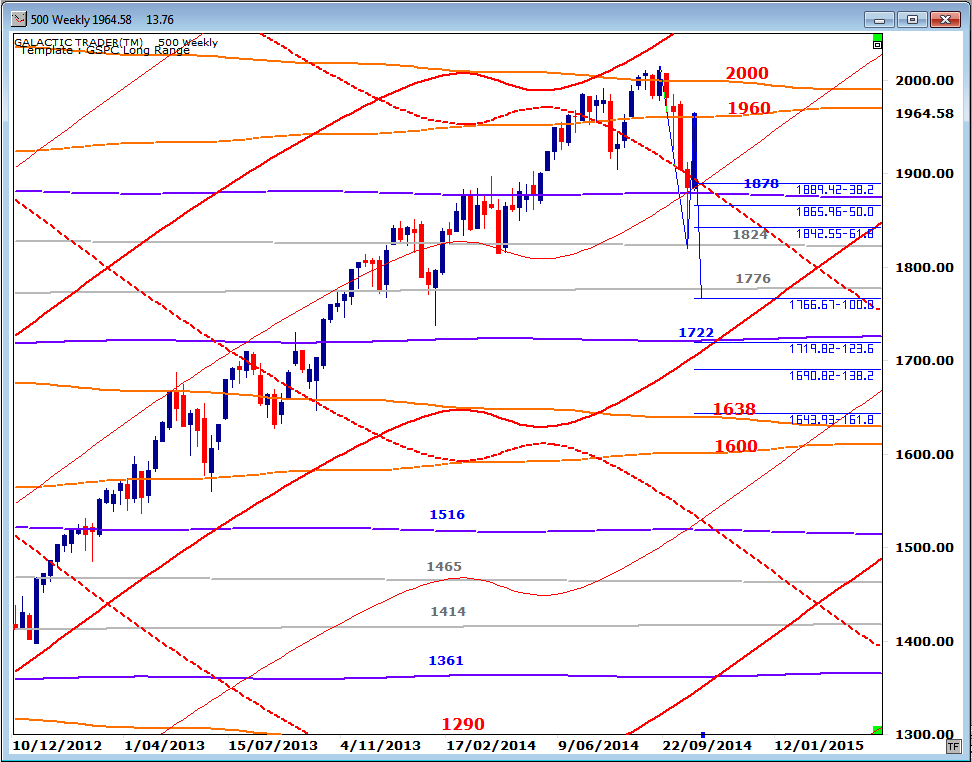

I'm not going to spend a lot of time on Pollyanna, the 500. It gets a lot of attention every week ... and it is now fairly clear what will happen with the index if the bounceback fails in the next few days.

The big picture planet price charts have been published over the past couple of weeks. Now we'll zoom-in a little. In an ABC correction, where A is the first leg down, B is the bounce, and the C leg is the last decline, it is relatively common for C to equal A.

So long as Polly doesn't bounce too much higher than last week's Close, the "normal" target for the next downleg takes it down to about the $1776 level. It might double-bottom around the $1824 Neptune price line ... or it could continue to $1722 and still be within the general rules for a "correction" in an ongoing Bull. Too much further than that, however, and we would need to consider carefully whether the Bull has given way to a new Bear.

The next down phase will probably help us to define exactly which one it is. We'll be looking this weekend at the SP500, the FTSE, the ASX200 and India's Nifty.

I'm not going to spend a lot of time on Pollyanna, the 500. It gets a lot of attention every week ... and it is now fairly clear what will happen with the index if the bounceback fails in the next few days.

The big picture planet price charts have been published over the past couple of weeks. Now we'll zoom-in a little. In an ABC correction, where A is the first leg down, B is the bounce, and the C leg is the last decline, it is relatively common for C to equal A.

So long as Polly doesn't bounce too much higher than last week's Close, the "normal" target for the next downleg takes it down to about the $1776 level. It might double-bottom around the $1824 Neptune price line ... or it could continue to $1722 and still be within the general rules for a "correction" in an ongoing Bull. Too much further than that, however, and we would need to consider carefully whether the Bull has given way to a new Bear.

Now let's turn our attention to the FTSE, starting with the long-range planetary pricing. Begin by looking at the price "zone" between a primary Pluto (thick blue line) currently priced around 6500 and a primary Neptune (thick grey line) around 7000. This "band" was broken only briefly at the 1999 peak, caused a top to the 2007 peak ... and is doing the same again.

Also, look closely at the implications of what happens to the index once that primary Pluto line fails to support Bullish prices.

Also, look closely at the implications of what happens to the index once that primary Pluto line fails to support Bullish prices.

Now let's look again at a simple weekly technical chart we've used before. We knew that horizontal trading band marked by the two thin black lines was getting close to failing because of the extreme negative divergence building in the Big Bird oscillator.

It has plunged so deeply, it is likely that we will have to see a very clear incidence of positive divergence in the oscillator before we can be sure the FTSE price dive is finished. I've marked an example of this with a black circle. While the price retested its lows, Big Bird made higher troughs, indicating that internal strength was coming back into the market.

It has plunged so deeply, it is likely that we will have to see a very clear incidence of positive divergence in the oscillator before we can be sure the FTSE price dive is finished. I've marked an example of this with a black circle. While the price retested its lows, Big Bird made higher troughs, indicating that internal strength was coming back into the market.

So, we know the big picture on the FTSE has some major warning signs, because the index has lost the support of the primary Pluto ... and that weekly Big Bird is suggesting the correction is not over.

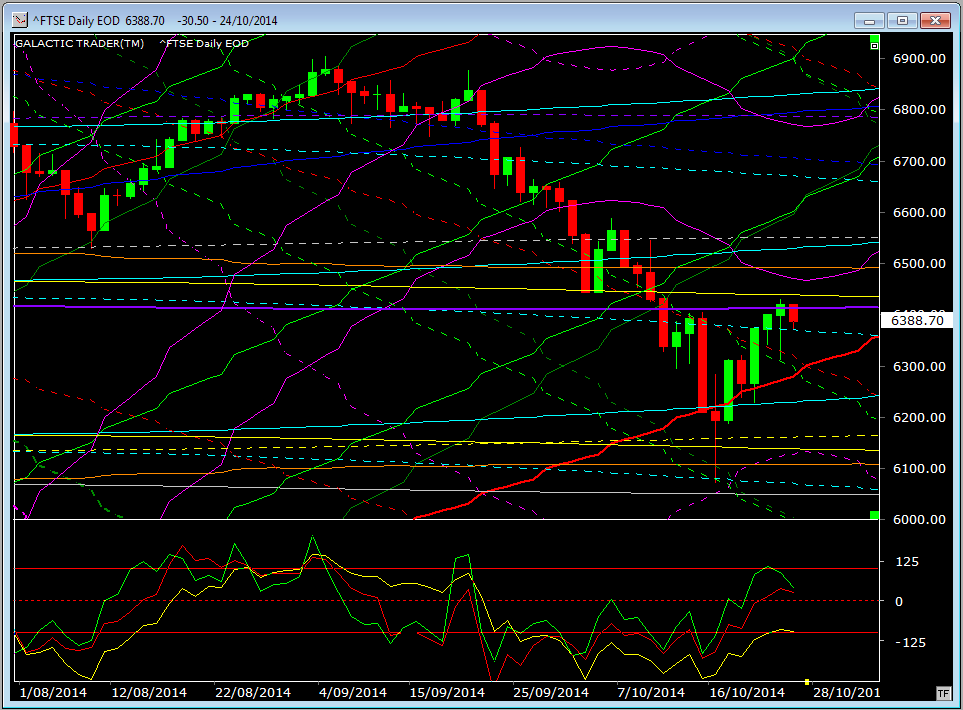

The chart below is the FTSE's daily and, yes, it's a big bowl of coloured spaghetti showing ALL the planetary price lines currently affecting the price of the index. All you really need to know is that there is a LOT of resistance immediately overhead ... and that all three Canaries in the oscillator panel are starting to roll over again, so breaching all of that resistance will be difficult.

The chart below is the FTSE's daily and, yes, it's a big bowl of coloured spaghetti showing ALL the planetary price lines currently affecting the price of the index. All you really need to know is that there is a LOT of resistance immediately overhead ... and that all three Canaries in the oscillator panel are starting to roll over again, so breaching all of that resistance will be difficult.

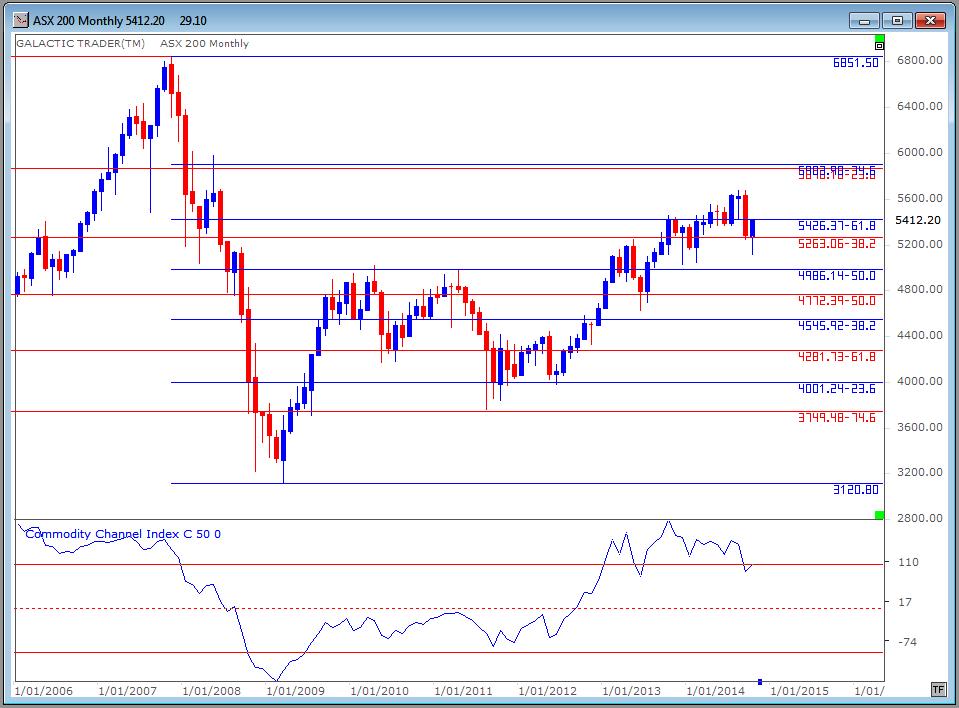

Turning our attention now to the ASX200 ... and we begin not with planet prices, but with two sets of Fibonacci Retracement levels, the red lines are anchored at the 2003 Low and 2007 High and the blue lines at the 2007 High and 2009 Low.

Their long-range influence is obvious even from a quick glance.

Their long-range influence is obvious even from a quick glance.

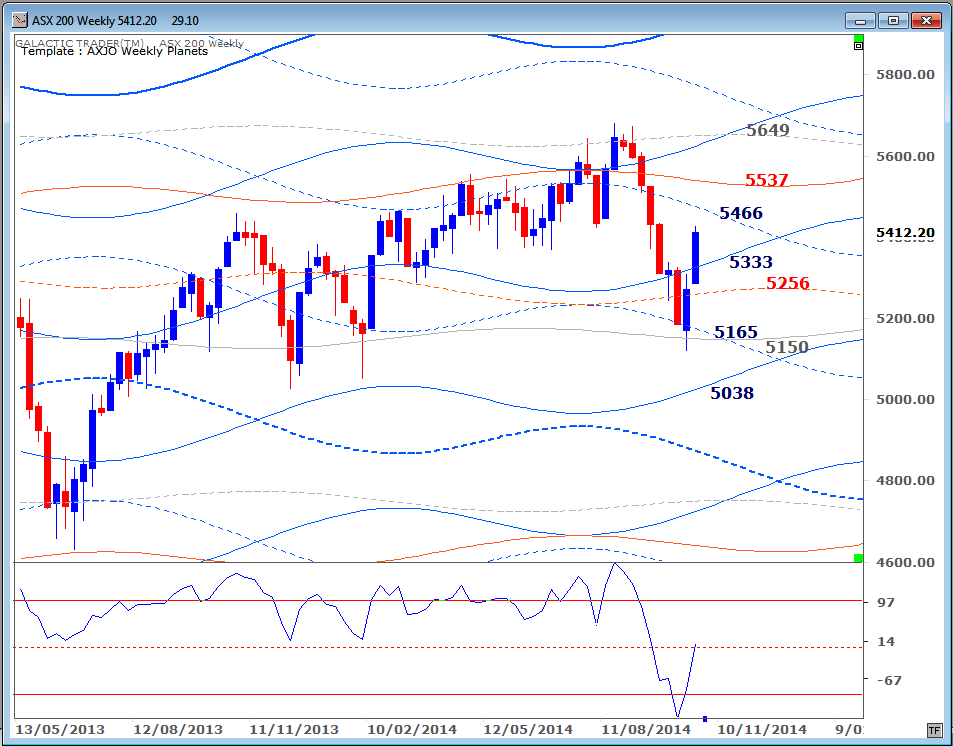

Next is Auntie's Weekly Planets chart I show you virtually every weekend and most of you will be very familiar with it.

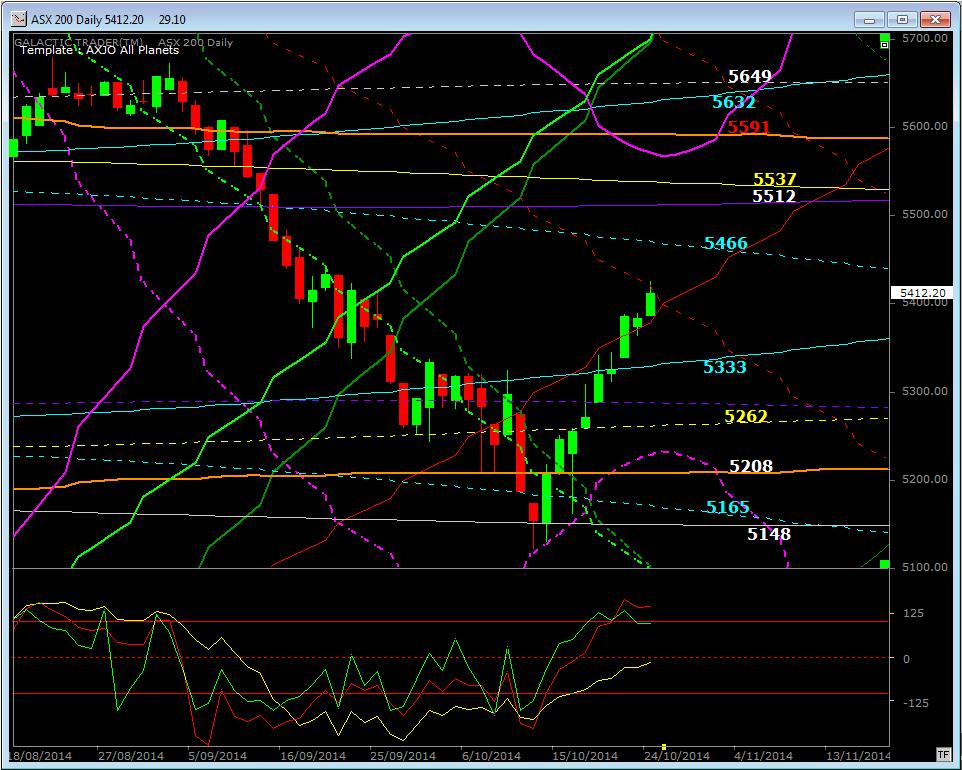

And next is my private All Planets chart for the index's daily price moves. The blue Saturn line at 5333 for early this week provided only temporary resistance last Monday and Tuesday. The index escaped on Wednesday, attaching itself to a rising Mars ... and closed out the week trapped between rising Mars and falling Mars.

The green Bird, a fast 6 CCI is starting to falter; but the red Bird, a medium 14 CCI, is still strong. So, it is possible the ASX200 will hit the next upside Saturn at 5466. If and when it does, we would need to take another reading from the state of the Canaries to get an idea if the bounce is over, or will head to the 5500s.

The green Bird, a fast 6 CCI is starting to falter; but the red Bird, a medium 14 CCI, is still strong. So, it is possible the ASX200 will hit the next upside Saturn at 5466. If and when it does, we would need to take another reading from the state of the Canaries to get an idea if the bounce is over, or will head to the 5500s.

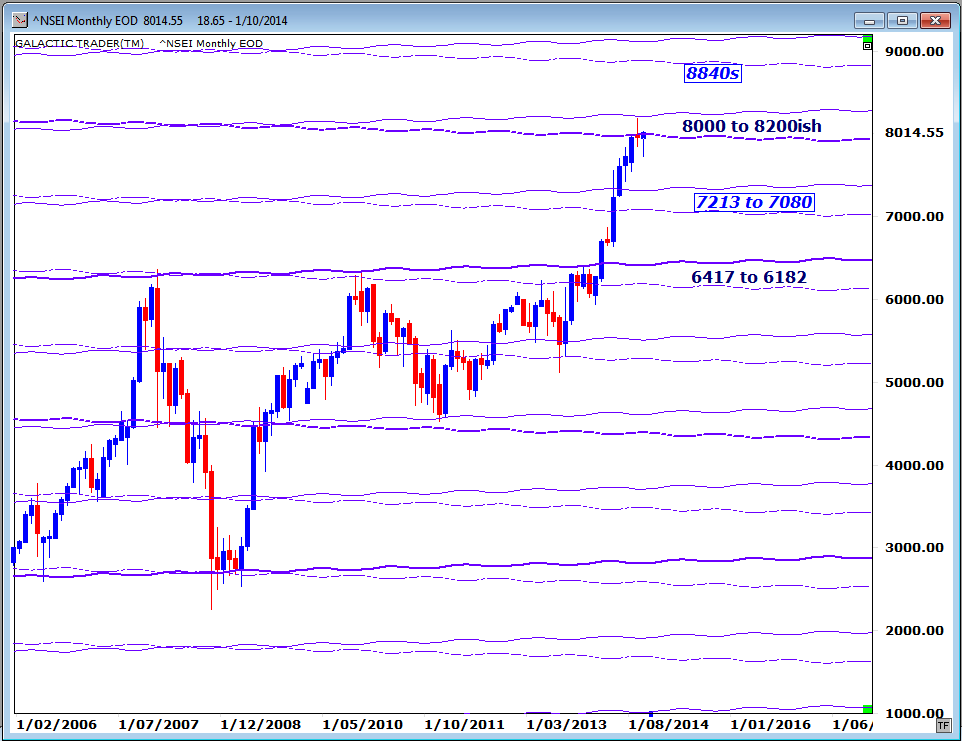

And finally for this weekend, a quick look at the state of the Nifty. My apologies to my Indian readers for not doing this more often. It's my long-range planetary price chart and you can see the Mumbai market has run into resistance.

Please check your own weekly charts for the technical condition of the recommended oscillators to see whether breakout or breakdown is more likely from this planetary price zone.

Please check your own weekly charts for the technical condition of the recommended oscillators to see whether breakout or breakdown is more likely from this planetary price zone.