Murky Wrecks ... and more gold mystery

Week beginning October 21, 2013

There are a couple of astro events this week likely to have an impact on stock markets ... Mercury goes Retrograde and the Sun shifts from Libra into Scorpio.

Copyright: Randall Ashbourne - 2011-2013

It's just a lack of concentration, which is easy to overcome if we're aware of the tendency and adopt a policy of double, even triple, checking.

There is also a general tendency for stock markets to start a move in the few days around the Merc Rx date which reverses course halfway through the phase (normally about 3 weeks long).

It doesn't always happen, but it does more frequently than not ... and since the last Mercury Retrograde phase in June/July launched a strong rally throughout the period, the coming phase probably has a higher chance of returning to "normalcy" mode.

We'll take a look at a chart on the topic in a moment. We'll also be taking another look at gold, where mysterious big money buyers have replaced the mysterious sellers, and I'll start the process of updating the Weekly Planets charts for a range of indices ... starting this weekend with India's Nifty, London's FTSE and Singapore's STI.

There is also a general tendency for stock markets to start a move in the few days around the Merc Rx date which reverses course halfway through the phase (normally about 3 weeks long).

It doesn't always happen, but it does more frequently than not ... and since the last Mercury Retrograde phase in June/July launched a strong rally throughout the period, the coming phase probably has a higher chance of returning to "normalcy" mode.

We'll take a look at a chart on the topic in a moment. We'll also be taking another look at gold, where mysterious big money buyers have replaced the mysterious sellers, and I'll start the process of updating the Weekly Planets charts for a range of indices ... starting this weekend with India's Nifty, London's FTSE and Singapore's STI.

Firstly, the usual warning about Merc Rx - Murky Wrecks - make sure you double-check everything you do and expect some data feeds to go haywire.

Most of us make a few mental blunders during the Merc Rx periods; like hitting the Buy button when we actually meant to Sell.

Most of us make a few mental blunders during the Merc Rx periods; like hitting the Buy button when we actually meant to Sell.

Safe trading - RA

(Disclaimer: This article is not advice or a recommendation to trade stocks; it is merely educational material.)

There is great joy across America as its politicians vote to send the nation deeper into debt while refusing to do anything about its profligate spending.

This is good. It means we can all get back to the really important stuff ... like why Miley persists in sticking her tongue out so far when it's always covered in white fuzz ... or whether there should be a law compelling Kim Kardashian to wear a full burqa so we are all spared another one of those endless "selfies" displaying buttocks that would shame a dairy cow into going on a diet.

And speaking of vacuous trolls ...

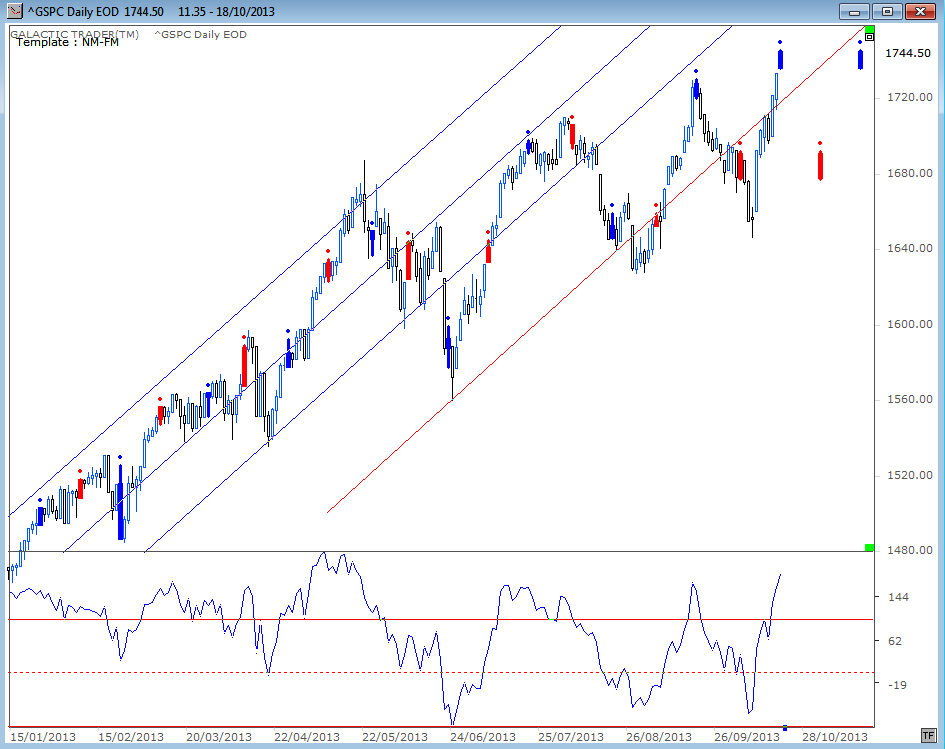

Miss Pollyanna, the SP500, gapped up on Friday into the Full Moon date, which statistically tends to be a low point in market mood. This inversion of the normal also happened at the last Full Moon - prompting a 3-week decline.

This is good. It means we can all get back to the really important stuff ... like why Miley persists in sticking her tongue out so far when it's always covered in white fuzz ... or whether there should be a law compelling Kim Kardashian to wear a full burqa so we are all spared another one of those endless "selfies" displaying buttocks that would shame a dairy cow into going on a diet.

And speaking of vacuous trolls ...

Miss Pollyanna, the SP500, gapped up on Friday into the Full Moon date, which statistically tends to be a low point in market mood. This inversion of the normal also happened at the last Full Moon - prompting a 3-week decline.

The optimism displayed by Pollyanna is not universally shared.

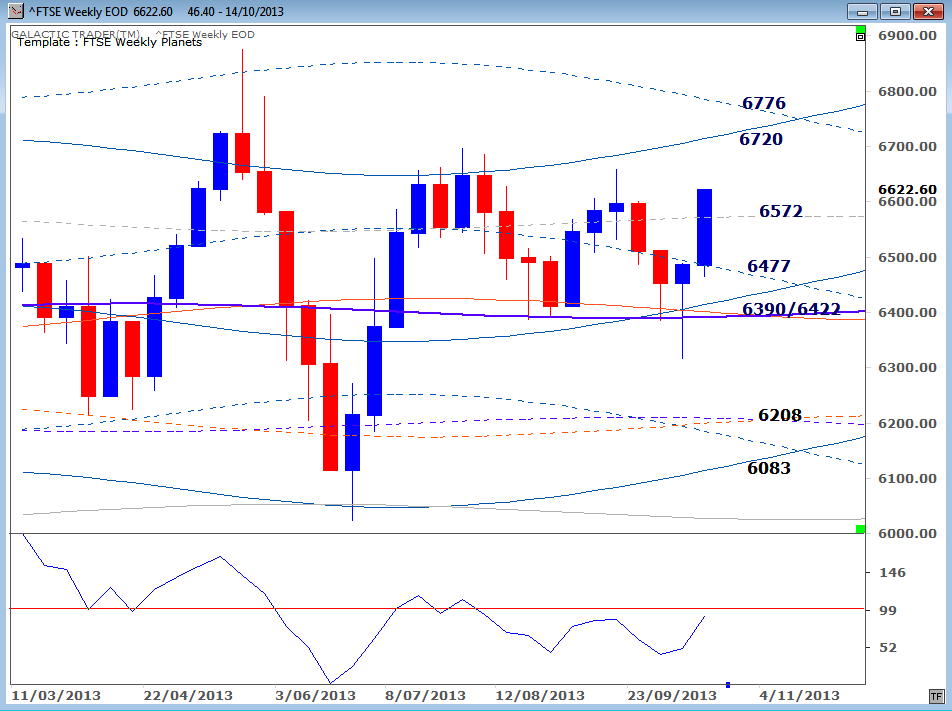

London's FTSE index remains below its May highs; in fact, it's still below its August and September highs.

London's FTSE index remains below its May highs; in fact, it's still below its August and September highs.

The new Price high has received an approving nod from the Big Bird oscillator, which has also recorded a higher peak ... though not as high as it recorded in May.

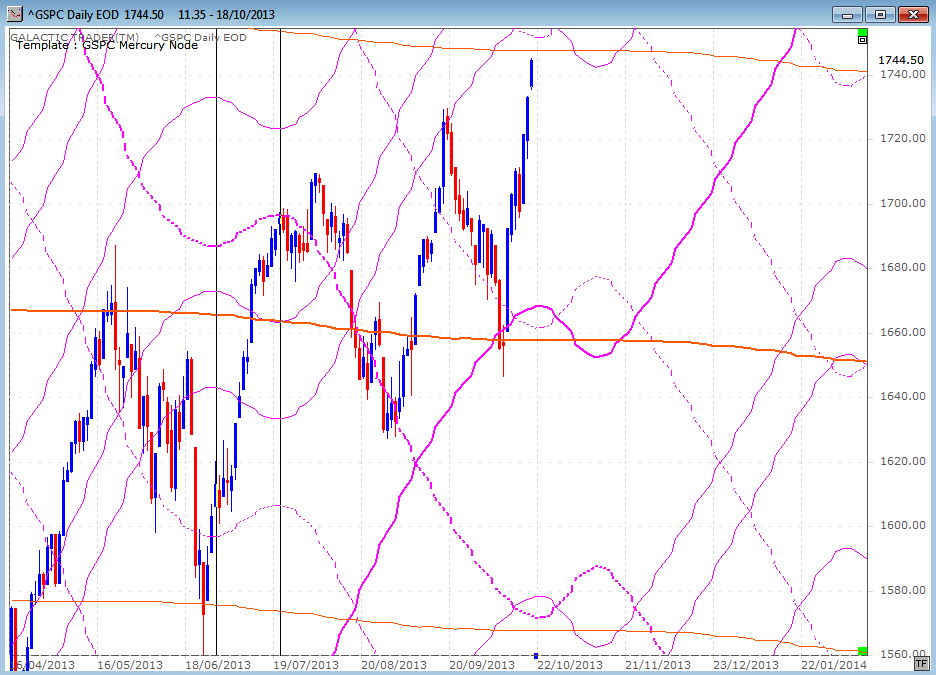

Next, we will look at a Mercury/Node chart for the index. In the left third of the chart I've marked the previous Merc Rx phase with two black verticals. The index rallied all the way through the phase, which is a little unusual.

Next, we will look at a Mercury/Node chart for the index. In the left third of the chart I've marked the previous Merc Rx phase with two black verticals. The index rallied all the way through the phase, which is a little unusual.

Miss Polly has a tendency to travel between Node price lines, which are the orange horizontals on the chart above. And there's one of those immediately overhead.

The astrological symbolism applied to Mercury Retrograde periods is that it denotes time for a RE-think about what's happening. I showed you a few weeks ago that the Sun in Libra tends to be a bit chaotic. Libra symbolises balance and a drive to reach agreement and an harmonious outcome.

I also said it can just mean the iron fist is wrapped in a velvet glove. We had that sort of stuff happening in Washington. Nevermind. We got the agreement, which kicks the whole mess down the road until early next year.

The Sun's shift to Scorpio, in conjunction with the Merc Rx phase for the next few weeks, means it's very likely there'll be a national re-think about how to handle all the debt (Scorpio) issues.

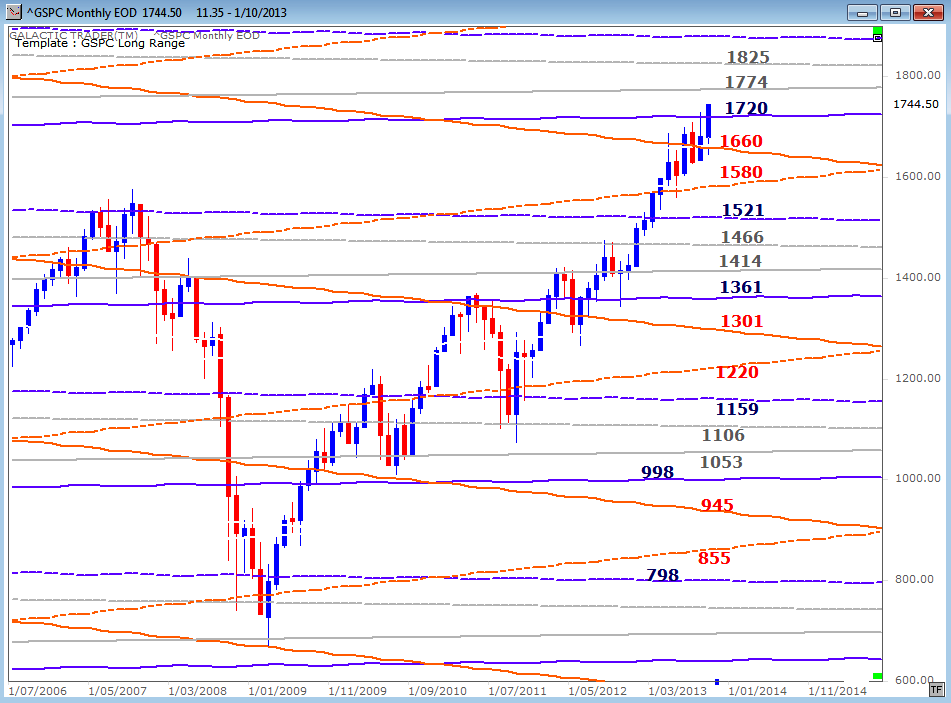

So, we do need to be aware that the breakout could be subject to a reversal. However, it is a breakout and the next highest level of long-range planetary price resistance doesn't come into effect until the $1770s.

The astrological symbolism applied to Mercury Retrograde periods is that it denotes time for a RE-think about what's happening. I showed you a few weeks ago that the Sun in Libra tends to be a bit chaotic. Libra symbolises balance and a drive to reach agreement and an harmonious outcome.

I also said it can just mean the iron fist is wrapped in a velvet glove. We had that sort of stuff happening in Washington. Nevermind. We got the agreement, which kicks the whole mess down the road until early next year.

The Sun's shift to Scorpio, in conjunction with the Merc Rx phase for the next few weeks, means it's very likely there'll be a national re-think about how to handle all the debt (Scorpio) issues.

So, we do need to be aware that the breakout could be subject to a reversal. However, it is a breakout and the next highest level of long-range planetary price resistance doesn't come into effect until the $1770s.

The daily Big Bird is crawling higher, even with the price lower. There's not quite the same level of agreement from weekly Big Bird on the FTSE's Weekly Planets chart (below).

Still, either on this rally or the next one, the FTSE seems to have its target set at the upside Saturns - in the 6700s.

Still, either on this rally or the next one, the FTSE seems to have its target set at the upside Saturns - in the 6700s.

Mumbai's Nifty Weekly Planets is below and the index has been playing those close to perfection. Big Bird likes the bounce and breakout is likely to target the 6400s.

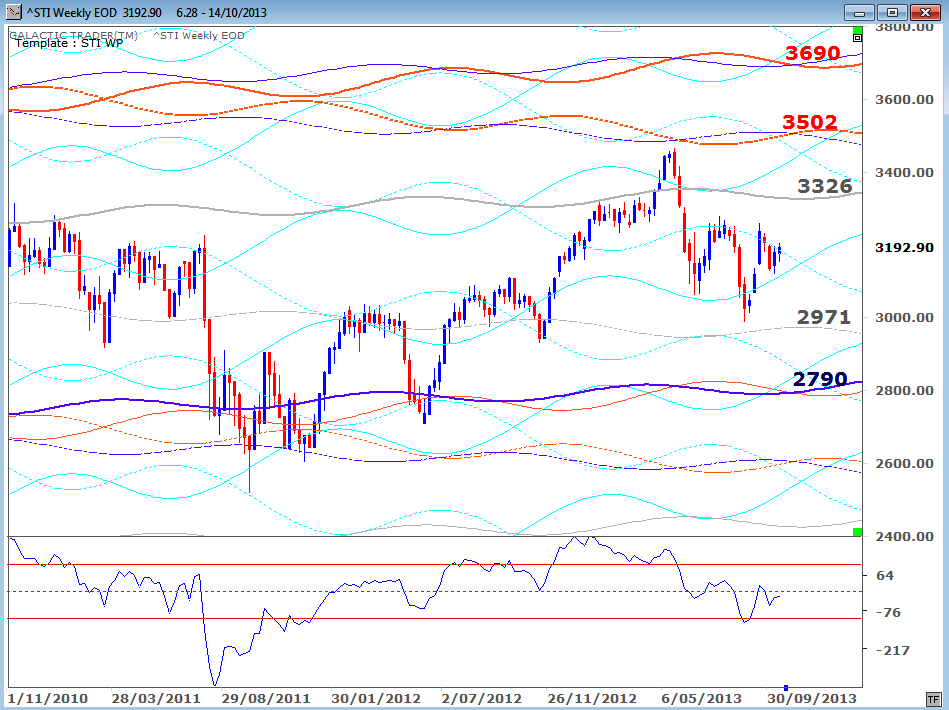

The Straits Times Index has been constrained by Saturn for many weeks - and its Big Bird is not giving clear signals for a move in either direction.

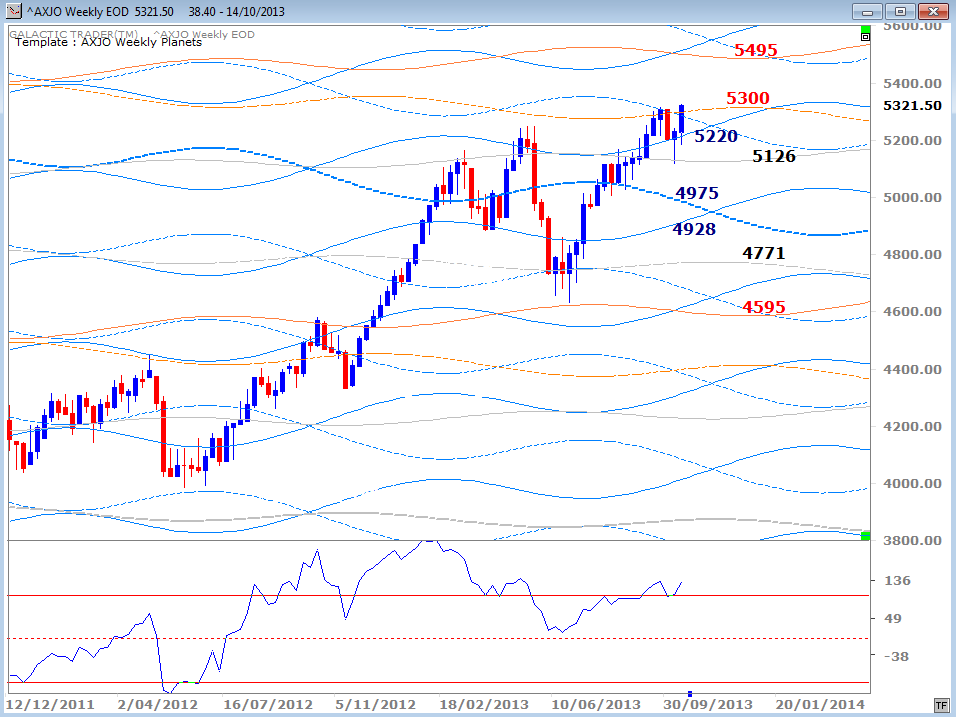

Similar to the Nifty, Auntie - the ASX200 - is playing almost perfect WP touches. We have preliminary indications of a break northwards ... and it's open space all the way to around 5500.

I'll try to update more European and Asian WP charts over the next couple of weekends. But now, let's turn our attention to the latest shenanigans in the bullion bazaar.

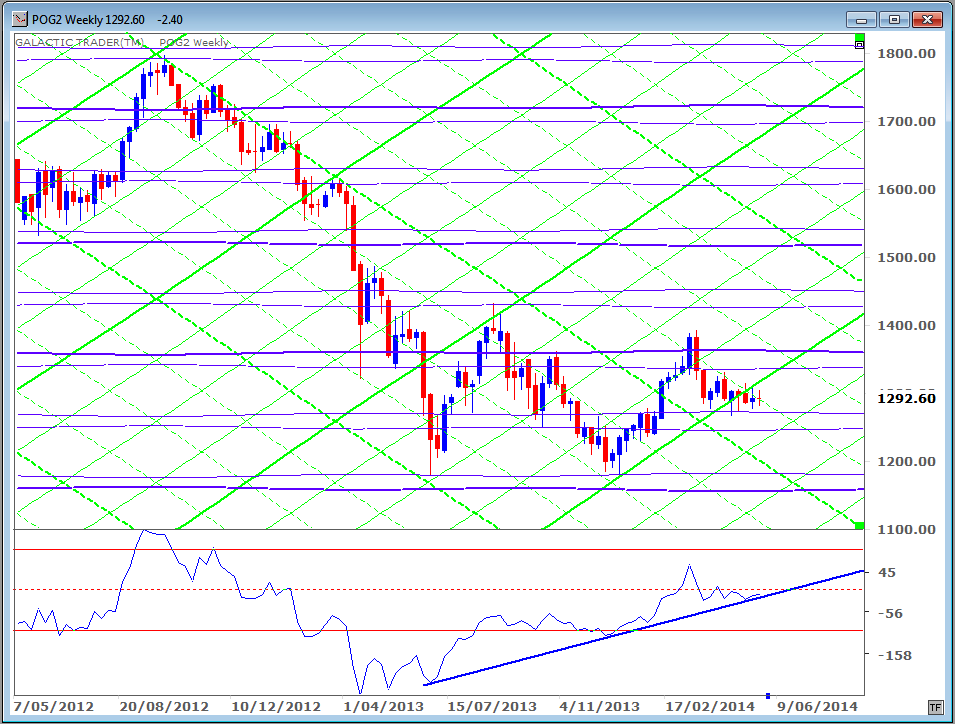

And bizarre it was again last week when, in the wee hours of New York's Thursday morning, a wave of Buy orders worth over $2.3 billion surged onto the markets, causing a 3% jump in prices in a matter of minutes. The manipulation continues unabated.

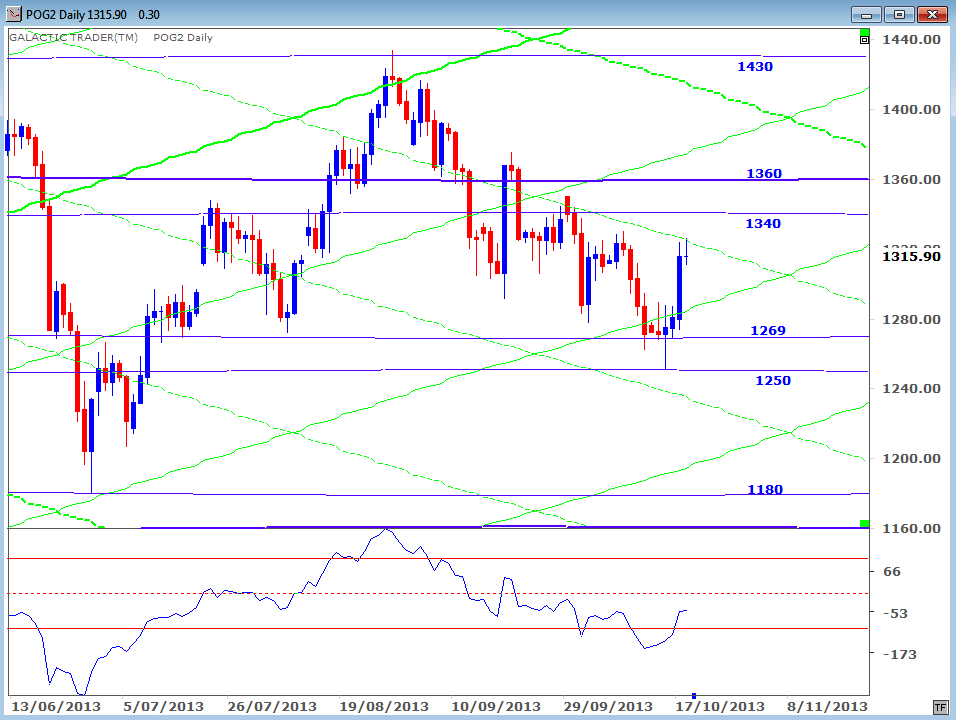

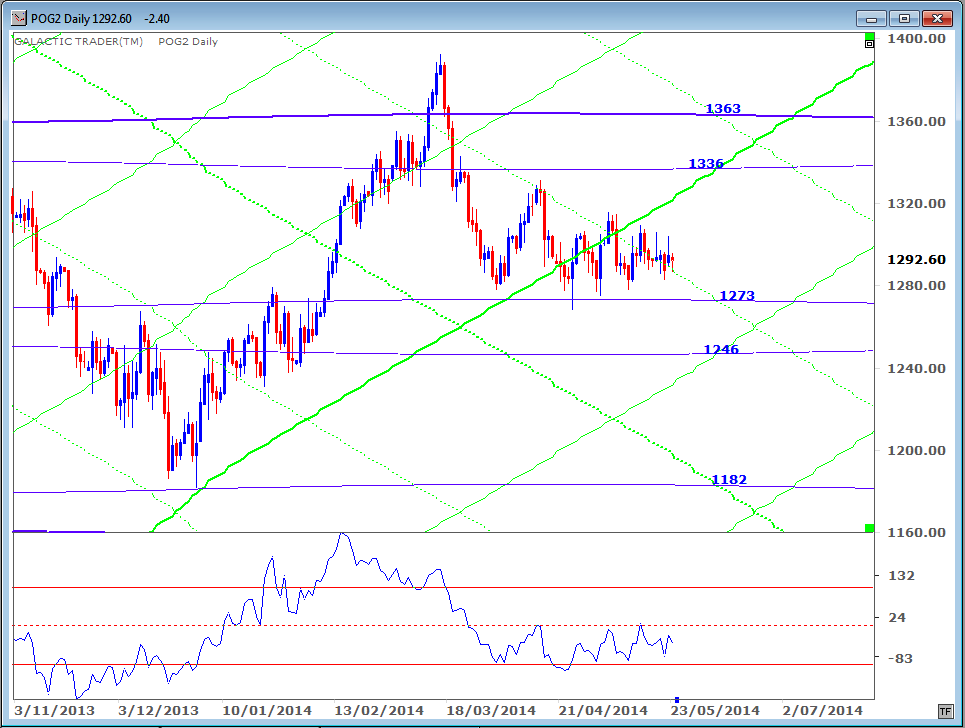

Let's look first at my planetary price chart for greenback gold. We got the lower prices when gold slumped down into the 1250 Pluto level early in the week and rebounded with all those mysterious early-am Buy orders on Thursday to finish the week capped by a falling Sun line.

And bizarre it was again last week when, in the wee hours of New York's Thursday morning, a wave of Buy orders worth over $2.3 billion surged onto the markets, causing a 3% jump in prices in a matter of minutes. The manipulation continues unabated.

Let's look first at my planetary price chart for greenback gold. We got the lower prices when gold slumped down into the 1250 Pluto level early in the week and rebounded with all those mysterious early-am Buy orders on Thursday to finish the week capped by a falling Sun line.

Thursday's raid also produced a breakout above the red downtrend line which has controlled the market since it peaked in August. Fast Bird (green) likes the move and so does the red Medium Bird.

So, despite Friday's stall it appears higher prices are ahead. So go consult the planetary chart.

So, despite Friday's stall it appears higher prices are ahead. So go consult the planetary chart.

But remember that there's still a lot of overhead resistance which has yet to be overcome before we can be sure gold has embarked on a sustained rally.