The 2 main scenarios and a head fake

Week beginning October 13, 2014

For the past few weeks we've been discussing the turmoil and volatility likely to be on display during this period.

Copyright: Randall Ashbourne - 2011-2014

Mercury is Retrograde for most of October, so there is a chance it's all a head fake. However, we still have the solar ecipse New Moon to come ... on the 23rd.

Western-allied markets are in turmoil. Not so much so for a lot of the Asian indices.

We now need to put aside The Spooky Stuff and look at what has happened from a more technical point of view.

And there are only two main scenarios. We are either in a secondary correction before another rally produces a final High to the Bull run sometime next year. Or, we are already in a new Bear.

Western-allied markets are in turmoil. Not so much so for a lot of the Asian indices.

We now need to put aside The Spooky Stuff and look at what has happened from a more technical point of view.

And there are only two main scenarios. We are either in a secondary correction before another rally produces a final High to the Bull run sometime next year. Or, we are already in a new Bear.

I warned that the Grand Trine between Mars, Jupiter and Uranus in Fire signs would break boundaries. That is the true nature of a trine.

We also talked about how the symbolism of the Fire trine would be further exacerbated by the Sun and Venus rocking the Libran scales.

And how last week's lunar eclipse Full Moon had the power to bring it all to a spectacular climax.

We also talked about how the symbolism of the Fire trine would be further exacerbated by the Sun and Venus rocking the Libran scales.

And how last week's lunar eclipse Full Moon had the power to bring it all to a spectacular climax.

Safe trading - RA

(Disclaimer: This article is not advice or a recommendation to trade stocks; it is merely educational material.)

The good news is that the extreme nature of the cosmic energy explosion should now begin to subside ... at least temporarily. The bad news is that we are probably in a correction due to run for weeks, possibly months.

In Elliott Wave terms, it would be a major Wave 4. Elliott theorised that stock markets run in 5 waves, where Waves 1, 3 and 5 are major rallies and Waves 2 and 4 are rather severe downturns within the overall structure.

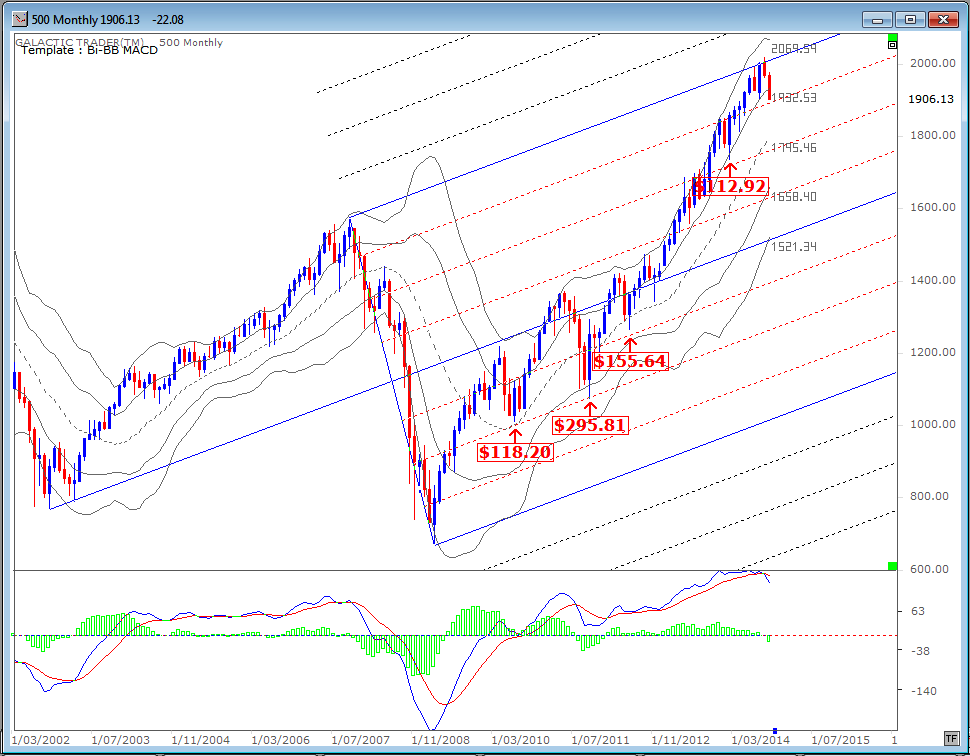

So, let's begin this weekend with a look at what we might expect as reasonable and "normal" if that scenario is in play. The chart below is a monthly of the SP500, using Bi-BBs (the use of which is outlined in The Technical Section of The Idiot & The Moon) and an Andrew's Pitchfork.

The current correction has so far run $113 ... so it is roughly on a par with three earlier corrections during this Bull phase. They were $118, $155 and $112.

The big correction, which EW acolytes believe was a Wave 2 downturn, ran for 6 months from start to finish and sliced $295 off the price of the index.

In Elliott Wave terms, it would be a major Wave 4. Elliott theorised that stock markets run in 5 waves, where Waves 1, 3 and 5 are major rallies and Waves 2 and 4 are rather severe downturns within the overall structure.

So, let's begin this weekend with a look at what we might expect as reasonable and "normal" if that scenario is in play. The chart below is a monthly of the SP500, using Bi-BBs (the use of which is outlined in The Technical Section of The Idiot & The Moon) and an Andrew's Pitchfork.

The current correction has so far run $113 ... so it is roughly on a par with three earlier corrections during this Bull phase. They were $118, $155 and $112.

The big correction, which EW acolytes believe was a Wave 2 downturn, ran for 6 months from start to finish and sliced $295 off the price of the index.

So, if we are now in Wave 4, this downturn will not be short-lived and there is more downside still to come. Normalcy dictates there should be a relationship with Wave 2, either in Time or Price, but not necessarily both.

Elliott Wavers use a rule-of-thumb that a major Wave 4 tends to decline into the same price territory as the previous Wave 4 of a lower level. Yes, I know ... it can be very difficult to get your head around if you haven't spent a lot of time trying to understand the theory.

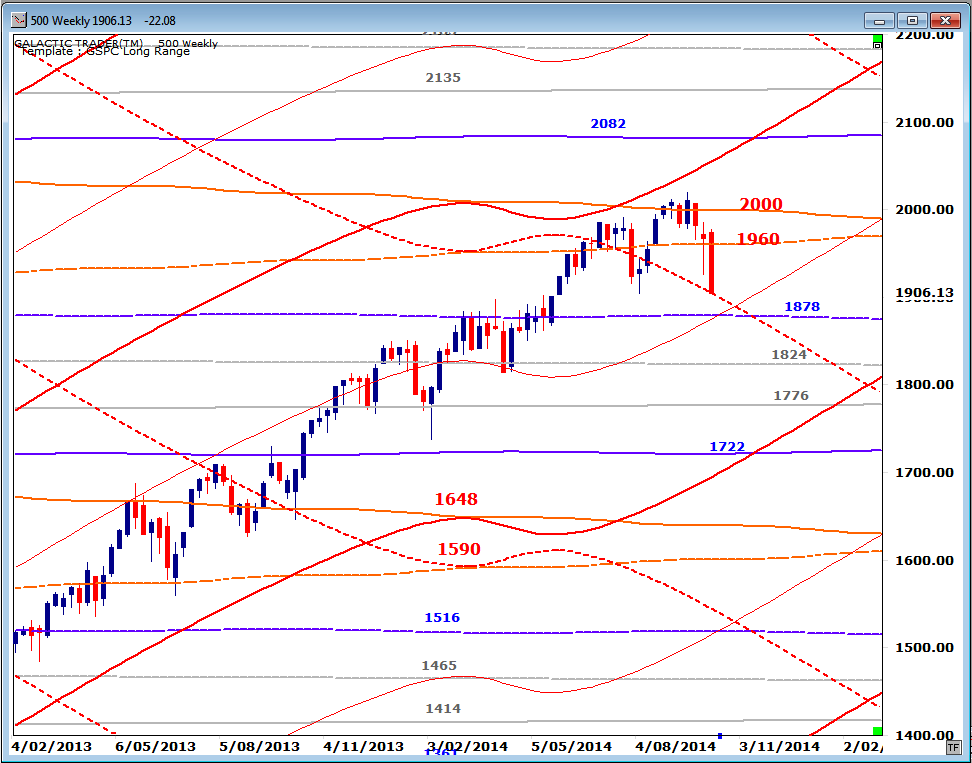

So, let me try to cut out the gobbledegook for you. It means, on our planetary prices chart below, that the target for the decline could be as high as $1878 ... or as low as $1776.

Elliott Wavers use a rule-of-thumb that a major Wave 4 tends to decline into the same price territory as the previous Wave 4 of a lower level. Yes, I know ... it can be very difficult to get your head around if you haven't spent a lot of time trying to understand the theory.

So, let me try to cut out the gobbledegook for you. It means, on our planetary prices chart below, that the target for the decline could be as high as $1878 ... or as low as $1776.

Now remember, that's the relatively optimistic scenario ... that this is just a significant downturn in a Bull run which still has another major rally to run.

The second scenario is that this is a screaming klaxon warning the Bull is dead and the Bear is back. Even if that's the case, there will be sharp and swift bouncebacks in the price as the central banks, the hedge funds, the fund managers try desperately to drive prices higher ... even if it's only to unload their toxic holdings onto poor mug punters who buy the media line that it's "a great time to buy".

Caveat emptor!

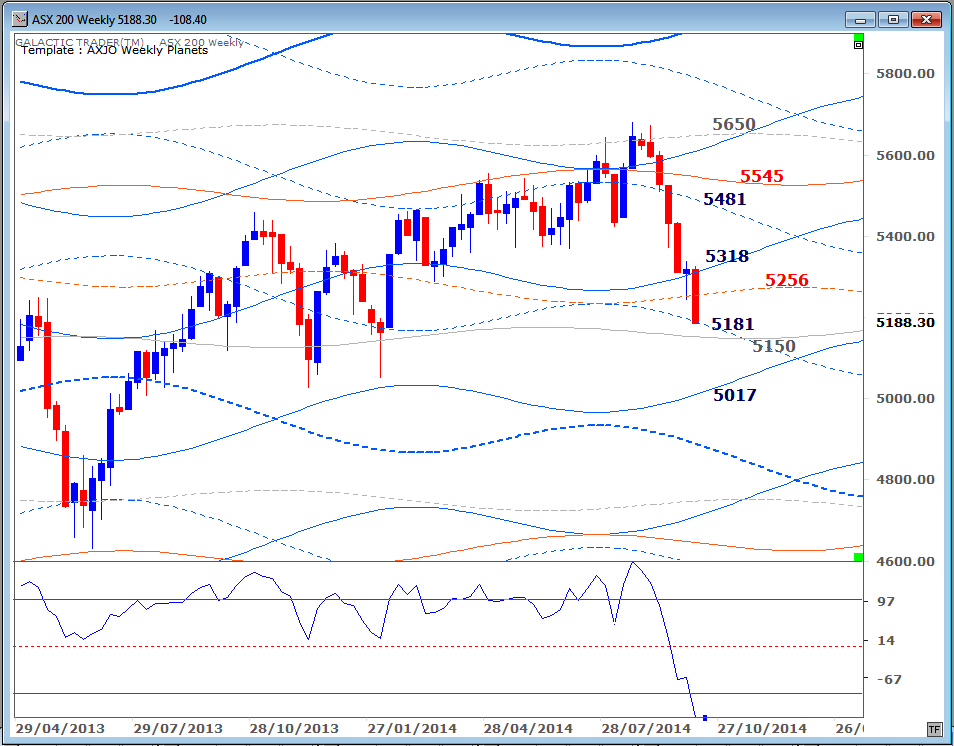

Now to my home market, the ASX200 and its routinely reliable Weekly Planets chart. Regular readers will know that Auntie is a strongly Neptunian index over the long term, even as she responds to Saturn lines during weekly moves.

The next potential Neptune "rescue" level is very nearby, priced around $5150. Note that the index topped out at the $5650 level, so $5150-ish is both a legitimate target and potentially quite strong as a Support level.

The Big Bird oscillator has gone into a death dive on the weekly. Poor little thing seems to be buried in the dirt on the mineshaft floor. We'll get no sustained bounce in Auntie's price levels until he manages to pop his head back above the lowest red line in the panel.

The second scenario is that this is a screaming klaxon warning the Bull is dead and the Bear is back. Even if that's the case, there will be sharp and swift bouncebacks in the price as the central banks, the hedge funds, the fund managers try desperately to drive prices higher ... even if it's only to unload their toxic holdings onto poor mug punters who buy the media line that it's "a great time to buy".

Caveat emptor!

Now to my home market, the ASX200 and its routinely reliable Weekly Planets chart. Regular readers will know that Auntie is a strongly Neptunian index over the long term, even as she responds to Saturn lines during weekly moves.

The next potential Neptune "rescue" level is very nearby, priced around $5150. Note that the index topped out at the $5650 level, so $5150-ish is both a legitimate target and potentially quite strong as a Support level.

The Big Bird oscillator has gone into a death dive on the weekly. Poor little thing seems to be buried in the dirt on the mineshaft floor. We'll get no sustained bounce in Auntie's price levels until he manages to pop his head back above the lowest red line in the panel.

And that's it for this weekend. Long-range charts and other stuff for the European indices have been published in previous weeks and if you didn't do a cut-and-paste of them, you can have a wander through the Archives.