The Bull ... Halloween costume change?

Week beginning November 4, 2013

There is a chance the Bull died quietly last week.

Copyright: Randall Ashbourne - 2011-2013

I indicated last weekend that the middle hit of the Uranus square Pluto aspect brought with it an increased danger of turning the tide, though the full effect might not become obvious for several months.

In the coming week, Venus shifts into Capricorn, the Sun has its annual conjunction with Saturn, and Jupiter turns Retrograde.

While many astrology buffs tend to view the latter two of those as being highly negative, the truth is neither has a particularly reliable record of turning the markets decisively. I'll show you the chart of past performance in a moment.

Of more concern is the deceleration in the rally which began a year ago. It is not so obvious on weekly and monthly charts. The daily channel of the rally tells quite another story.

We'll also take a quick look at gold and the possibility it is now nearing a bounce level that could be worth a couple of hundred dollars an ounce.

In the coming week, Venus shifts into Capricorn, the Sun has its annual conjunction with Saturn, and Jupiter turns Retrograde.

While many astrology buffs tend to view the latter two of those as being highly negative, the truth is neither has a particularly reliable record of turning the markets decisively. I'll show you the chart of past performance in a moment.

Of more concern is the deceleration in the rally which began a year ago. It is not so obvious on weekly and monthly charts. The daily channel of the rally tells quite another story.

We'll also take a quick look at gold and the possibility it is now nearing a bounce level that could be worth a couple of hundred dollars an ounce.

For the moment, it is merely a possibility, rather than a probability.

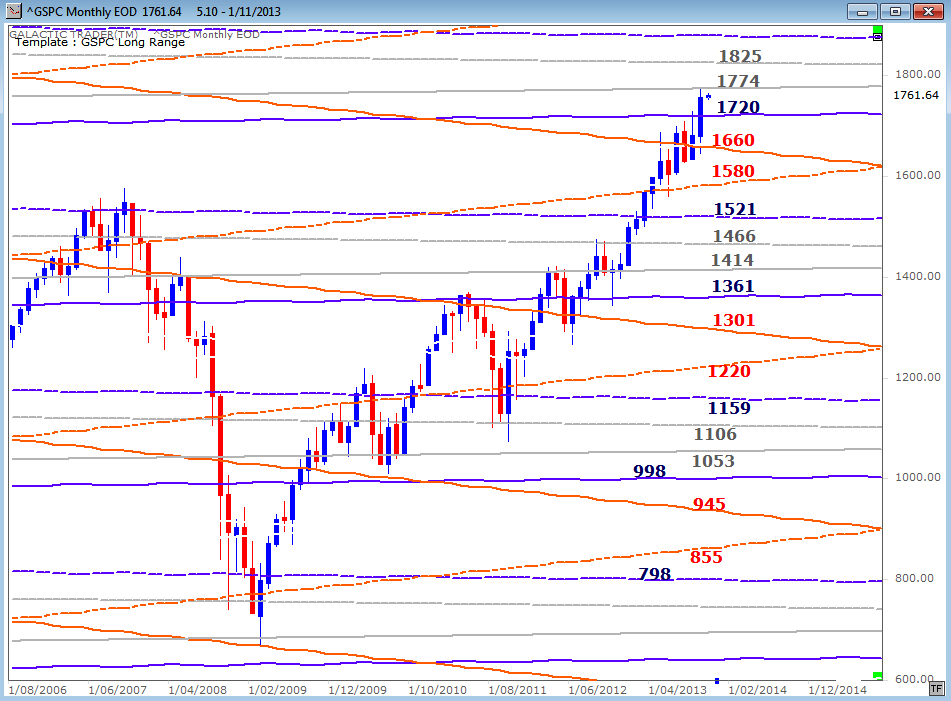

However, using three different techniques, Wall Street's major index, the SP500, has hit important long-range projections and resistance.

We will examine the omens in some detail this weekend because the implications are likely to have an impact on stock markets worldwide.

However, using three different techniques, Wall Street's major index, the SP500, has hit important long-range projections and resistance.

We will examine the omens in some detail this weekend because the implications are likely to have an impact on stock markets worldwide.

Safe trading - RA

(Disclaimer: This article is not advice or a recommendation to trade stocks; it is merely educational material.)

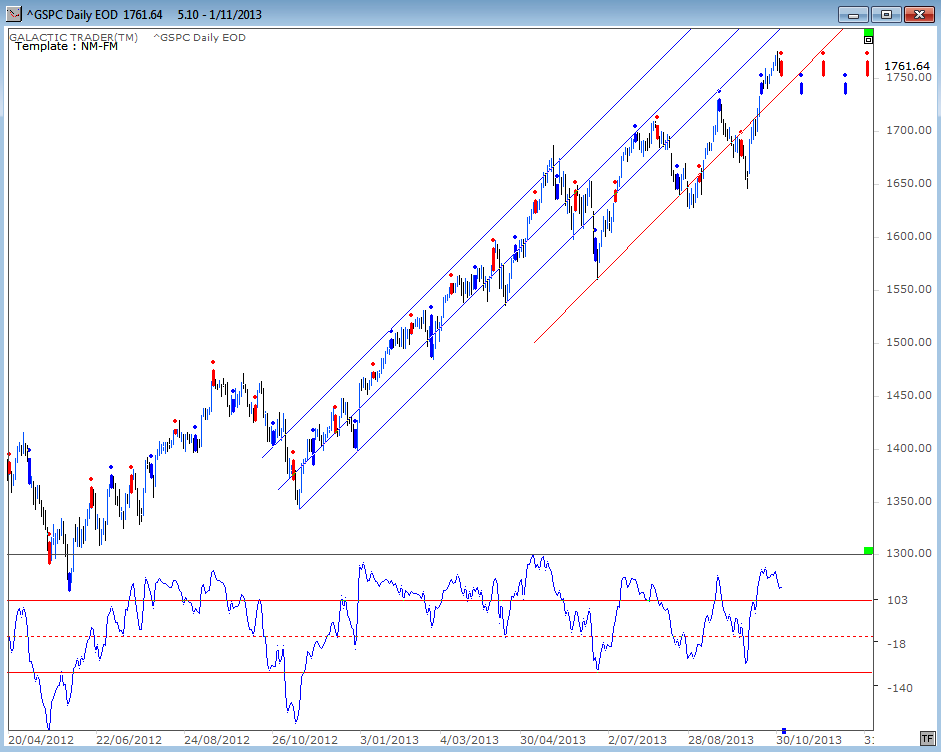

Let's begin by looking at the track record of the Sun conjuncting Saturn and Jupiter turning Retrograde. On the chart below, the Sun's annual conjunction with Saturn is marked with red bars and the Jupiter Rx phases are marked with the blue bars.

While the astrological expectation might be that they're a negative influence, neither turns up regularly as a reliable turn indicator.

While the astrological expectation might be that they're a negative influence, neither turns up regularly as a reliable turn indicator.

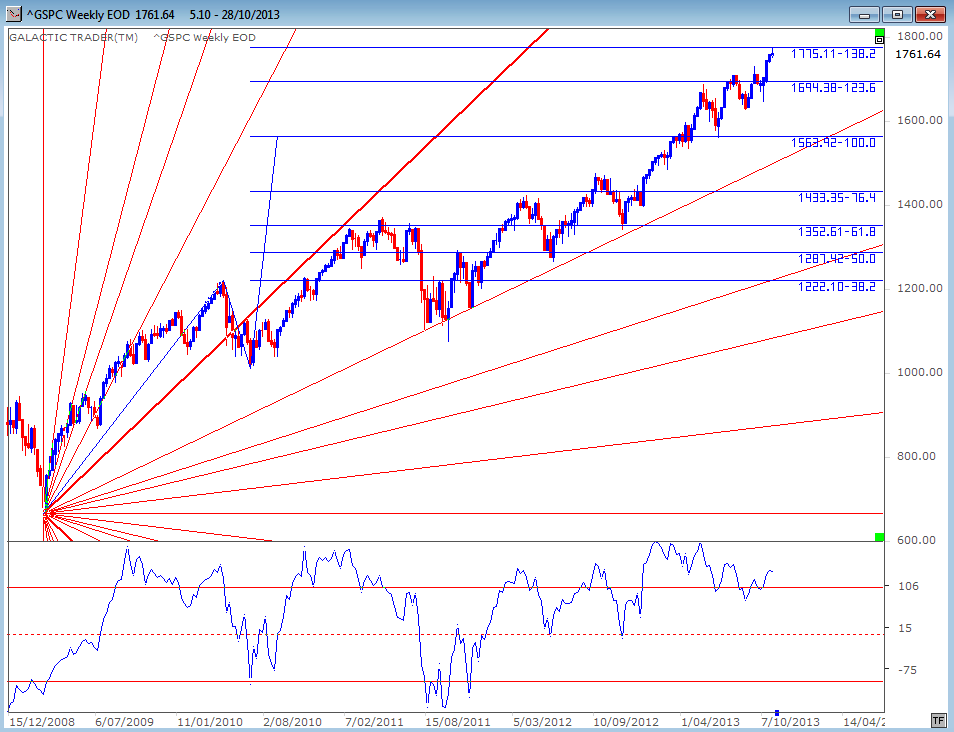

And thirdly, we see the potential for a top of real significance because the index has touched - and resiled from - an important Fibonacci price projection calculated as an extension from the first leg of the post-Bear rally.

But, there are other reasons to worry now. Using three different techniques, Pollyanna - the SP500 - has made exact hits of price levels which have the potential to stop the Bull in its tracks.

Firstly, Miss Polly's long-range planetary price levels ...

Firstly, Miss Polly's long-range planetary price levels ...

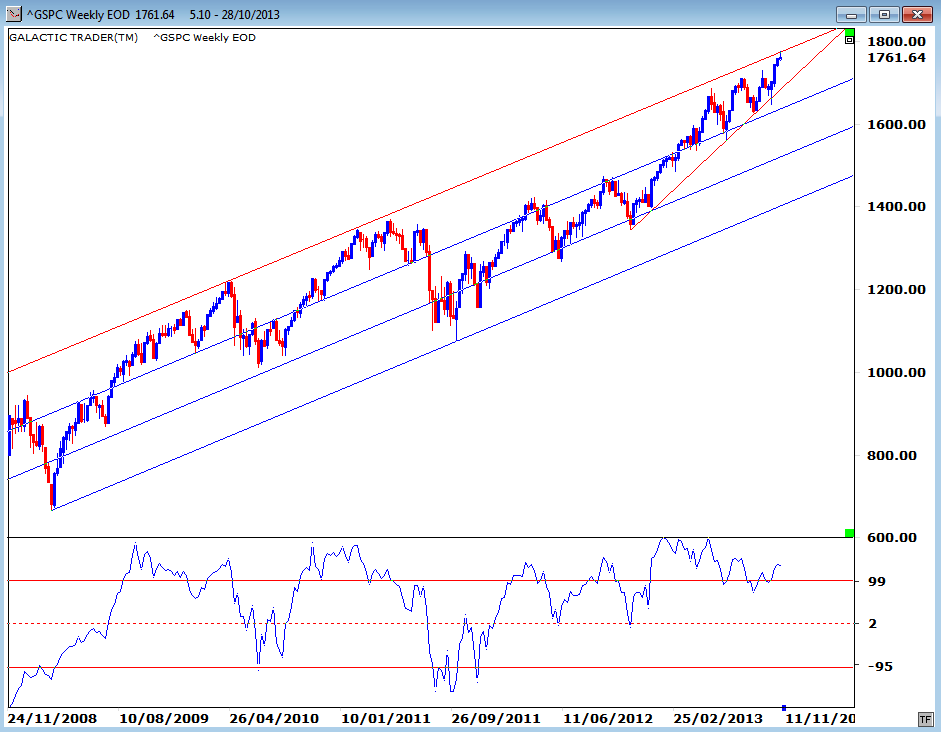

Secondly, it has made an exact touch of the upper trend channel line. Past contact with this line since the Bear bottomed in 2009 has caused major reversals.

Now, we have a difference between perception and reality. The perception Out There seems to be the Bull is running at full speed. The reality is that there signs of marked deceleration.

While Polly has hit the top of its long-range weekly channel, an examination of the rally leg which began a year ago shows something else. For the first 7 or 8 months of the rally, price stayed within the rising blue channel.

After the first dropout, it regained the channel. And that's something the index has been unable to achieve since.

While Polly has hit the top of its long-range weekly channel, an examination of the rally leg which began a year ago shows something else. For the first 7 or 8 months of the rally, price stayed within the rising blue channel.

After the first dropout, it regained the channel. And that's something the index has been unable to achieve since.

So the danger continues to develop. There is a chance - a possibility - that the Bull died quietly on Wednesday. It seems unlikely. And it could be weeks, perhaps even a few months, before we will know for sure whether it's all over - or whether there will be another rally.

Topping is a process, not an event. But the danger signs are there for those who want to ignore the chattering and simply take notice of what the charts are warning.

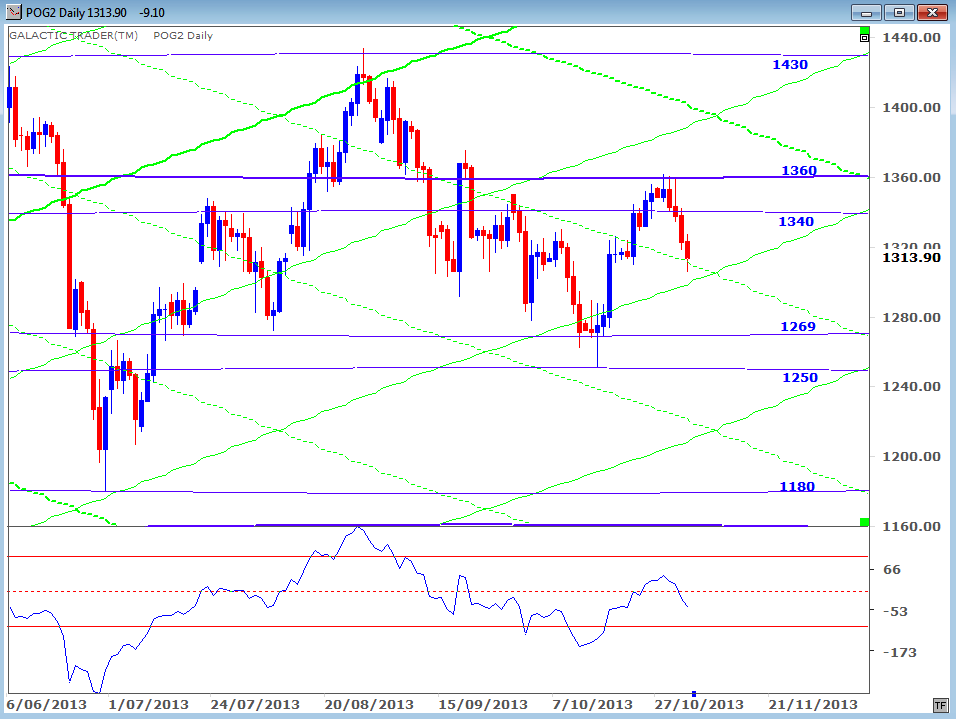

Now, let's have another look at the price of gold. Despite the obvious manipulation, price continues to play to Sun-Pluto markers. There are two major views of this chart.

The gold bugs think the past week's performance is just a small breather before a huge rally higher; the gold bears view this as the start of a sharp new wave downwards.

Topping is a process, not an event. But the danger signs are there for those who want to ignore the chattering and simply take notice of what the charts are warning.

Now, let's have another look at the price of gold. Despite the obvious manipulation, price continues to play to Sun-Pluto markers. There are two major views of this chart.

The gold bugs think the past week's performance is just a small breather before a huge rally higher; the gold bears view this as the start of a sharp new wave downwards.

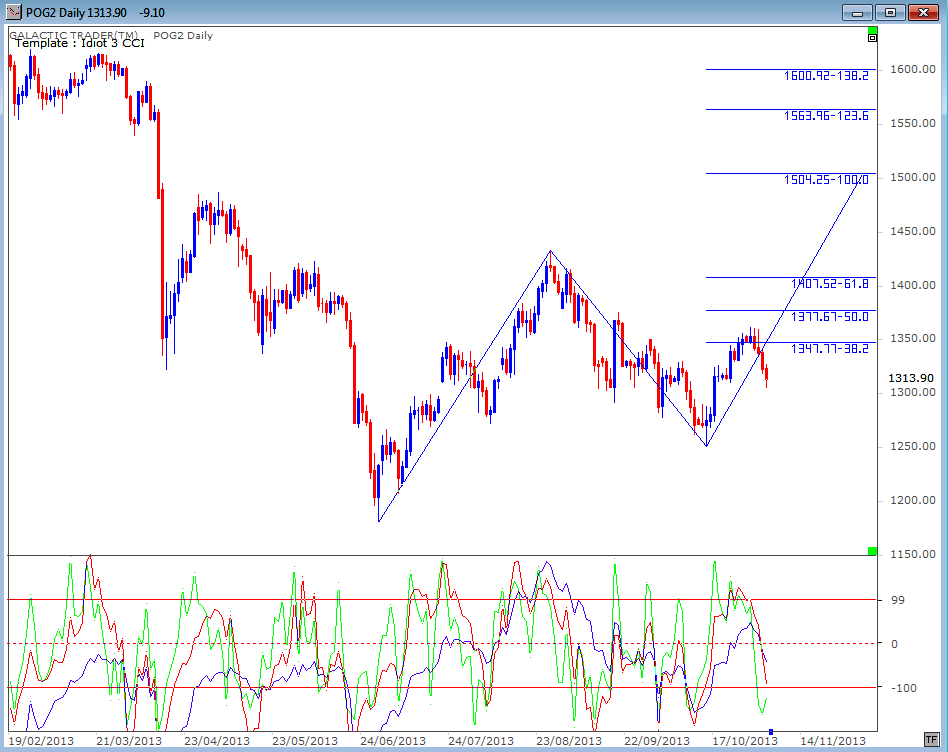

There is an alternative. In Elliott Wave terms, a correction forms a 3-wave pattern known as an ABC. These patterns are usually obvious only with the wisdom of hindsight because the waves can break down into smaller abc patterns.

In the chart below, I have assumed that gold is still within a large-scale correction and has not yet made its final bottom. In this scenario, it will eventually take out the June lows. But, in all probability, not before it rallies.

This chart assumes that the rally from late June to late August was the "A" of an ABC. The decline into mid October was the "B". If that is so, then the final component ... the "C" ... still has further to run in Time and Price.

It means we have seen only the "a" and most of the "b" of the "C" leg. We should find out this week. If price continues down past the October 15 Low, it's also likely the June Low will be breached.

We need to watch for a potential turn northwards almost immediately or at prices very close to last week's Close. We can see the potential for a turn is provided by contact with the green Sun lines on the chart above.

In the chart below, I have assumed that gold is still within a large-scale correction and has not yet made its final bottom. In this scenario, it will eventually take out the June lows. But, in all probability, not before it rallies.

This chart assumes that the rally from late June to late August was the "A" of an ABC. The decline into mid October was the "B". If that is so, then the final component ... the "C" ... still has further to run in Time and Price.

It means we have seen only the "a" and most of the "b" of the "C" leg. We should find out this week. If price continues down past the October 15 Low, it's also likely the June Low will be breached.

We need to watch for a potential turn northwards almost immediately or at prices very close to last week's Close. We can see the potential for a turn is provided by contact with the green Sun lines on the chart above.

If that does turn out to be the case, then we should assume some level of normalcy is at work ... and what is reasonably normal is that a C wave will tend to be a very similar length to the initial A wave. And that puts the target at around 1500 - a potential rise of $200 an ounce.

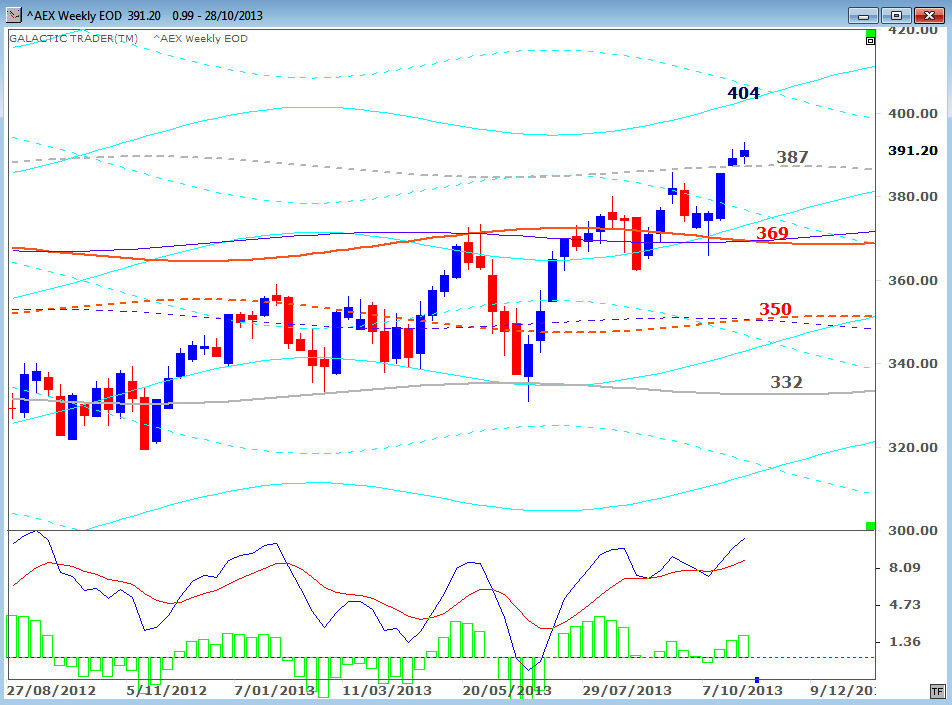

I'll wrap-up this edition by updating the Weekly Planets charts for Paris and Amsterdam and with a quick look at the Australian market.

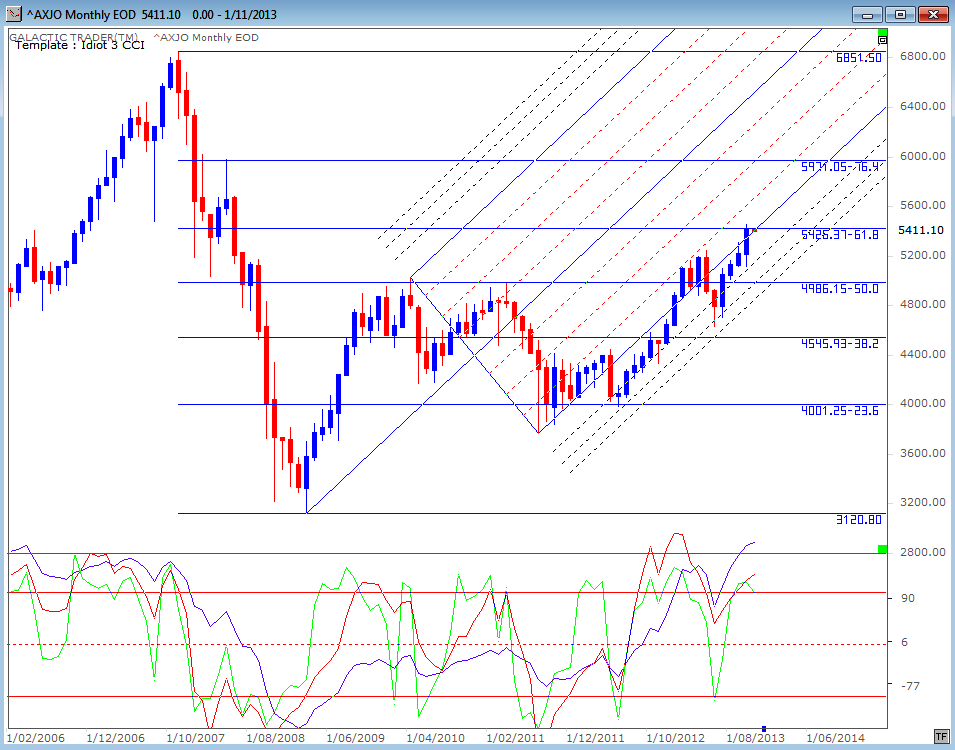

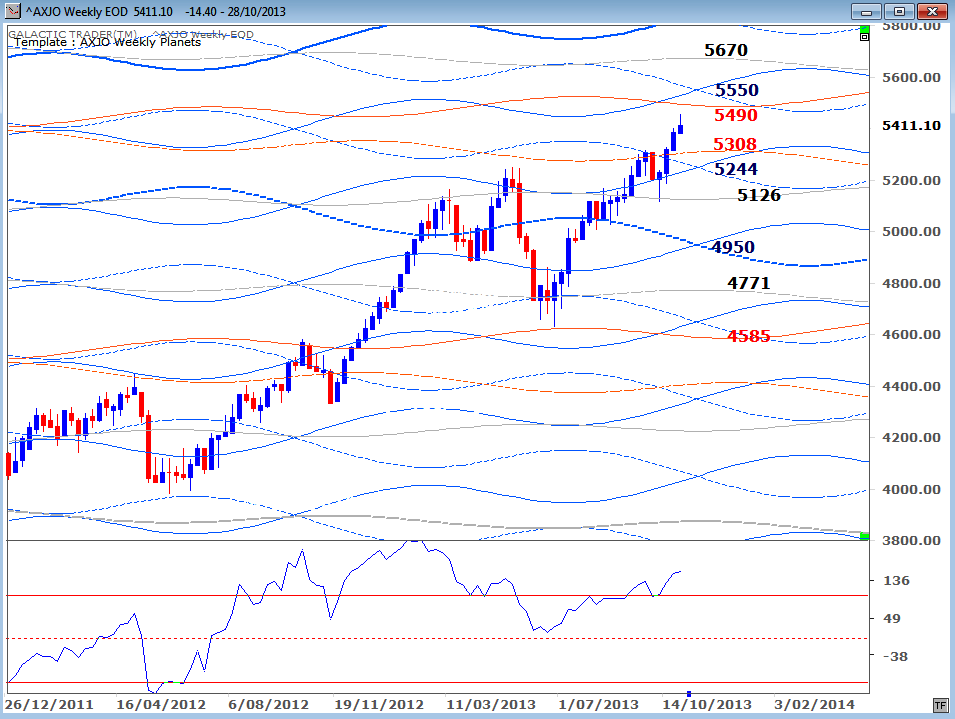

Auntie, the ASX200, has hit new highs ... much lower than the 2007 peak! The first two rallies after the 2009 Bear bottom stalled out at the 50% retracement level. Last week we had what appears to be a "false break" of the 61.8% Fibonacci Rx line.

However, there's a technical condition evident here which cautions me against declaring the Bull to be dead. And it's the state of the long-range Big Bird oscillator (the blue line in the indicator panel). It agrees emphatically that the new price high is entirely legitimate and that it is highly likely even higher prices are not only possible, but probable, over the next few months.

I'll wrap-up this edition by updating the Weekly Planets charts for Paris and Amsterdam and with a quick look at the Australian market.

Auntie, the ASX200, has hit new highs ... much lower than the 2007 peak! The first two rallies after the 2009 Bear bottom stalled out at the 50% retracement level. Last week we had what appears to be a "false break" of the 61.8% Fibonacci Rx line.

However, there's a technical condition evident here which cautions me against declaring the Bull to be dead. And it's the state of the long-range Big Bird oscillator (the blue line in the indicator panel). It agrees emphatically that the new price high is entirely legitimate and that it is highly likely even higher prices are not only possible, but probable, over the next few months.

The current resistance is the "obvious" level of the FiboRx line; it's not a weekly planetary level. If there is, ultimately, to be a break higher, I suspect 5670 to be a reasonable target ... since Auntie is very much a Neptunian index.

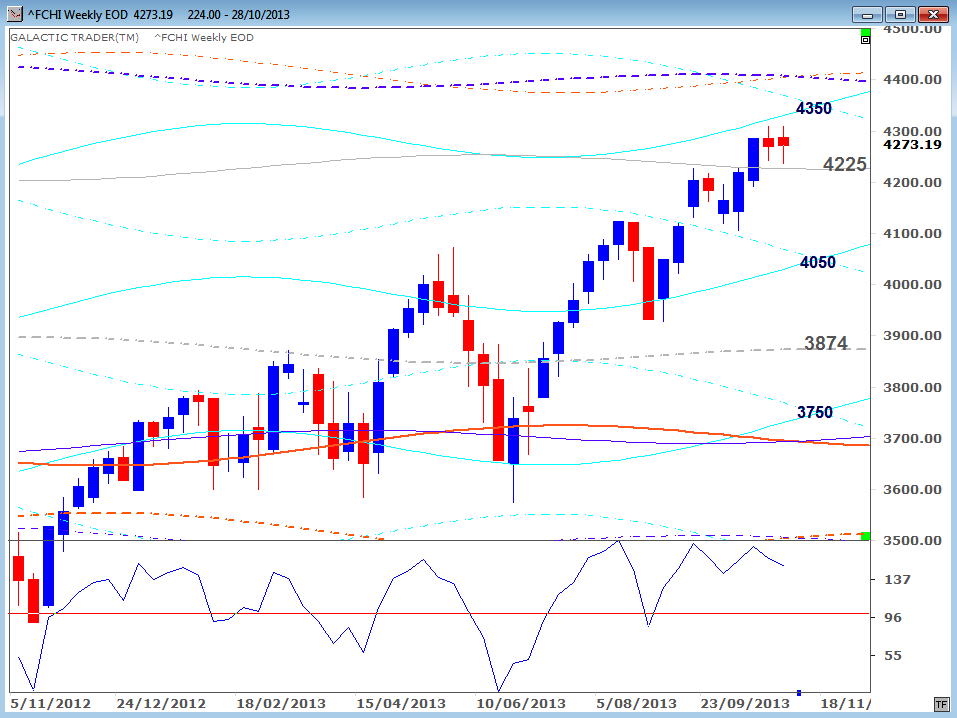

France:

Holland: