Dive or rally ... which one's the head fake?

Week beginning November 3, 2014

The exuberance of the stock rally on Wall Street calls into serious question whether it is merely a bounceback, or a resumption of the Bull market.

Copyright: Randall Ashbourne - 2011-2014

It seemed as if that scenario might be playing out when markets stalled on Wednesday. But! On Thursday and particularly, Friday, Wall Street launched a Moon shot. So, it's certainly possible markets have renewed their Bull campaign.

And it still seems to me to be irrational exuberance. The mid-October turnaround came when a regional Fed-head made noises about continuing QE. Then the actual Fed meeting went hawkish. Instead of turning down, Wall Street continued rising.

And on Friday it went totally ga-ga, ostensibly because Japan will continue the dismal polices which have kept its economy and stock market totally moribund for a quarter of a century. Rational? I don't think so.

And it still seems to me to be irrational exuberance. The mid-October turnaround came when a regional Fed-head made noises about continuing QE. Then the actual Fed meeting went hawkish. Instead of turning down, Wall Street continued rising.

And on Friday it went totally ga-ga, ostensibly because Japan will continue the dismal polices which have kept its economy and stock market totally moribund for a quarter of a century. Rational? I don't think so.

There was always a chance that the steep dive into mid-October was a Mercury Retrograde head fake, but that was the least preferred of three options.

I indicated last weekend there was potential for the stock bounce to start topping out as early as Monday or Tuesday when the Sun and Venus were due to trine Neptune.

I indicated last weekend there was potential for the stock bounce to start topping out as early as Monday or Tuesday when the Sun and Venus were due to trine Neptune.

Safe trading - RA

(Disclaimer: This article is not advice or a recommendation to trade stocks; it is merely educational material.)

The stock market Moon shot was launched when the Bank of Japan and the Japanese Government's main pension fund suddenly announced they would pump trillions more yen into the country's sputtering economy. The Nikkei "soared" ... and many other markets did the same.

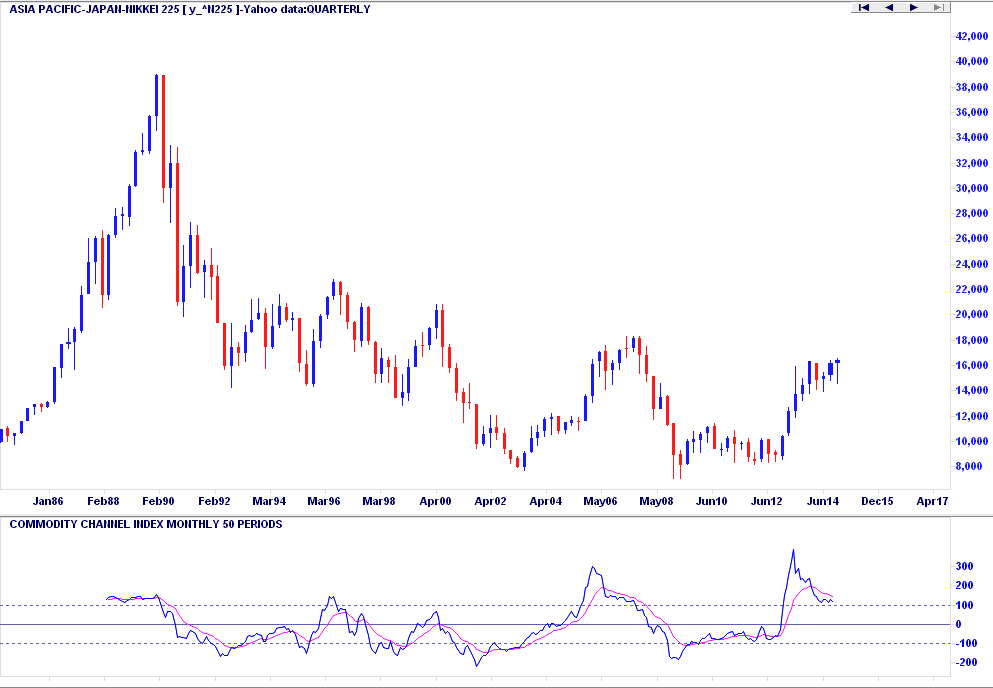

Yeah. So here's a quarterly chart of the Nikkei. It doesn't exactly look like skyrockets in flight.

Yeah. So here's a quarterly chart of the Nikkei. It doesn't exactly look like skyrockets in flight.

The Wall Street rally is unusual for other reasons ... one of them being three huge Opening gaps. Another of the supposed "reasons" is a surprising jump in GDP. But the increase in "production" was largely in destruction. In other words, it was caused by a big jump in American military spending.

More bombs, more bullets. Think rationally for a moment about the end consequences. It means more terror, not less. The nutbags have already shown they can take this out of the desert dunes and onto the streets of Britain, Canada and Boston. And, inevitably, it means more money on "Homeland Security".

Also, Wall Street's Moon shot is not yet being followed on other markets ... except for India, New Zealand and Switzerland.

Astrologically, we have another round of cosmic turmoil fast approaching. We have the usually negative period of the Full Moon this week, but even stronger potential negatives the following week when Mars conjuncts Pluto and squares Uranus; the Sun squares Jupiter and Venus conjuncts Saturn.

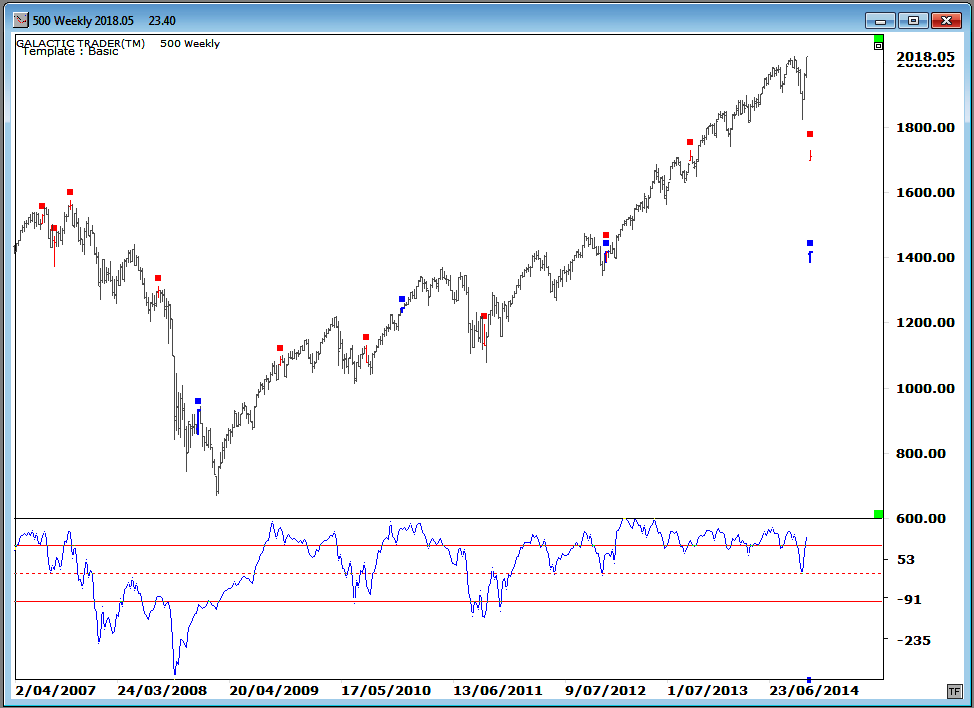

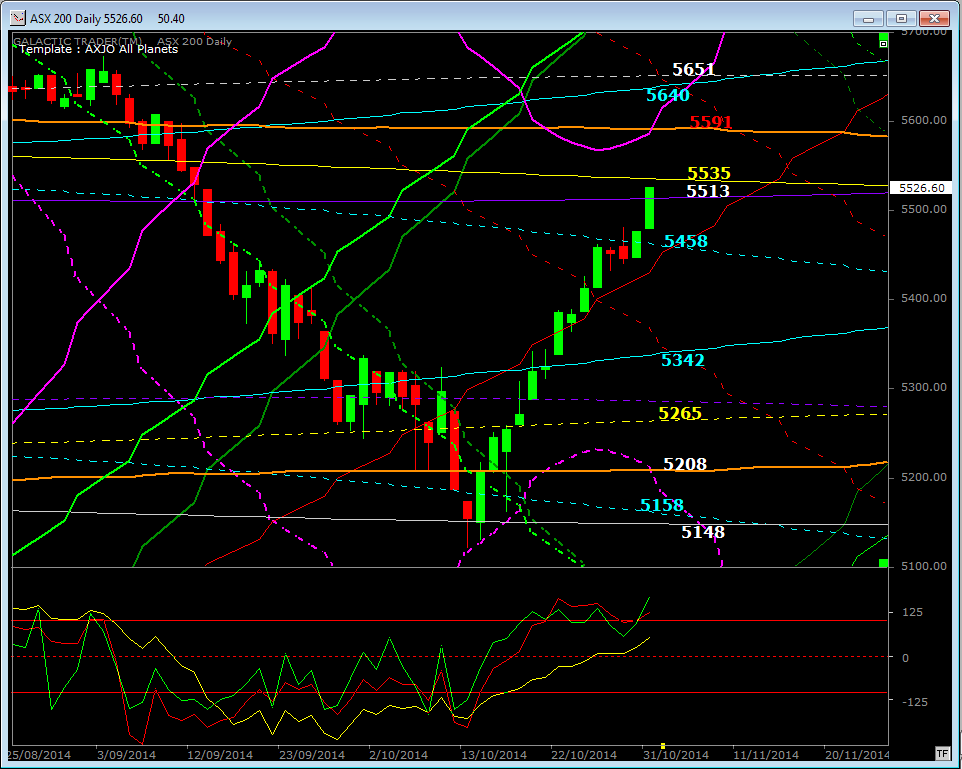

It's the last of those which has a strong track record of changing trend direction. Venus conjunct Saturn aspects are shown with red bars on the chart below and the blue bars are Mars conjunct Pluto.

More bombs, more bullets. Think rationally for a moment about the end consequences. It means more terror, not less. The nutbags have already shown they can take this out of the desert dunes and onto the streets of Britain, Canada and Boston. And, inevitably, it means more money on "Homeland Security".

Also, Wall Street's Moon shot is not yet being followed on other markets ... except for India, New Zealand and Switzerland.

Astrologically, we have another round of cosmic turmoil fast approaching. We have the usually negative period of the Full Moon this week, but even stronger potential negatives the following week when Mars conjuncts Pluto and squares Uranus; the Sun squares Jupiter and Venus conjuncts Saturn.

It's the last of those which has a strong track record of changing trend direction. Venus conjunct Saturn aspects are shown with red bars on the chart below and the blue bars are Mars conjunct Pluto.

The astrological aspects suggest there is more trouble and more volatility to come. However, let's look at a few charts and be prepared for whatever comes.

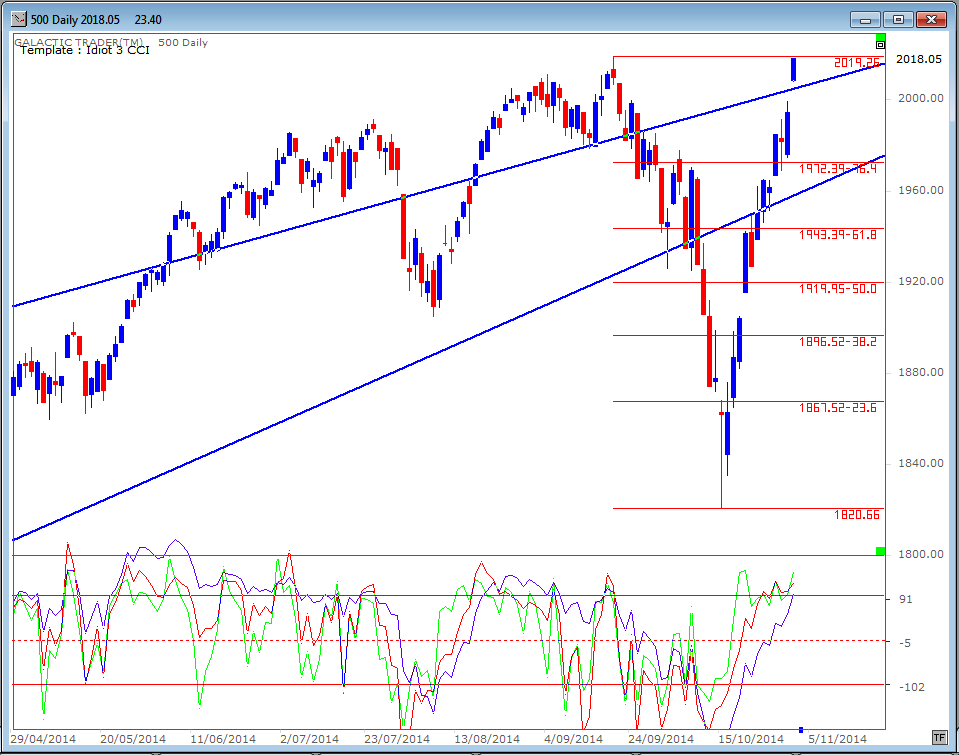

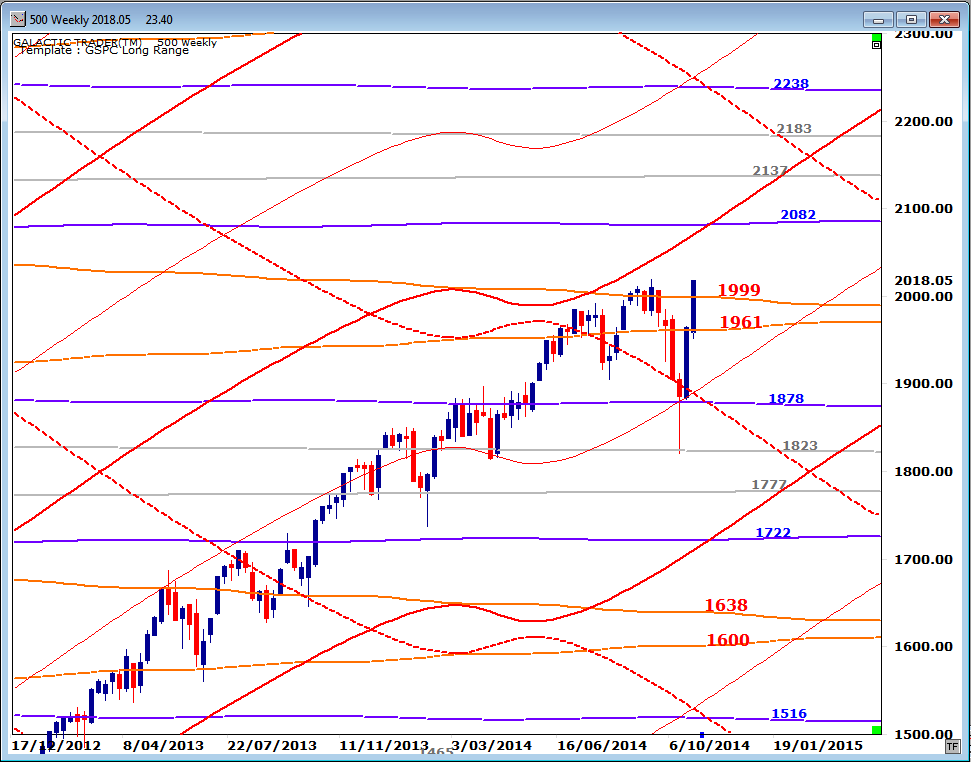

Firstly to the SP500 and the strong rally. The gaps are unusally large.

Firstly to the SP500 and the strong rally. The gaps are unusally large.

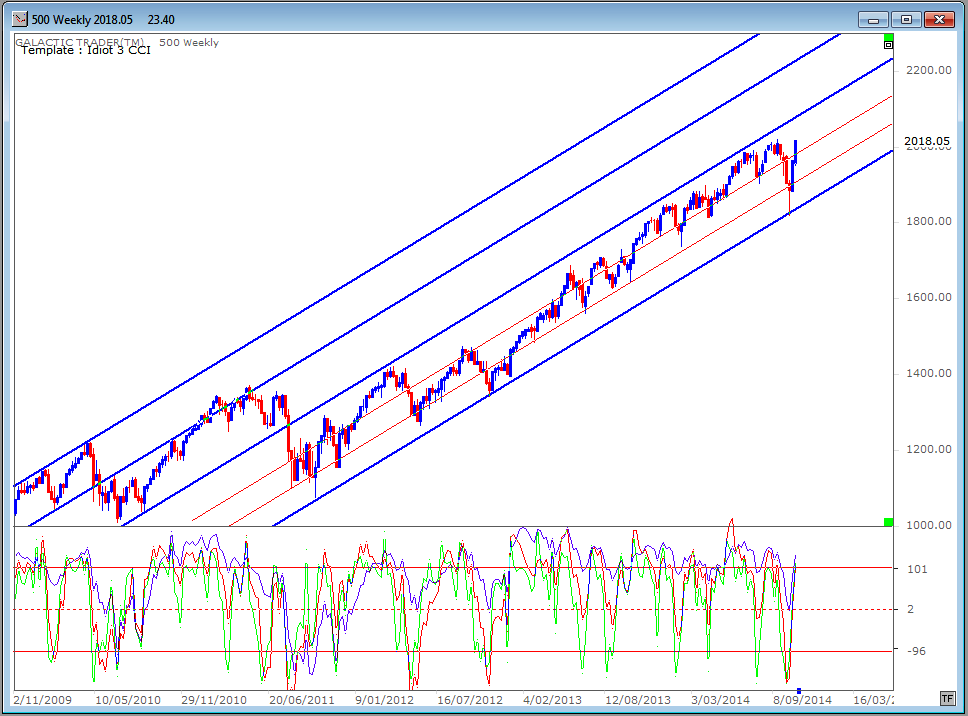

On the weekly chart below, the bounce started from an "obvious" level, the bottom marker of a trend channel which has defined the price moves since midway through 2011. The new price peak is, so far, accompanied by lower peaks in all three Canary oscillators.

Still, it could be a resumption of the Bull phase, so we need to be aware of the upside price targets if that is the case. The first major target is the blue Pluto line in the 2080s. You will note there was stalling at the 1878 Pluto line and that it did hold the Closing weekly prices on the correction into mid-October. And since the bounce came from the Neptune line at 1823, it wouldn't be unusual for the 2137 line to be hit if the Bull is back in play.

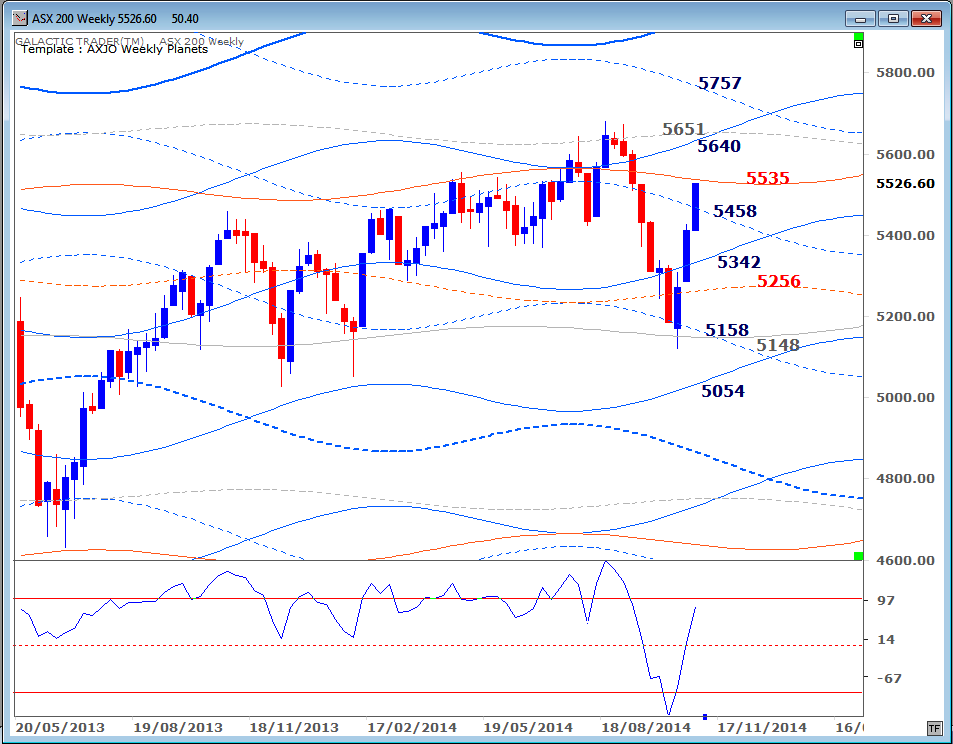

Turning to the ASX200, I indicated last weekend we would need to monitor the state of the Birds when price reached the Saturn line now priced at 5458 to get an idea if the bounce was over or the index would target the 5500s. It certainly looked as if the rally was going to stall at Saturn. But, the Birds got it wrong.

The Big Bird oscillator on the ASX Weekly Planets chart, below, has rebounded even more strongly than it has (the yellow line) on the daily chart. So, as we did with the SP500, we need to be aware of the potential upside targets over the next few weeks if the Bull is back.