Mercury Rx & Mars meets el Weirdo

Week beginning November 19, 2012

We have reached the halfway mark of the current Mercury Retrograde period ... and Mars changes signs from Sagittarius to Capricorn this weekend.

Copyright: Randall Ashbourne - 2011-2012

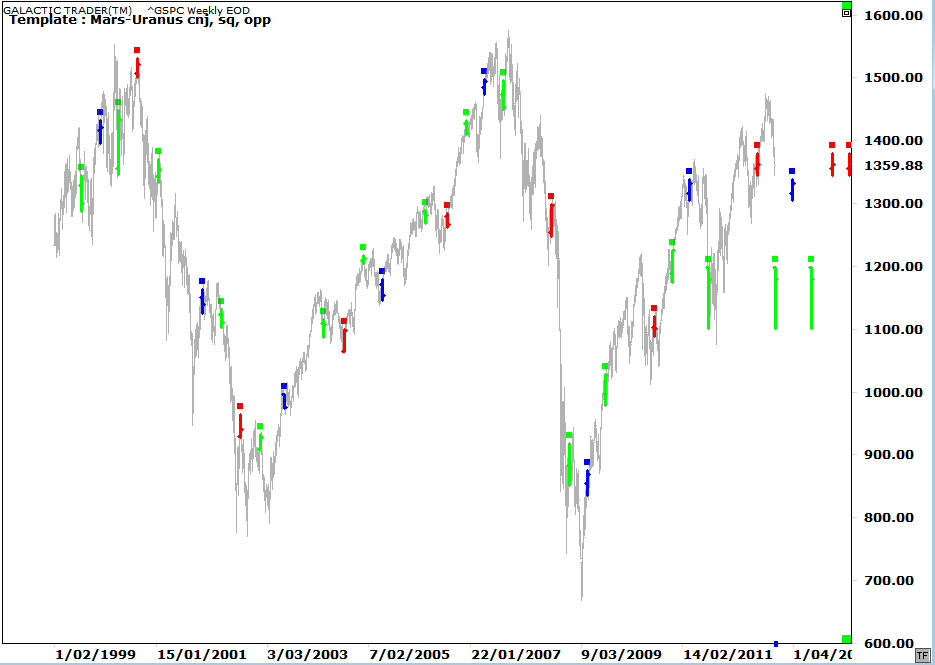

I have discussed with you in the past the so-called Mars/Uranus crash cycle and its total, complete and utter NON-reliability to actually bring on a crash. Just because certain members of the astrological community like to make dire predictions about Mars/Uranus hard aspects, doesn't mean they know what they're talking about.

We will take a graphical look at the aspects again in a moment or two, as well as what is "normal" halfway though a Merc Rx period. And we will consider a particular technical condition which indicates the bottom of the current correction is not yet complete.

But, let me first deal with the astro symbolism. Mars is energy and drive. He's the all-action guy, not overly blessed in the brain department. Uranus is a weirdo nutbag who delights in giving everyone the irrits by doing the complete opposite of what one would expect conditions dictate.

We will take a graphical look at the aspects again in a moment or two, as well as what is "normal" halfway though a Merc Rx period. And we will consider a particular technical condition which indicates the bottom of the current correction is not yet complete.

But, let me first deal with the astro symbolism. Mars is energy and drive. He's the all-action guy, not overly blessed in the brain department. Uranus is a weirdo nutbag who delights in giving everyone the irrits by doing the complete opposite of what one would expect conditions dictate.

Either of these astro events is enough to change the direction of the existing trend.

The big question is for how long, since by the end of the week Mars will be squaring Uranus and conjuncting Pluto.

The big question is for how long, since by the end of the week Mars will be squaring Uranus and conjuncting Pluto.

Safe trading - RA

(Disclaimer: This article is not advice or a recommendation to trade stocks; it is merely educational material.)

When Action Guy meets up with Psycho Nutbag in conjunction, opposition or square, "stuff" happens ... just not necessarily the stuff you were counting on.

So let's remind ourselves of the actual historical performance, as opposed to the crash predictions.

So let's remind ourselves of the actual historical performance, as opposed to the crash predictions.

In brief, it's entirely possible we have seen the range for November and the final half of the month will play within that territory.

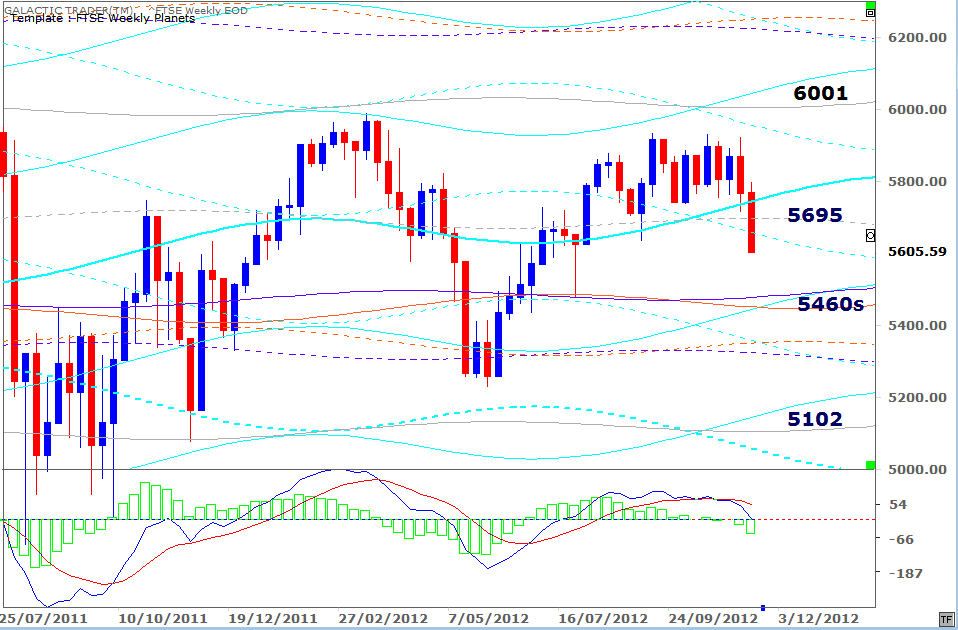

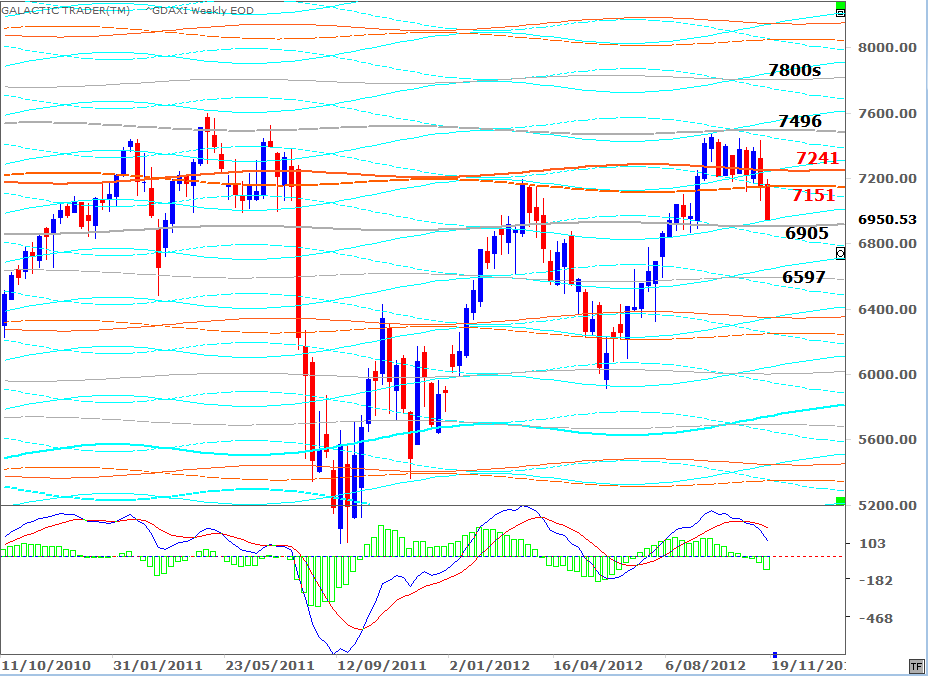

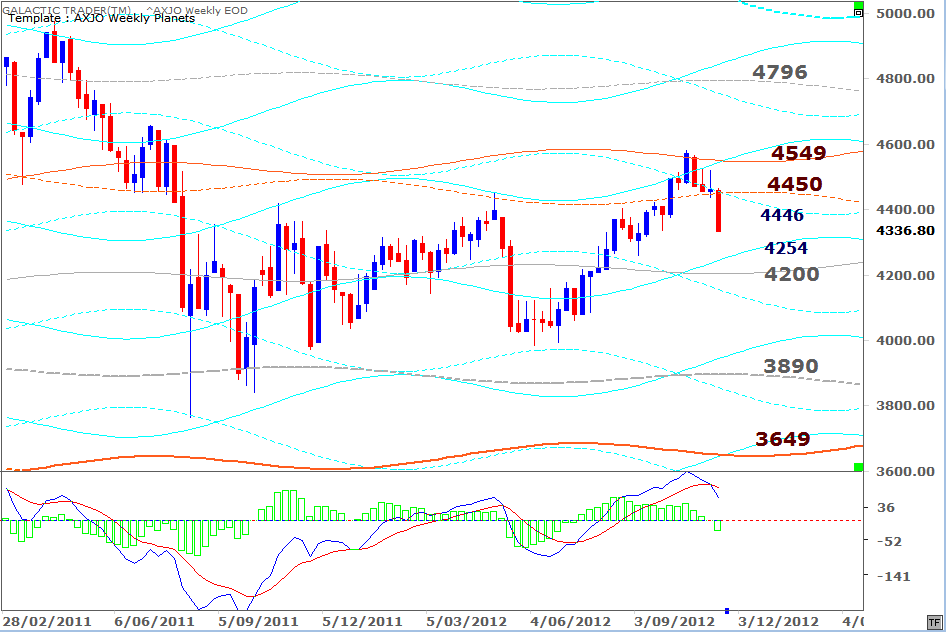

But, we need to be fully aware that the danger to continuation of the Bull recovery run is significant; the fast MACD signals on Weekly Planets charts for most indices are still in decline - and could drop much further yet.

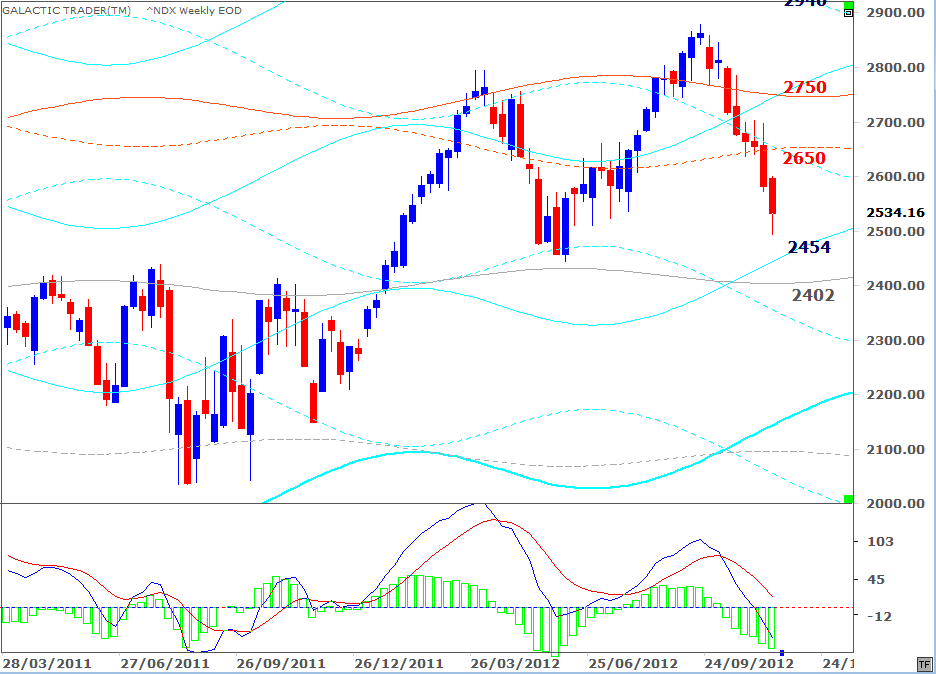

The Nasdaq 100, NDX, chart is below, followed by similar charts for the FTSE, the DAX and the ASX 200.

But, we need to be fully aware that the danger to continuation of the Bull recovery run is significant; the fast MACD signals on Weekly Planets charts for most indices are still in decline - and could drop much further yet.

The Nasdaq 100, NDX, chart is below, followed by similar charts for the FTSE, the DAX and the ASX 200.

You'll note the MACD decline on most of those charts is in its early stages, so I'm basing my expectation of a bounce largely on what is "normal" behaviour during a Merc Rx period ... and on the usual pattern of a Mars sign change at least temporarily changing the trend in play.

And, also, because while there's no positive divergence between price and oscillator on Miss Polly's dailies, it actually is there on my NDX charts and the Nasdaq often acts as a leading index - that is, it changes direction before the DJI or the 500.

And if Wall Street goes that way, we can assume most of the other major indices will do the same.

And, also, because while there's no positive divergence between price and oscillator on Miss Polly's dailies, it actually is there on my NDX charts and the Nasdaq often acts as a leading index - that is, it changes direction before the DJI or the 500.

And if Wall Street goes that way, we can assume most of the other major indices will do the same.

So, Friday went to a new Low ... and bounced; indicating that, perhaps, we are going to get the "normal" behaviour ... which is that a trend which starts when Mercury goes Retrograde, reverses course halfway through the cycle. In fact, it's fairly normal for markets to finish the Merc Rx period with prices within 1% of the level they were when the phase started.

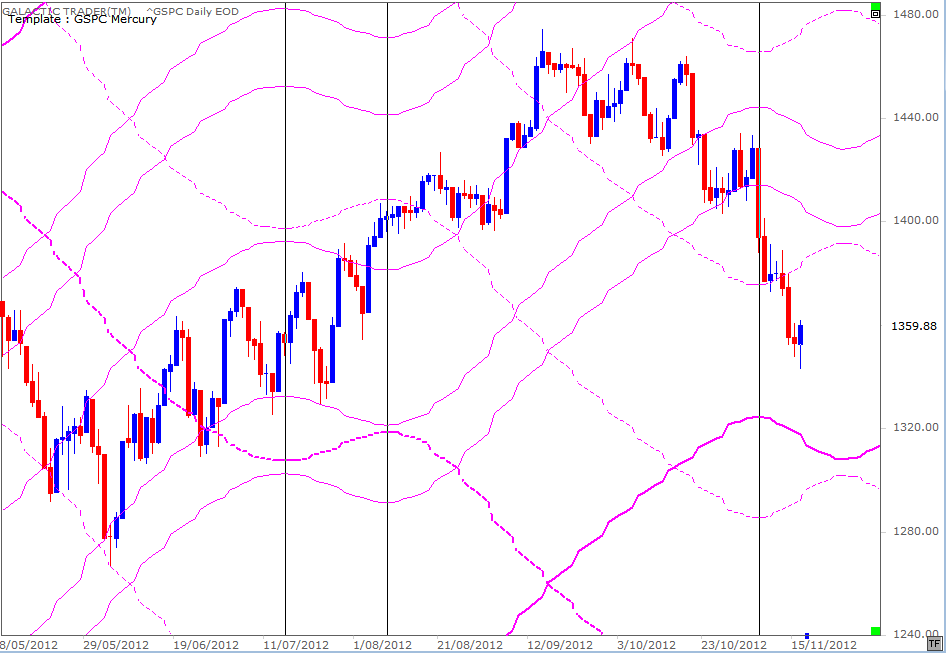

The chart above marks the last Merc Rx period between the two black verticals and the current one is now halfway through. IF we do get a Thanksgiving week bounceback, and optimism is the mood "norm" for America in this week, it wouldn't be unusual for the index to reconnect with a Mercury planetary price line.

The prices are: 1428 if the rebound recovers within 1% of the start of the period; 1398 and 1391 as "safer" targets ... and 1308 if the plunge continues.

Now, I have a caveat about the potential length of any bounceback ... and it's not really related to the Mars/Uranus/Pluto aspects coming up as we end the coming week.

The chart above marks the last Merc Rx period between the two black verticals and the current one is now halfway through. IF we do get a Thanksgiving week bounceback, and optimism is the mood "norm" for America in this week, it wouldn't be unusual for the index to reconnect with a Mercury planetary price line.

The prices are: 1428 if the rebound recovers within 1% of the start of the period; 1398 and 1391 as "safer" targets ... and 1308 if the plunge continues.

Now, I have a caveat about the potential length of any bounceback ... and it's not really related to the Mars/Uranus/Pluto aspects coming up as we end the coming week.

In the weekly chart of Miss Pollyanna above, the Mars/Uranus conjunctions are marked in blue, the oppositions in red, and the squares are the green bars. Of the 7 oppositions shown, only 3 show up at peaks, bringing on a crash. The first shows up at the August 2000 peak and the second instance was a countertrend top just before the index made a Bear bottom in 2002. The 3rd instance was in August 2008, just before markets went into the worst of the post-2007 crash.

The blue conjunctions don't seem to signify much at all and nor do the squares, which are sometimes sort-of near tops, sometimes sort-of near bottoms, and sometimes sort-of midway through a trend which just continues in the direction it was going beforehand.

Ergo, the "Mars/Uranus crash cycle" is a cycle the way a rectangle is a wheel. It doesn't bloody work! The Mars/Uranus oppositions would seem to be more dangerous than the conjunctions and squares ... and even they seem to work only half the time.

I'm not dismissing the potential out-of-hand, merely indicating that the actual track record suggests it's not an aspect which reliably brings about a crash.

Now, let's turn our attention to the Mercury Retrograde phase. In the first report for November, I said: "What normally happens with stock markets when Merc goes Rx is that it starts a trend which goes into reverse halfway through the period. That would mean a potential trend change date on the 16th - the day Mars changes signs from Sagittarius to Capricorn and starts making its own aspects to the ongoing Uranus/Pluto square."

It's true I thought the bounceback might have started earlier last week, but the "fiscal cliff" reiterations kept markets in a freefall until Friday.

The blue conjunctions don't seem to signify much at all and nor do the squares, which are sometimes sort-of near tops, sometimes sort-of near bottoms, and sometimes sort-of midway through a trend which just continues in the direction it was going beforehand.

Ergo, the "Mars/Uranus crash cycle" is a cycle the way a rectangle is a wheel. It doesn't bloody work! The Mars/Uranus oppositions would seem to be more dangerous than the conjunctions and squares ... and even they seem to work only half the time.

I'm not dismissing the potential out-of-hand, merely indicating that the actual track record suggests it's not an aspect which reliably brings about a crash.

Now, let's turn our attention to the Mercury Retrograde phase. In the first report for November, I said: "What normally happens with stock markets when Merc goes Rx is that it starts a trend which goes into reverse halfway through the period. That would mean a potential trend change date on the 16th - the day Mars changes signs from Sagittarius to Capricorn and starts making its own aspects to the ongoing Uranus/Pluto square."

It's true I thought the bounceback might have started earlier last week, but the "fiscal cliff" reiterations kept markets in a freefall until Friday.

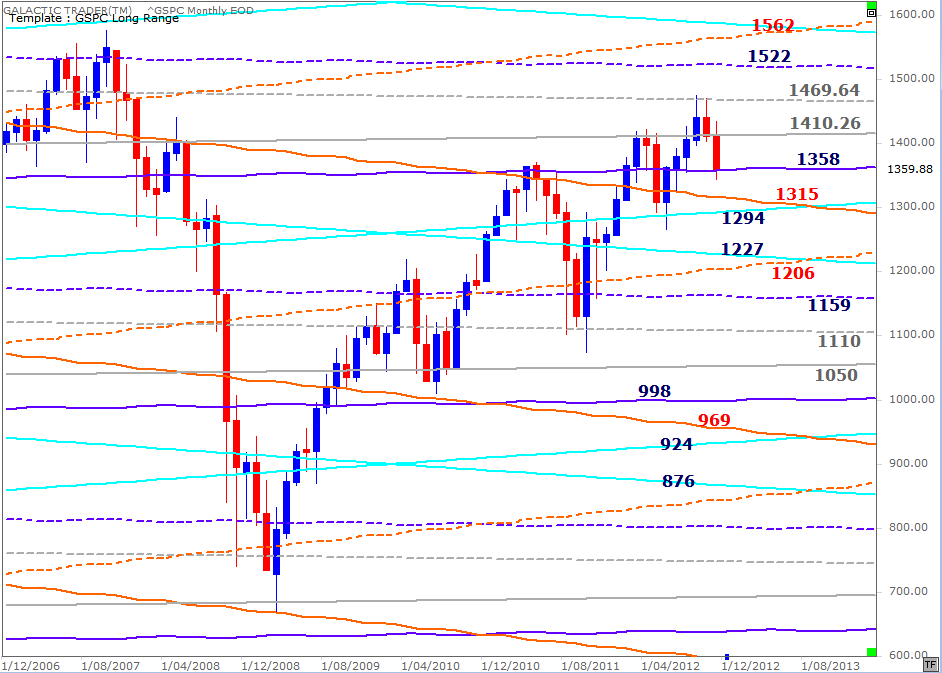

It's related to a technical condition, not an astrological expectation. Simply, there is no positive divergence in the state of the long-range Canary on Miss Pollyanna's daily chart. First, just an eyeball ... this is a significant correction in terms of time and price.

And because it is, we would normally expect to see an instance of divergence between price and the oscillator ... as we did during previous corrections of this significance. Divergence is explained in The Technical Section of the book and is worth re-reading if you're still trying to come to grips with it.

We can see it quite clearly in the chart above. The lack of positive divergence in the current set-up is a warning that any bounceback has a high chance of failing and that Miss Polly, the SP500, needs to make a lower price low below 1343, while the Canary makes a higher trough.

Also in the November 5 edition, available in the Archives, I published a broad range of index charts in an attempt to show the likely range for the whole month ... and here's how Polly has played with Chicken Little back on stage.

And because it is, we would normally expect to see an instance of divergence between price and the oscillator ... as we did during previous corrections of this significance. Divergence is explained in The Technical Section of the book and is worth re-reading if you're still trying to come to grips with it.

We can see it quite clearly in the chart above. The lack of positive divergence in the current set-up is a warning that any bounceback has a high chance of failing and that Miss Polly, the SP500, needs to make a lower price low below 1343, while the Canary makes a higher trough.

Also in the November 5 edition, available in the Archives, I published a broad range of index charts in an attempt to show the likely range for the whole month ... and here's how Polly has played with Chicken Little back on stage.