Americans skittish ... others not so much

Week beginning November 12, 2012

The big astrological event for the coming week is the Solar Eclipse New Moon in Scorpio.

Copyright: Randall Ashbourne - 2011-2012

Since it's in Scorpio, ruled by Mars and Pluto, and since it's directly above the so-called Ring of Fire, there's probably an increased likelihood of seismic disturbances in the region.

However, let's talk about Wall Street's seismic disturbances. The Mercury Rx station had little impact on the vote - except in Florida, which used not be able to print proper ballot papers, but got over that problem and now just needs to learn how to count them.

We'll spend some time this weekend pawing over the entrails of the SP500 to see whether, and what sort of, bounce might be expected.

However, let's talk about Wall Street's seismic disturbances. The Mercury Rx station had little impact on the vote - except in Florida, which used not be able to print proper ballot papers, but got over that problem and now just needs to learn how to count them.

We'll spend some time this weekend pawing over the entrails of the SP500 to see whether, and what sort of, bounce might be expected.

Two editions ago I published an historical chart showing the impact of Solar Eclipses on the SP500 - and caution again that there is no truly reliable prediction that can be made about the effect on markets.

The path of this one takes in Indonesia, northern Australia and New Zealand and into the mid-Pacific.

The path of this one takes in Indonesia, northern Australia and New Zealand and into the mid-Pacific.

Safe trading - RA

(Disclaimer: This article is not advice or a recommendation to trade stocks; it is merely educational material.)

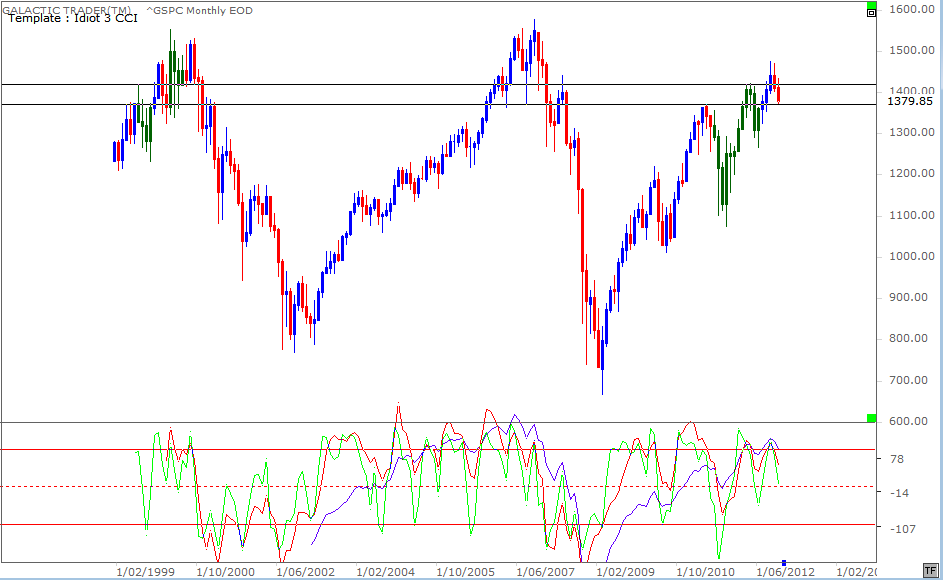

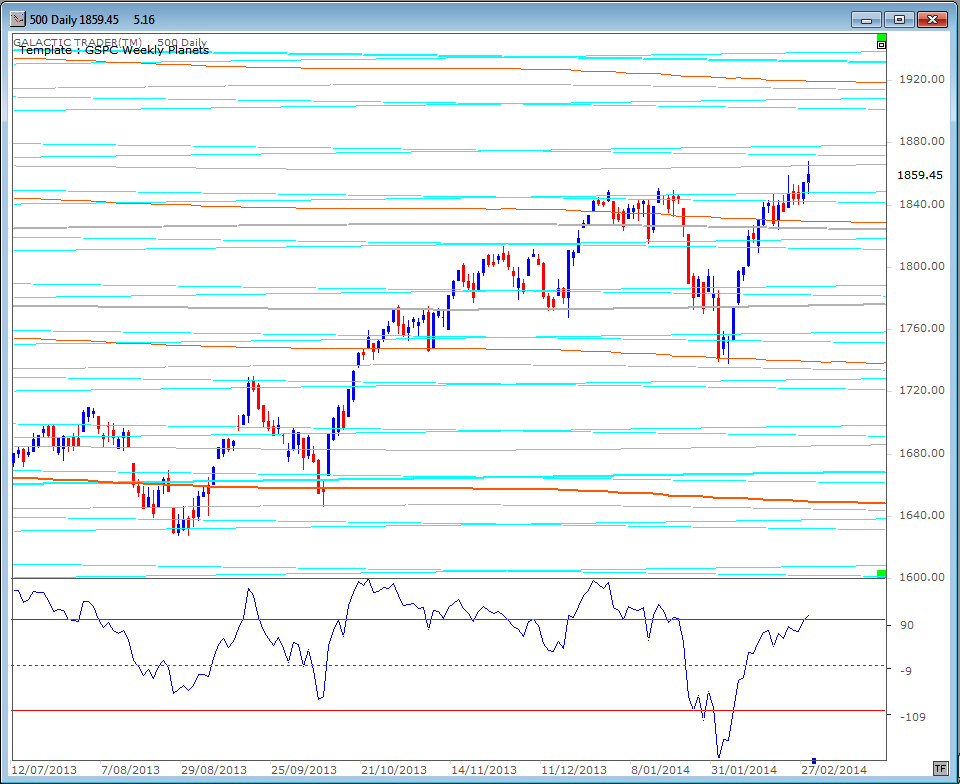

First, let's remind ourselves of where we are in terms of the big picture.

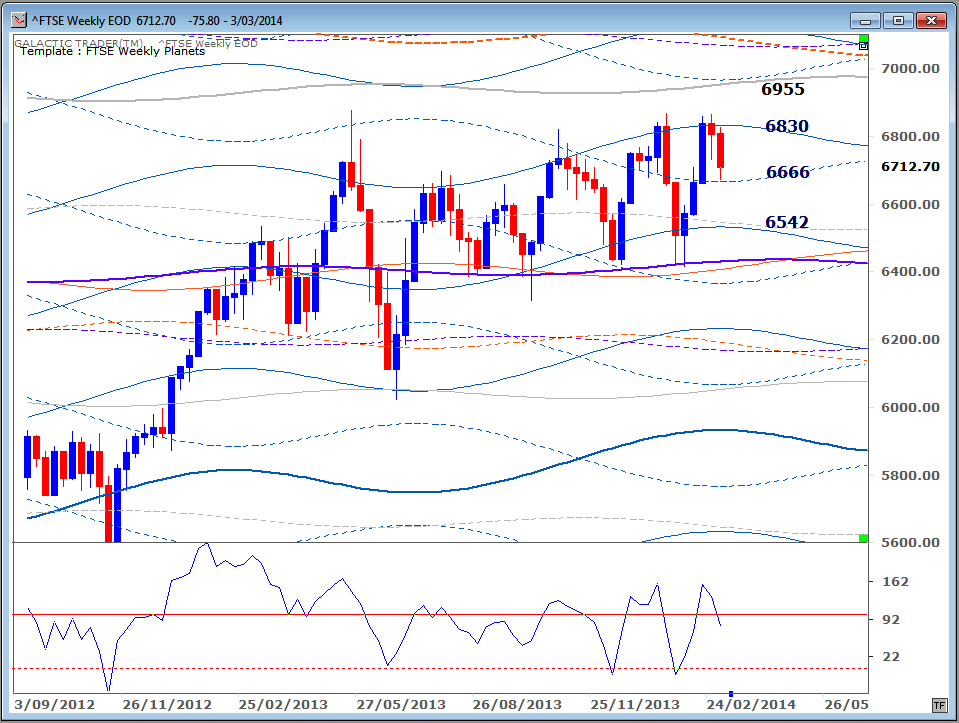

And golly-gee-whizz, ditto for Polly's Weekly Planets chart.

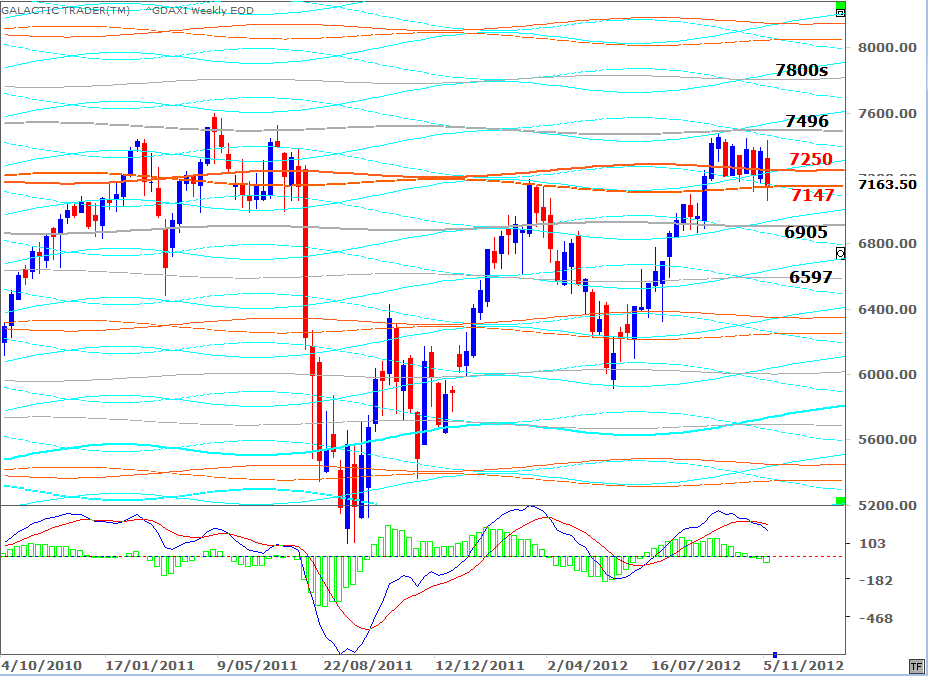

Ditto for Germany's DAX index, below. In both indices, there was a break of planetary support which was recovered by the end of the week. The only note of caution - apart from the continued deterioration of the MACD signal - is the appearance of Bearish engulfing bars.

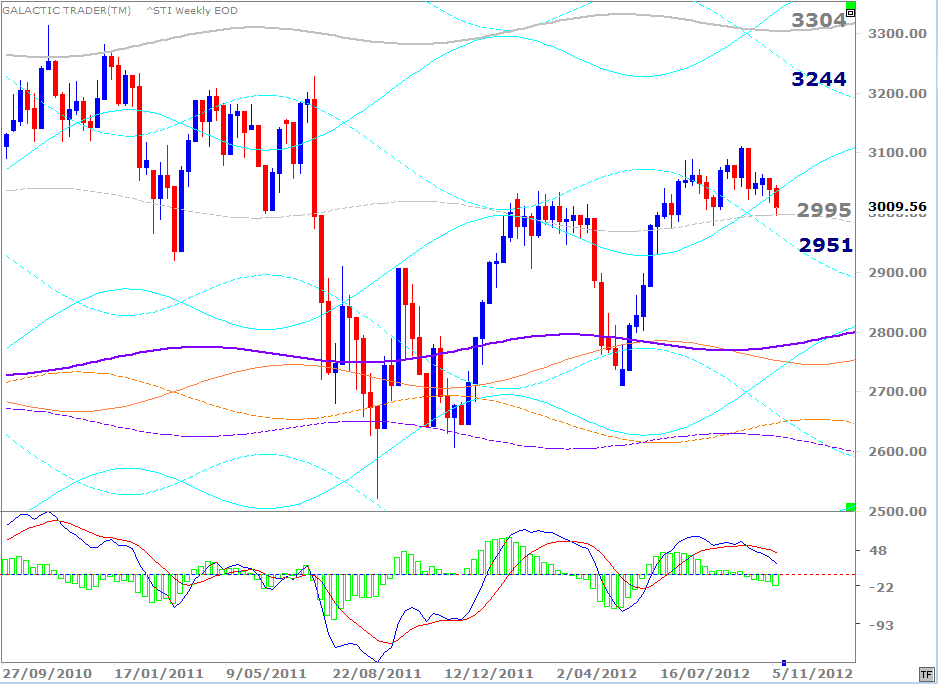

Singapore is below, still deciding whether to bounce from, or breakdown below, a vital Neptune line at 2995.

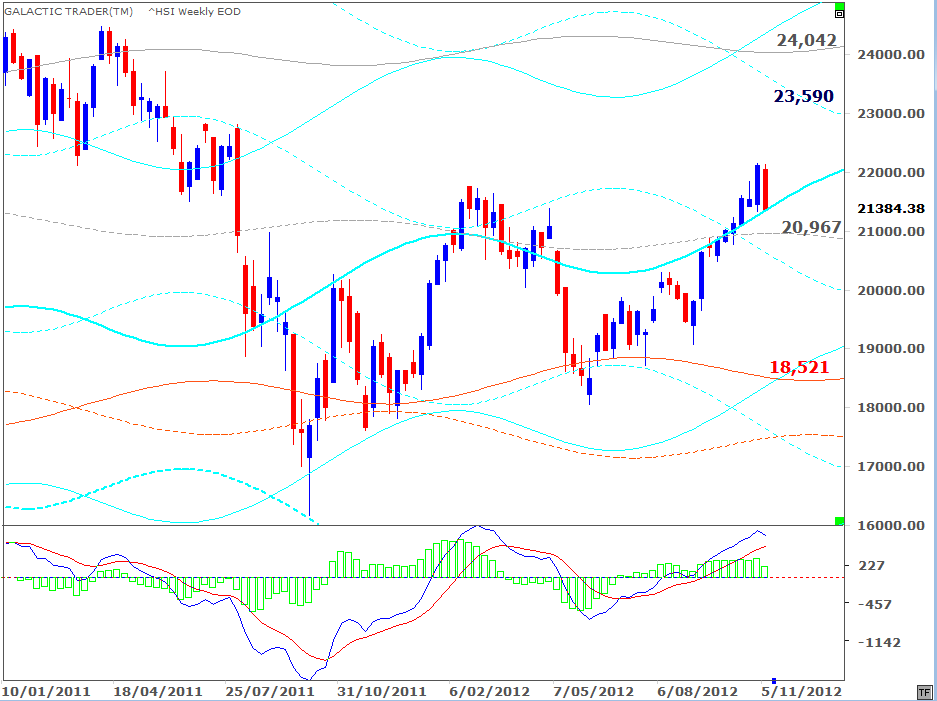

And the Hang Seng in Hong Kong dived into a Saturn level on its Weekly Planets chart (below).

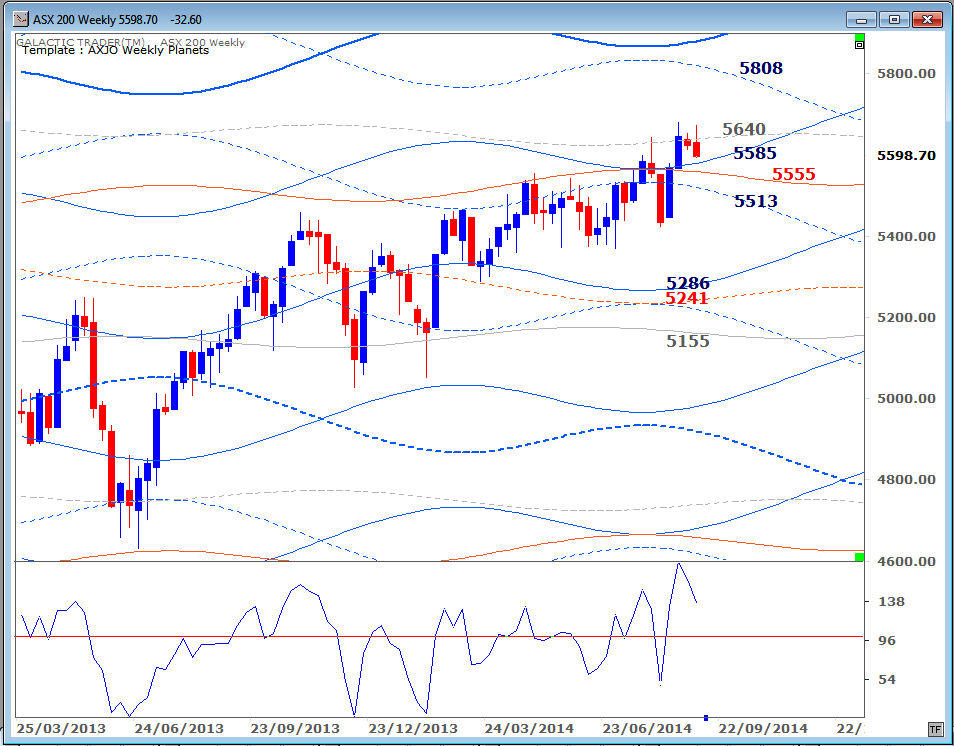

The ASX 200 basically didn't go anywhere and continues to hold Uranus support at 4450ish.

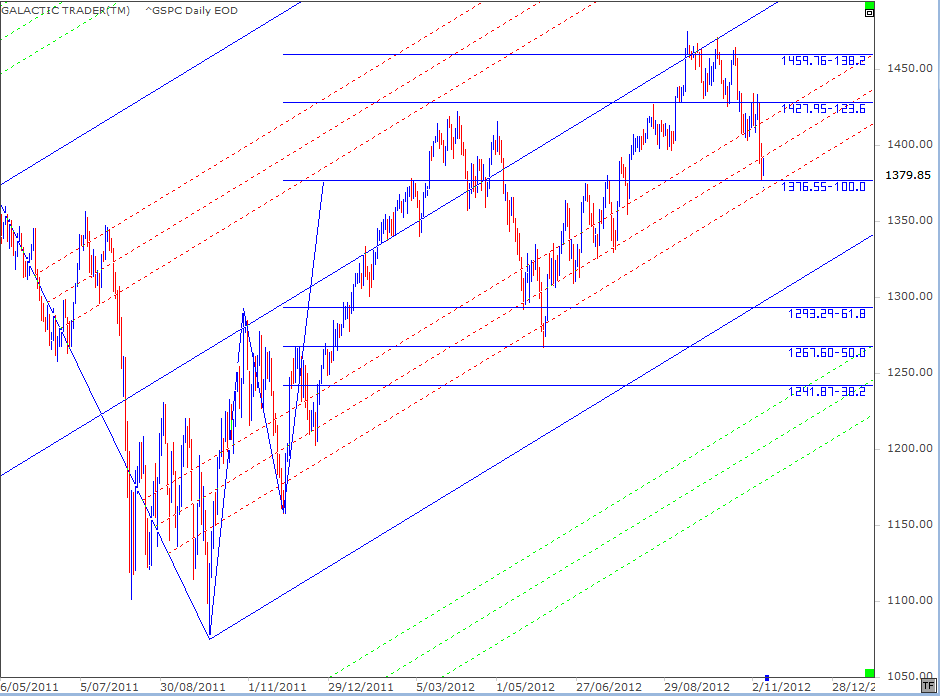

This was the first of them, showing Pollyanna behaving relatively routinely within a rising pitchfork since the August/October plunge a year ago.

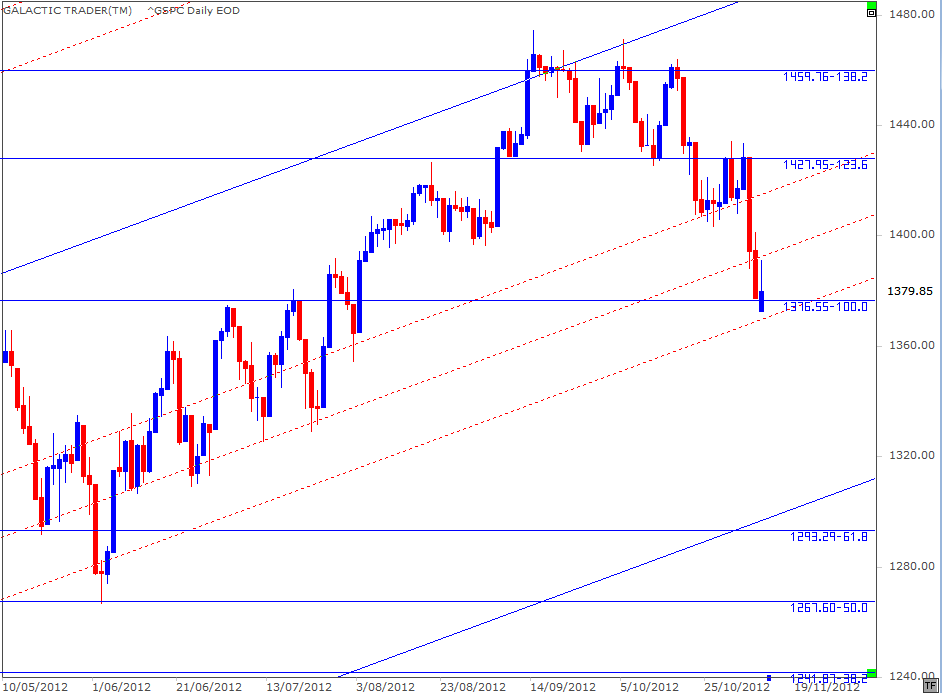

And the next chart is simply a close-up ...

And the next chart is simply a close-up ...

Above we have the long-range monthly. The Jupiter-in-Taurus bars, which have a very close historical relationship with Bull market tops, are in dark green. And we discussed a couple of times recently what might be happening with the NDX in this regard.

But, what we really want to do here is just get an "eyeball" view of the current state of affairs with the broad-based SP500. The index briefly poked its head back into the irrational exuberance zone of the two previous Bull peaks ... and closed out last week, testing the first line of defence at the lower horizontal line of technical Support.

Nothing out of the ordinary so far ... though we have been chatting recently about the growing danger signs within the American indices.

Two editions ago, I published a couple of versions of the same chart, indicating where the Pollyanna index was likely to head if prices continued the correction.

But, what we really want to do here is just get an "eyeball" view of the current state of affairs with the broad-based SP500. The index briefly poked its head back into the irrational exuberance zone of the two previous Bull peaks ... and closed out last week, testing the first line of defence at the lower horizontal line of technical Support.

Nothing out of the ordinary so far ... though we have been chatting recently about the growing danger signs within the American indices.

Two editions ago, I published a couple of versions of the same chart, indicating where the Pollyanna index was likely to head if prices continued the correction.

The last time we looked at these charts, I made the point the index was trying to hold the upper red line of a Fibonacci-calculated zone within the bottom half of the fork and that if it failed to hold, the Bulls would mount a fight at the 1390 and/or 1370s levels.

And that's where we're at. So, the index is at an important horizontal level on the long-range monthly AND at an important level within the internal Fibonacci bands of a daily chart.

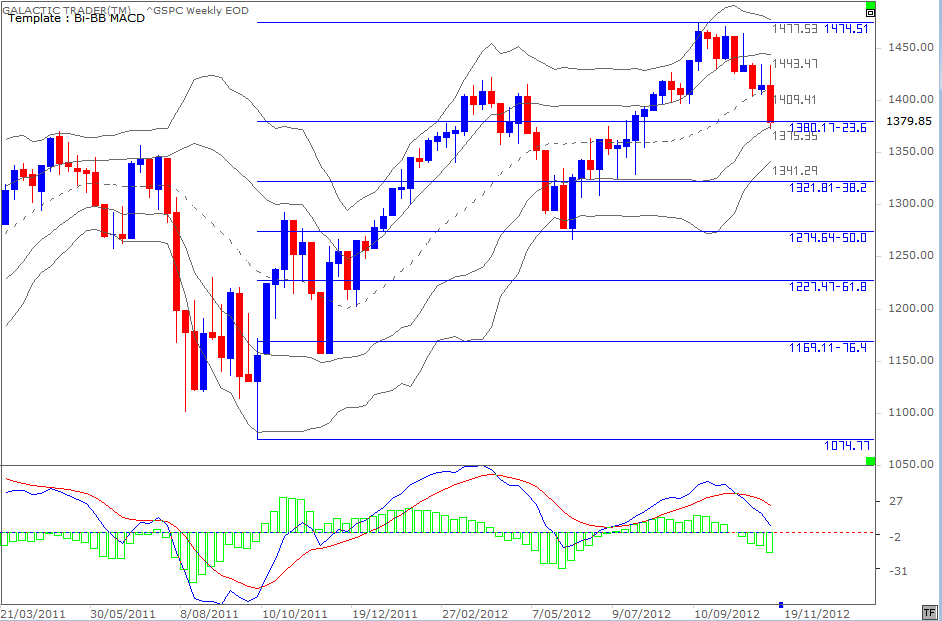

We'll look next at a couple of weekly charts. Below is a Bi-BB. Price found support on Friday at the mid-level of the lower band, which also happens to be close to a routine Fibonacci Rx level of the whole rally over the past year.

And that's where we're at. So, the index is at an important horizontal level on the long-range monthly AND at an important level within the internal Fibonacci bands of a daily chart.

We'll look next at a couple of weekly charts. Below is a Bi-BB. Price found support on Friday at the mid-level of the lower band, which also happens to be close to a routine Fibonacci Rx level of the whole rally over the past year.

Okay. So, we know that there is a statistical tendency for New Moons to coincide with a near-term High. However, we also know from the Solar Eclipse chart from the October 29 edition, that eclipses can distort the statistical tendency ... and this may be one of those times.

I mentioned last weekend during a brief discussion about Mercury Retrograde that ... "What normally happens with stock markets when Merc goes Rx is that it starts a trend which goes into reverse halfway through the period. That would mean a potential trend change date on the 16th ..."

So, because Pollyanna is hitting Support levels - technical, Fibonacci, or planetary - on monthly, weekly and daily charts, we need to be aware of the potential for a bounce to develop in the coming week.

And, perhaps especially, because other major indices didn't go into the same sort of overly dramatic swoon as Miss Pollyanna.

Below is the Footsie Weekly Planets chart. The index traded within largely the same range as it has been for many weeks.

I mentioned last weekend during a brief discussion about Mercury Retrograde that ... "What normally happens with stock markets when Merc goes Rx is that it starts a trend which goes into reverse halfway through the period. That would mean a potential trend change date on the 16th ..."

So, because Pollyanna is hitting Support levels - technical, Fibonacci, or planetary - on monthly, weekly and daily charts, we need to be aware of the potential for a bounce to develop in the coming week.

And, perhaps especially, because other major indices didn't go into the same sort of overly dramatic swoon as Miss Pollyanna.

Below is the Footsie Weekly Planets chart. The index traded within largely the same range as it has been for many weeks.

In signing off last weekend, I said: "Regardless of what happens on Tuesday, have at least some faith in the Old Gods. In Bulls and Bears, through Goldmanesque manipulation and BenDraghi interventions, the pulse of the markets beats to coloured spaghetti trails marked by the passage of planets."

Eh. And so they did. Again. As usual. Of course, we're all educated adults and we don't actually believe in astrology and Old Gods. Do we?!?

Enough of the waffle for this week. Don't be surprised by an imminent bounceback. Virtually no major markets other than Wall Street rose so far back into irrational exuberance territory before the correction started; virtually no major markets have swooned as much as The Vacuous Troll, Pollyanna.

And, regardless of which way things go, the charts published last weekend and this one show the probable range targets - upside and down.

Oh! Thank you to Praveen and Andy, who wrote with suggestions about where to find data for those indices Yahoo has dropped from its historical price data. I'm not terribly good at formatting spreadsheets and need to fiddle with date formats and a few other things.

However, hopefully I'll be able to bring the Indian and Canadian market charts up-to-date when I get it all sorted out.

Eh. And so they did. Again. As usual. Of course, we're all educated adults and we don't actually believe in astrology and Old Gods. Do we?!?

Enough of the waffle for this week. Don't be surprised by an imminent bounceback. Virtually no major markets other than Wall Street rose so far back into irrational exuberance territory before the correction started; virtually no major markets have swooned as much as The Vacuous Troll, Pollyanna.

And, regardless of which way things go, the charts published last weekend and this one show the probable range targets - upside and down.

Oh! Thank you to Praveen and Andy, who wrote with suggestions about where to find data for those indices Yahoo has dropped from its historical price data. I'm not terribly good at formatting spreadsheets and need to fiddle with date formats and a few other things.

However, hopefully I'll be able to bring the Indian and Canadian market charts up-to-date when I get it all sorted out.