Full Moon low ... or something else?

Week beginning June 16, 2014

It was a week when all the expectations became reality ... the war drums started sounding again, the Moon in Sadge delivered wide-range days, and Polly and the DAX turned down from long-range planetary price lines.

Copyright: Randall Ashbourne - 2011-2014

If it's the second, no real turnaround can be expected until late in the week. That's because there is a general tendency, by no means certain, for a trend which begins near the start of the Mercury Rx cycle to reverse course halfway through the phase.

There's not a lot of astrological activity this week, leading into the Solstice. The most notable event Up There is still Mars and its moves. We've had the square to Pluto and the red planet is now heading into opposition again with Uranus (exact midway through the following week).

The war drums will continue beating. They always made the cavalry nervous.

There's not a lot of astrological activity this week, leading into the Solstice. The most notable event Up There is still Mars and its moves. We've had the square to Pluto and the red planet is now heading into opposition again with Uranus (exact midway through the following week).

The war drums will continue beating. They always made the cavalry nervous.

What we don't know yet is whether it was just a Full Moon drop, part of a Mercury Retrograde spurt-and-reverse, or the start of something significant.

If it's the first, this week should see stock prices stablise and start to rise again.

If it's the first, this week should see stock prices stablise and start to rise again.

Safe trading - RA

(Disclaimer: This article is not advice or a recommendation to trade stocks; it is merely educational material.)

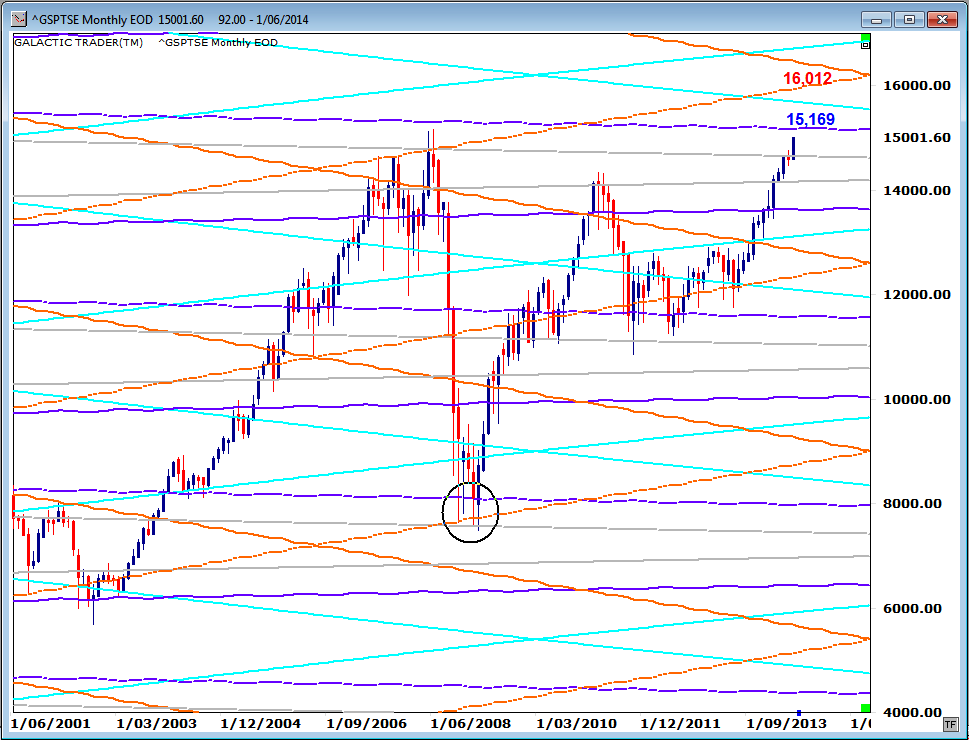

We'll begin this weekend with a quick look at Canada, which went in the opposite direction from most other Western indices. Price of the composite is still trying to reach an important Pluto/Node zone priced from the early 15,000s to just above 16,000.

If we backtrack, we can see the last two Bear bottoms came in at Pluto/Node zones ... the last one of which I've circled. The reason I highlight that zone is because it's made up of "mirror" lines and the orange Node line now priced at 16,012 was a major player in stopping the last Bull peak.

If we backtrack, we can see the last two Bear bottoms came in at Pluto/Node zones ... the last one of which I've circled. The reason I highlight that zone is because it's made up of "mirror" lines and the orange Node line now priced at 16,012 was a major player in stopping the last Bull peak.

There's a general tendency for these zones to act a little like strong magnets over the longer term. That tendency is why I was fairly sure both the SP500 and Germany's DAX were due to make an exact touch of some overhead planetary prices. The DAX hit 10,033 on Tuesday, a slight overshoot, and then started backing off strongly.

NEW:

Forecast 2014 is now available for sale and download.

Click the button on the right for more details.

Click the button on the right for more details.

Pollyanna hit her high on Monday, also with a slight overshoot. In both cases, the indices have hit long-range planet lines which should be strong enough to cause a strong countertrend. However, it's difficult to be sure of anything with Mercury Retrograde.

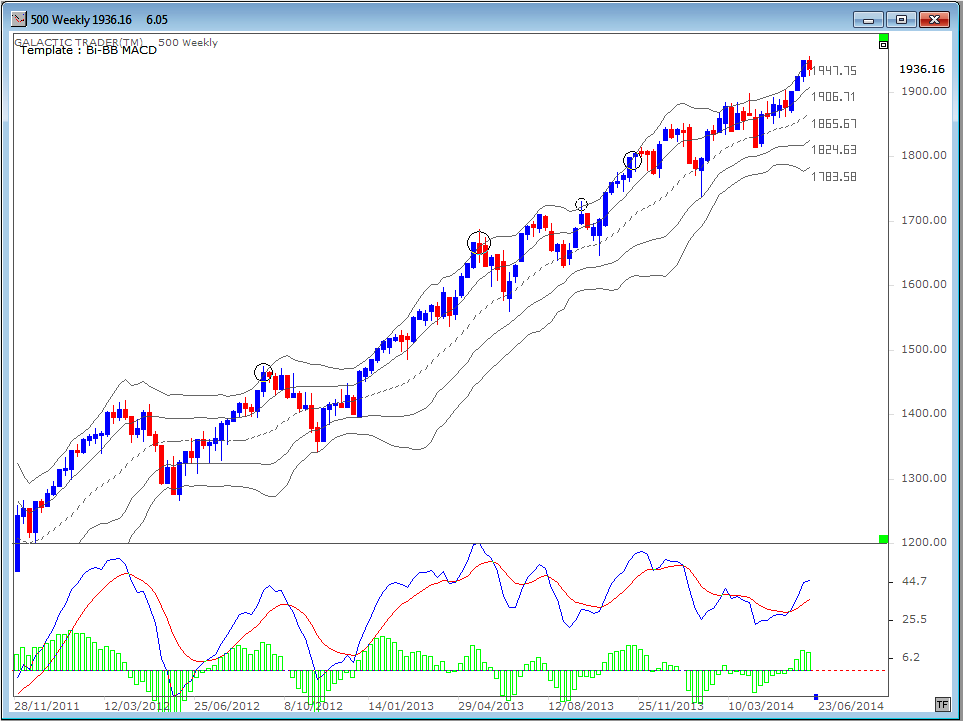

There is also a technical reason for last week's drop. Earlier in the year we spent several weeks discussing potential trades set up by price breaks of the outer BBs and I circled some past instances of normal behaviour when that happens.

A similar set-up occurred last week, when an outer band break caused a stall, or potential reversal.

A similar set-up occurred last week, when an outer band break caused a stall, or potential reversal.

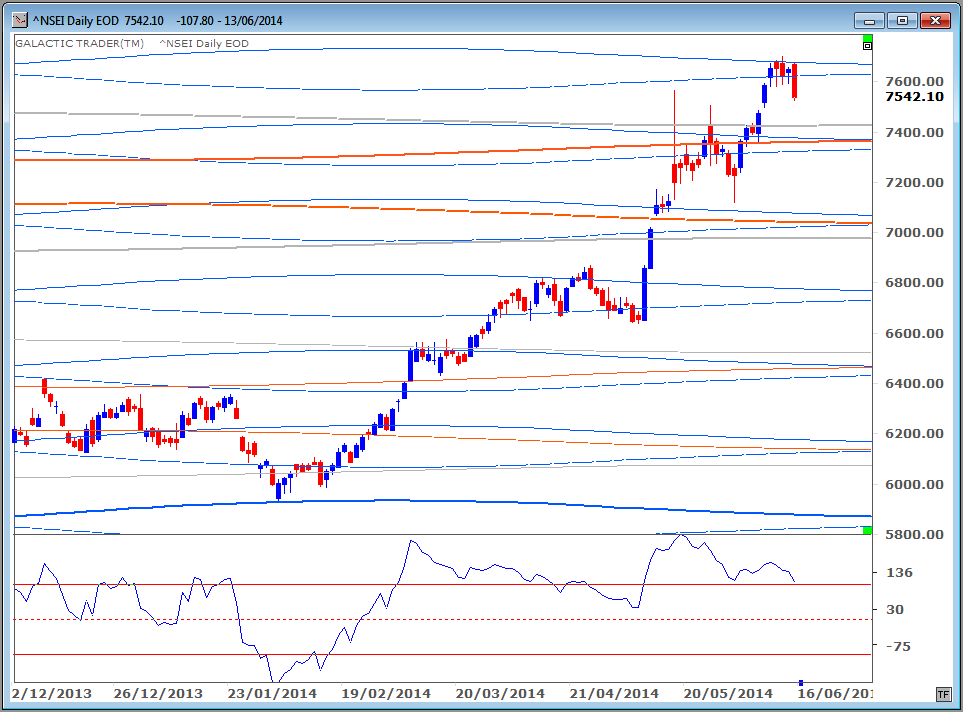

India also ran into troubles last week, failing to break past a couple of Saturn barriers on the Nifty's Weekly Planets chart. The price bars are daily, not weekly, and so is the Big Bird oscillator which was clearly disenchanted with the new price highs.

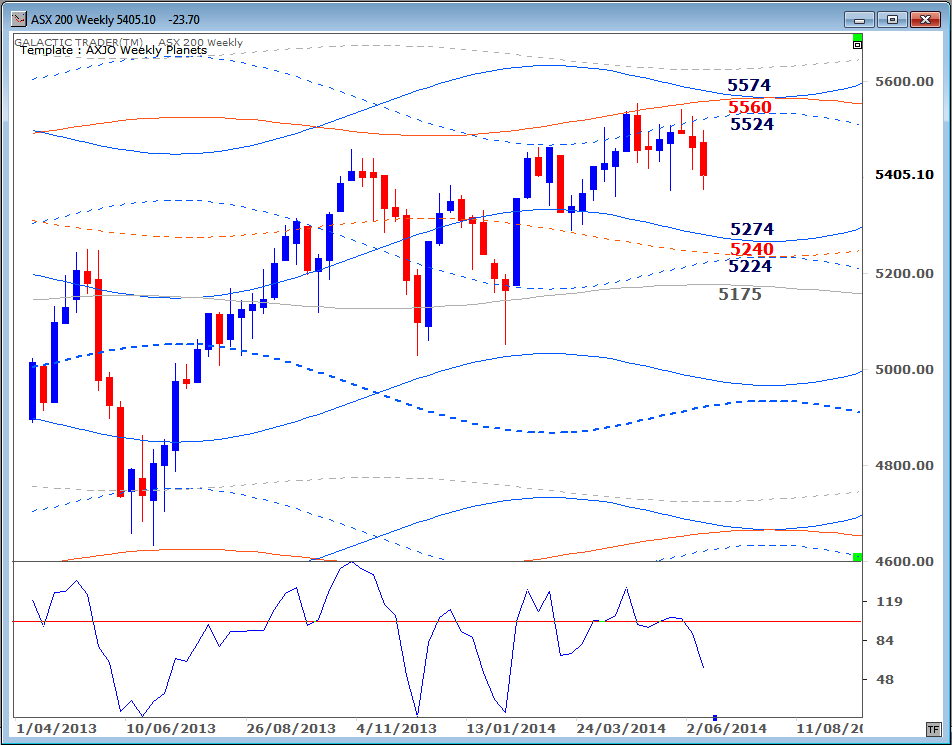

The ASX 200 has been in an intermediate downtrend, though it's really more of a sideways shuffle so far. Weekly Big Bird suggests there is more downside to come.

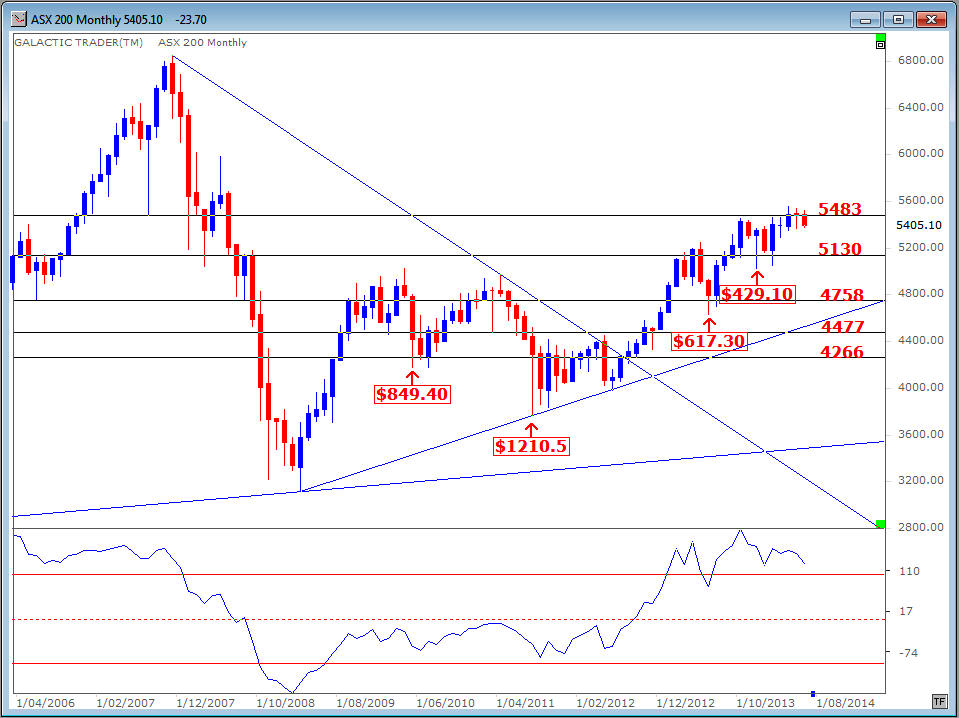

The problem for the ASX continues to be the August 2007 spike low ... a resistance barrier I've talked about before, known as hitting the last low before the high.

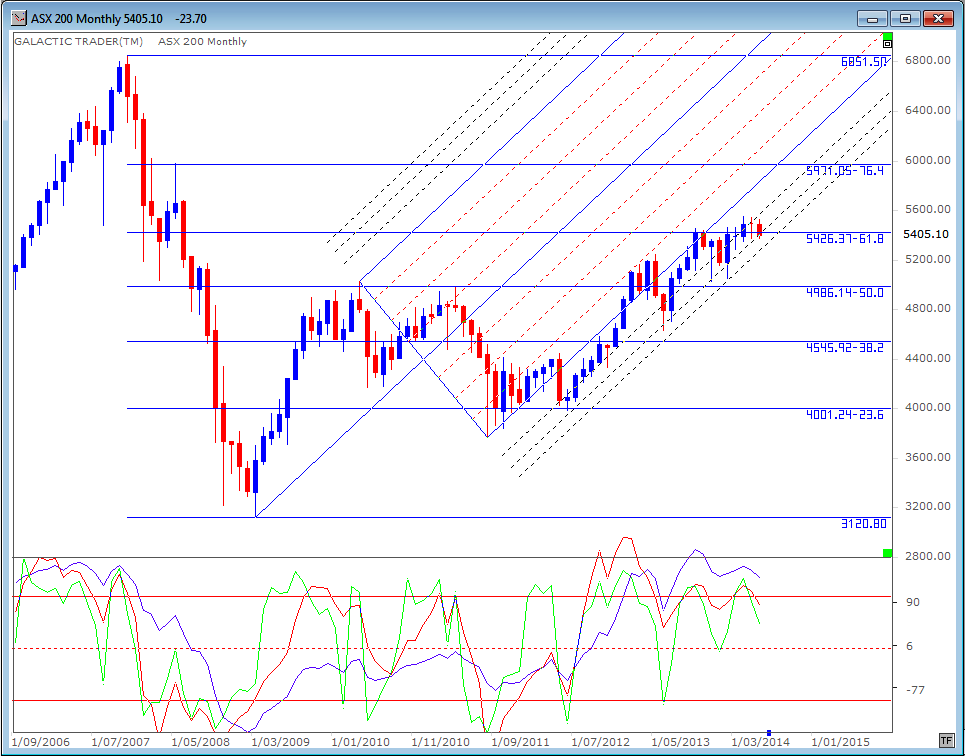

The LLBH price is not far above an important Fibonacci Retracement level. Still, in overall terms, the index is clinging to a weak uptrend, riding external Fibonacci parallels of its main pitchfork. All 3 Birds ... Fast 6, Medium 14 and Long-Range 50 ... are stacked in decline mode.

There hasn't been a monthly close below the current Fibonacci fork extension since the index fell off the main tynes.

There hasn't been a monthly close below the current Fibonacci fork extension since the index fell off the main tynes.

As stocks dropped, gold jumped ... getting a boost from holding support at the horizontal Pluto level and rising Sun. The rise brought it up to the next Pluto level.

I'm still wary about just how long this rally will last or how far it can go ... because of the technical damage done during the last big dump on the overnight markets.

I'm still wary about just how long this rally will last or how far it can go ... because of the technical damage done during the last big dump on the overnight markets.