Reviewing the correction ... and long-term

Week beginning June 10, 2013

Late in May, I indicated there was a strong chance stock markets had gone into a correction mode likely to last for several weeks.

Copyright: Randall Ashbourne - 2011-2013

Last weekend we reviewed the potential for a major trend change to develop this month - if indices continue to follow the major turning points indicated in this year's Bradley Model major dates. If you haven't read it, you can review the edition by accessing the Archives via the red button just above this paragraph.

This weekend, we'll be taking a look at the status of the current correction and looking again at where we are in a long-range context.

I indicated last weekend that Pollyanna, the SP500, was giving relatively clear signals that we are now probably within the process of topping out the Bull run which got underway in 2009.

At this stage, that's still my view. But, we'll begin this weekend by looking firstly at where we are within the correction.

This weekend, we'll be taking a look at the status of the current correction and looking again at where we are in a long-range context.

I indicated last weekend that Pollyanna, the SP500, was giving relatively clear signals that we are now probably within the process of topping out the Bull run which got underway in 2009.

At this stage, that's still my view. But, we'll begin this weekend by looking firstly at where we are within the correction.

In some markets, the correction has been deep and steep; in others the decline has been shallow. Too shallow, in fact - both in terms of time and price.

But regardless of that, we may have reached bounce levels across most of the major world indices.

But regardless of that, we may have reached bounce levels across most of the major world indices.

Safe trading - RA

(Disclaimer: This article is not advice or a recommendation to trade stocks; it is merely educational material.)

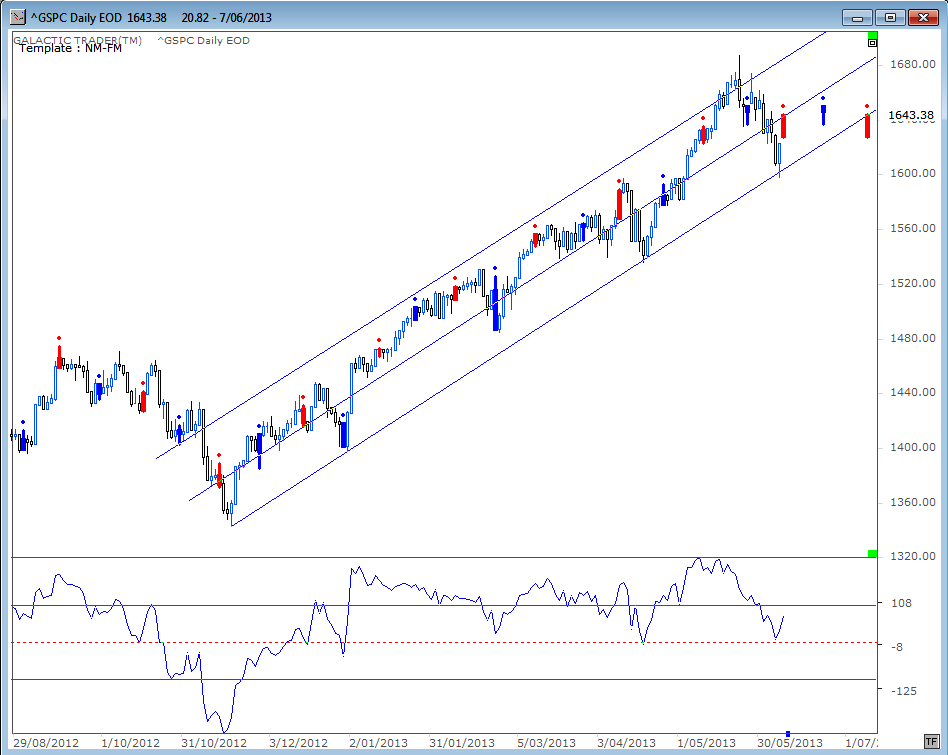

In late May, I warned against short-term traders taking the usual Long trades between Full Moon and New Moon. I wrote: "Polly has been rising in a clear channel since the Santa Claus rally got underway late last year. A breach of the upside channel line, with negative divergence in the oscillator, puts the index under threat of a retreat to retest the lower trendline."

And so it came to pass ...

Polly spiked briefly down through the lower trendline on Thursday before bouncing strongly on Friday, the last trading day before the New Moon.

And so it came to pass ...

Polly spiked briefly down through the lower trendline on Thursday before bouncing strongly on Friday, the last trading day before the New Moon.

Full Moons are the heavy blue candles, New Moons the red ones. We got a clear V-turn in the oscillator, as we did at the three previous corrections within this rising channel.

But, there's a difference ... two of the price/oscillator turns arrived at Full Moon bottoms and the third one arrived with a 1Q Moon. This bounce has arrived right on New Moon timing, when markets statistically are most bouyant. It's not unusual for rallying markets to continue rising in the statistically negative period between NM and FM, but the rises do tend to muted, at least most of the time.

So, the Friday bounce could be short-lived. We need to pay close attention to price reaction on Tuesday and Wednesday when Venus opposes Pluto and squares Uranus.

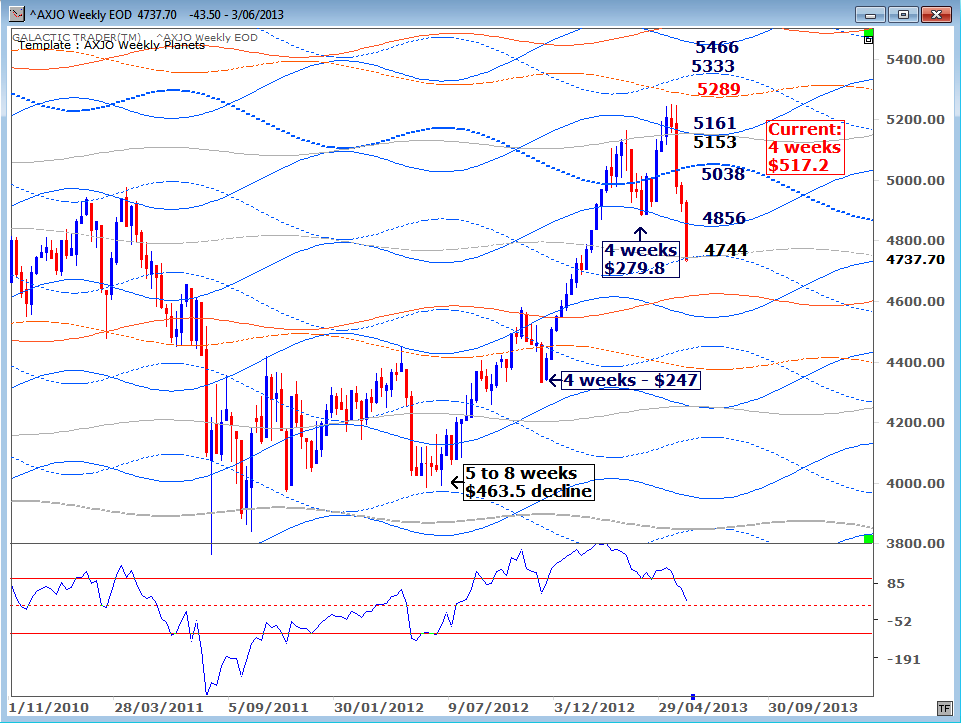

In the late May edition, I used a chart of the ASX200 as proxy for what I thought was happening and said: "Technically, it appears to be a high-level Wave 4 underway. This is the last major correction before the final rally of a Bull leg."

I had expected the Elliott Wave Theory of "alernation" to come into play - that the correction could drag out in terms of Time, without necessarily losing quite as much in Price as did the first similar-level correction within the rally out of the spike lows in August/October, 2011.

Wrong! The ASX, and some other indices, just kept diving!

But, there's a difference ... two of the price/oscillator turns arrived at Full Moon bottoms and the third one arrived with a 1Q Moon. This bounce has arrived right on New Moon timing, when markets statistically are most bouyant. It's not unusual for rallying markets to continue rising in the statistically negative period between NM and FM, but the rises do tend to muted, at least most of the time.

So, the Friday bounce could be short-lived. We need to pay close attention to price reaction on Tuesday and Wednesday when Venus opposes Pluto and squares Uranus.

In the late May edition, I used a chart of the ASX200 as proxy for what I thought was happening and said: "Technically, it appears to be a high-level Wave 4 underway. This is the last major correction before the final rally of a Bull leg."

I had expected the Elliott Wave Theory of "alernation" to come into play - that the correction could drag out in terms of Time, without necessarily losing quite as much in Price as did the first similar-level correction within the rally out of the spike lows in August/October, 2011.

Wrong! The ASX, and some other indices, just kept diving!

Forecast 2013 is now available for sale and download.

Click the button on the right for more details.

Click the button on the right for more details.

Forecast 2013 is now available for sale and download.

Click the button on the right for more details.

Click the button on the right for more details.

If this is a high-level Wave 4 correction, it has overshot the Wave 2 decline into June 2012 in terms of Price, but not yet of Time. And the index has breached the important Weekly Planets level at 4744.

That does set up the potential for a bounce from here, even in the face of the negative tendency of the NM-FM phase. It took a few weeks of bouncing about for the last correction of this level to get enough traction to start rising again. Whatever happens, the Weekly Planets price targets for a bounce are clearly marked and likely to be significant.

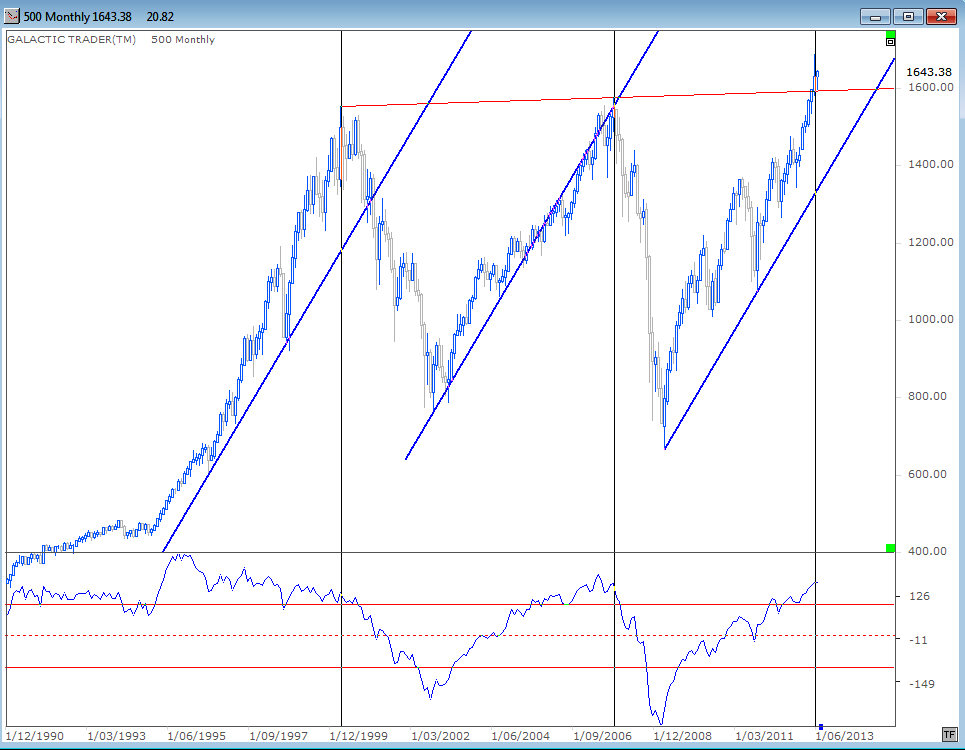

Now, let's turn our attention again to the bigger picture ... and we'll begin with a look at Pollyanna's long-range monthly. Those of you who've read The Idiot & The Moon will know that one of the techniques outlined in The Technical Section deals with how a particular stock, or index, will repeat the same angles of trend over and over again.

The chart below is simply a slight variation on that theme. I've taken the angle of the current Bull run and applied it to the two previous ones, rather than the other way around - just to see how this one is performing in comparison with the other two.

We can see fairly quickly that this Bull is more like the blow-off Tech Bubble run into 1999/2000. The 2002-2007 Bull run oscillated around this angle, rarely getting too far ahead, or too far behind the trendline.

The earlier bubble run soared away from the line and had deeper corrections to reconnect ... as has this one. The second thing to note is the thin red line connecting the 1999 and 2007 Bull peaks. And that's what Miss Polly came down to retest last week.

That does set up the potential for a bounce from here, even in the face of the negative tendency of the NM-FM phase. It took a few weeks of bouncing about for the last correction of this level to get enough traction to start rising again. Whatever happens, the Weekly Planets price targets for a bounce are clearly marked and likely to be significant.

Now, let's turn our attention again to the bigger picture ... and we'll begin with a look at Pollyanna's long-range monthly. Those of you who've read The Idiot & The Moon will know that one of the techniques outlined in The Technical Section deals with how a particular stock, or index, will repeat the same angles of trend over and over again.

The chart below is simply a slight variation on that theme. I've taken the angle of the current Bull run and applied it to the two previous ones, rather than the other way around - just to see how this one is performing in comparison with the other two.

We can see fairly quickly that this Bull is more like the blow-off Tech Bubble run into 1999/2000. The 2002-2007 Bull run oscillated around this angle, rarely getting too far ahead, or too far behind the trendline.

The earlier bubble run soared away from the line and had deeper corrections to reconnect ... as has this one. The second thing to note is the thin red line connecting the 1999 and 2007 Bull peaks. And that's what Miss Polly came down to retest last week.

The third thing on the chart to consider is the state of the long-range Canary - the Big Bird. I've inserted a black vertical into the price of the two previous Bull peaks and at the current May peak in Pollyanna. And I repeat the point I made last weekend. The Canary is not dropping off its perch.

The negative divergence build-up going into the first Bull peak developed over a long period. There was a shorter, but nevertheless clear, warning at the 2007 peaks. And, at the moment, we just don't have it for the current Bull run.

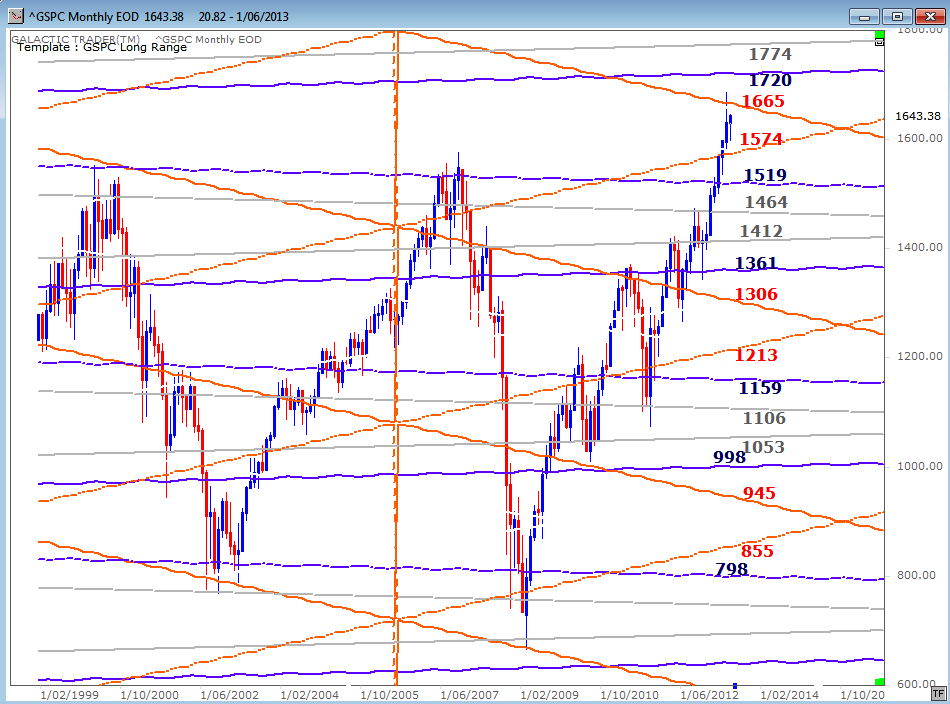

Now, let's review where we are in terms of Polly's long-range planetary price markers. I confess I had fully expected Pollyanna to go into a major swoon and exit the stage for a major Chicken Little performance as the index hit the levels between 1464 and 1519.

I'm a fool. Not an Idiot ... because The Idiot and Big Bird continually disagreed with my "astrological expectations". What can I say? The Idiot and that bloody Bird are always a lot smarter than I am!

The negative divergence build-up going into the first Bull peak developed over a long period. There was a shorter, but nevertheless clear, warning at the 2007 peaks. And, at the moment, we just don't have it for the current Bull run.

Now, let's review where we are in terms of Polly's long-range planetary price markers. I confess I had fully expected Pollyanna to go into a major swoon and exit the stage for a major Chicken Little performance as the index hit the levels between 1464 and 1519.

I'm a fool. Not an Idiot ... because The Idiot and Big Bird continually disagreed with my "astrological expectations". What can I say? The Idiot and that bloody Bird are always a lot smarter than I am!

Yes, yes. It's enough to give one the ... uhm, irrits. The truly sad thing is that even knowing The Idiot and Big Bird are smarter than I am, I still make that fatal trading error of "thinking" ... even after having gone to the trouble of putting it all in a book so that I, and you, would just shut-up and do what our charts tell us to do, rather than trying to anticipate them. Some lessons are very s-l-o-w-l-y learned!

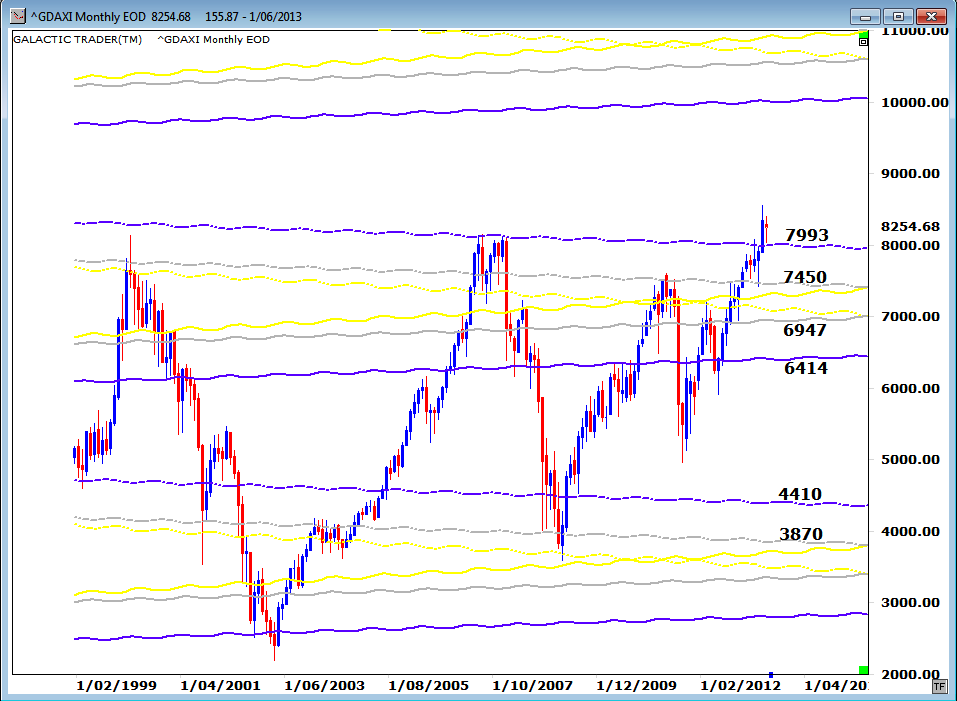

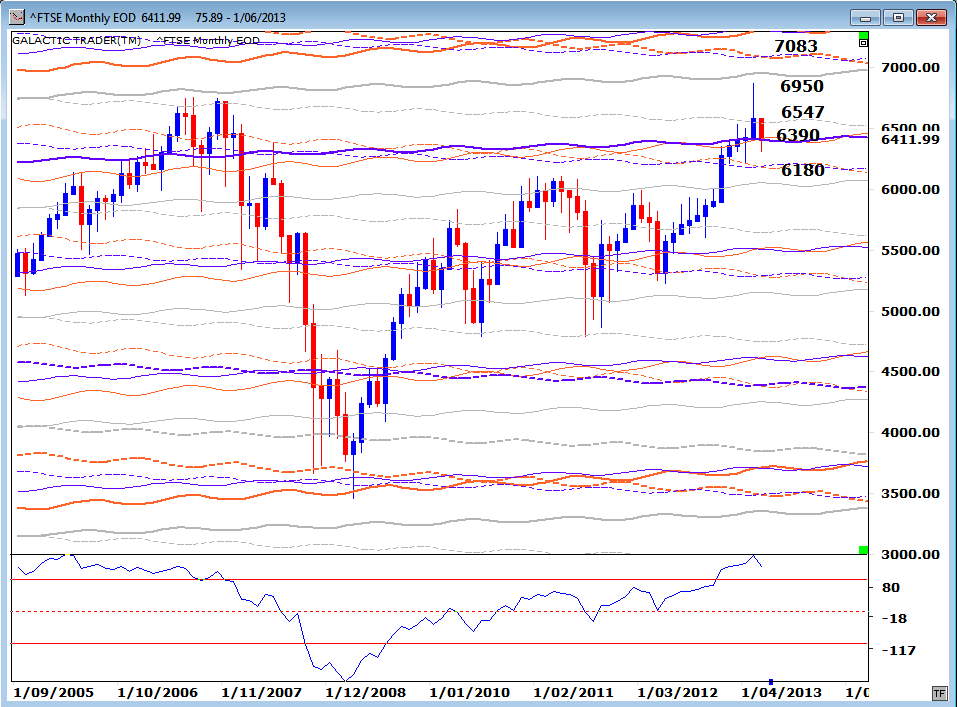

Ah, well. No time to wallow. Let's take a quick look at the long-range planetary charts for the FTSE and the DAX.

Germany is behaving like Pollyanna, trying desperately to hold onto the long-range breakout level.

Ah, well. No time to wallow. Let's take a quick look at the long-range planetary charts for the FTSE and the DAX.

Germany is behaving like Pollyanna, trying desperately to hold onto the long-range breakout level.

While London went into a deeper dive ...

Next weekend we'll have another look at what's happening with the Asian indices.

Overall though, we can see that stock indices have declined into apparent bounce levels. Shallow, but obvious, in the case of Pollyanna and the DAX. Deeper, but still obvious, for the ASX and FTSE.

The Bradley Model suggests markets should continue their rally phase into later in June.

And personally I believe that what is "normal" is that indices are now within a topping process where we are going to get jerked around for a few months ... before the Bear comes back. This certainly appears to be a Bernanke-blown bubble. Every piece of bad economic news is greeted as good news because benign Ben will stretch out his QE4-ever program.

I think we getting a taste of it. The slightest hint that the Fed might pull back, and the addicts suffer withdrawal shakes. However, I reiterate my earlier point. "Thinking" just isn't the best tool for trading stock markets. Trendlines, an Idiot and a silly bloody Canary tend to be a lot better at it.

Overall though, we can see that stock indices have declined into apparent bounce levels. Shallow, but obvious, in the case of Pollyanna and the DAX. Deeper, but still obvious, for the ASX and FTSE.

The Bradley Model suggests markets should continue their rally phase into later in June.

And personally I believe that what is "normal" is that indices are now within a topping process where we are going to get jerked around for a few months ... before the Bear comes back. This certainly appears to be a Bernanke-blown bubble. Every piece of bad economic news is greeted as good news because benign Ben will stretch out his QE4-ever program.

I think we getting a taste of it. The slightest hint that the Fed might pull back, and the addicts suffer withdrawal shakes. However, I reiterate my earlier point. "Thinking" just isn't the best tool for trading stock markets. Trendlines, an Idiot and a silly bloody Canary tend to be a lot better at it.