The Dow drop ... a major top may be in

Week beginning July 28, 2014

Several major stock indices in North America and Asia hit new highs last week.

Copyright: Randall Ashbourne - 2011-2014

It is possible the Pollyanna index, the SP500, peaked on Thursday with the Sun's conjunction to Jupiter in the early degrees of Leo.

There could be an attempt at new highs on Monday when Venus opposes Pluto. Monday will be one of two major action days in the coming week.

The second will come on Friday when Venus trines Saturn and squares Uranus and Mars makes a square aspect with Jupiter.

And, of course, we're now moving past the statistical bouyancy of the New Moon.

There could be an attempt at new highs on Monday when Venus opposes Pluto. Monday will be one of two major action days in the coming week.

The second will come on Friday when Venus trines Saturn and squares Uranus and Mars makes a square aspect with Jupiter.

And, of course, we're now moving past the statistical bouyancy of the New Moon.

But it wasn't universal, especially in Europe, and there is a danger that the grand daddy of stock indices, the Dow Jones Industrials, began a significant, intermediate downtrend from its all-time closing high on July 16, right on the July 14-16 major Bradley turn date I discussed in the July 7 edition.

Safe trading - RA

(Disclaimer: This article is not advice or a recommendation to trade stocks; it is merely educational material.)

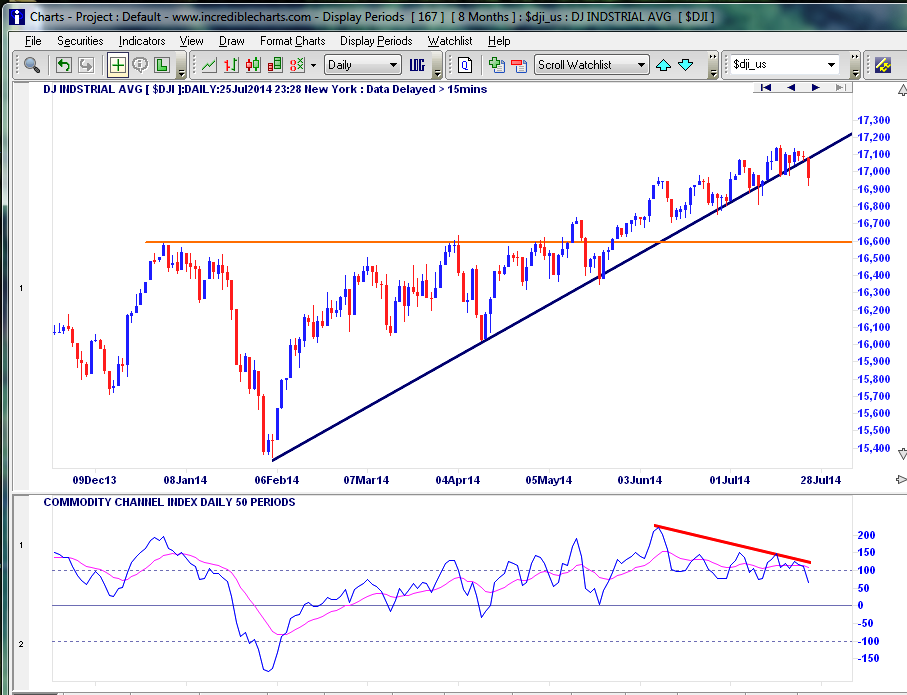

This weekend's report will be relatively brief because there's really only one stock chart that's important ... the DJI itself. On Friday, it closed decisively below the rising trendline which has supported the entire rally after the sudden January drop.

For the past few weeks, the rally has climbed the trendline while Big Bird, the 50CCI, went in the other direction, a fairly clear and obvious example of building negative divergence warning of danger.

For the past few weeks, the rally has climbed the trendline while Big Bird, the 50CCI, went in the other direction, a fairly clear and obvious example of building negative divergence warning of danger.

Pollyanna is still trading within the 1950s to 2003 range I discussed last weekend, but if the Dow is breaking down, the rest of Wall Street will be quick to follow.

And so will everybody else, including the Canadians. The German DAX looks as if it peaked a few weeks ago at the 10,000 level I'd warned was likely to prove a major barrier.

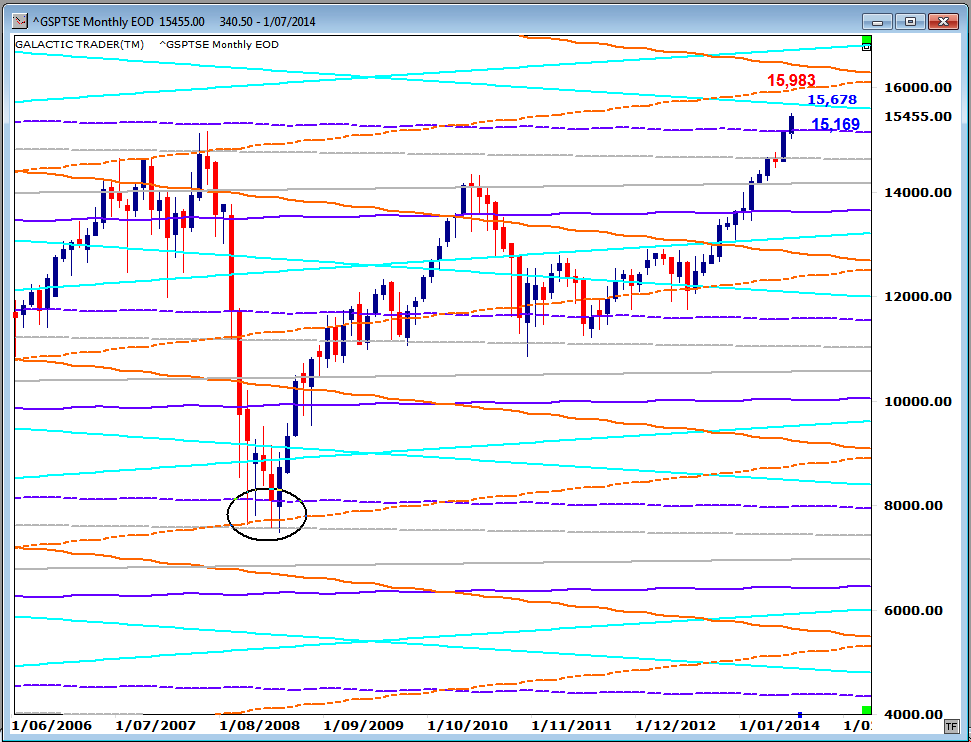

Toronto's strong run has taken it well inside the "zone" I indicated could turn out to be "it" for this Bull run. That zone runs from the early to high 15,000s. It's a Pluto-Node price zone, a higher level of a similar zone which put a stop to the last big Bear drop.

And so will everybody else, including the Canadians. The German DAX looks as if it peaked a few weeks ago at the 10,000 level I'd warned was likely to prove a major barrier.

Toronto's strong run has taken it well inside the "zone" I indicated could turn out to be "it" for this Bull run. That zone runs from the early to high 15,000s. It's a Pluto-Node price zone, a higher level of a similar zone which put a stop to the last big Bear drop.

The ASX 200 finally broke through the $5533 Saturn barrier on its weekly planets chart and finished the past week above the $5565 Saturn-Uranus price lines. It's a breakout, giving the index its highest weekly Close since the bottom of the last Bear.

This week and next should tell us whether it's a "false break" or the real thing. If it's a fake-out, there'll be a fast drop immediately ahead. If it's real, the negative period between New Moon and Full Moon should not cause major damage. You can check the major price levels on last weekend's chart in the Archives.

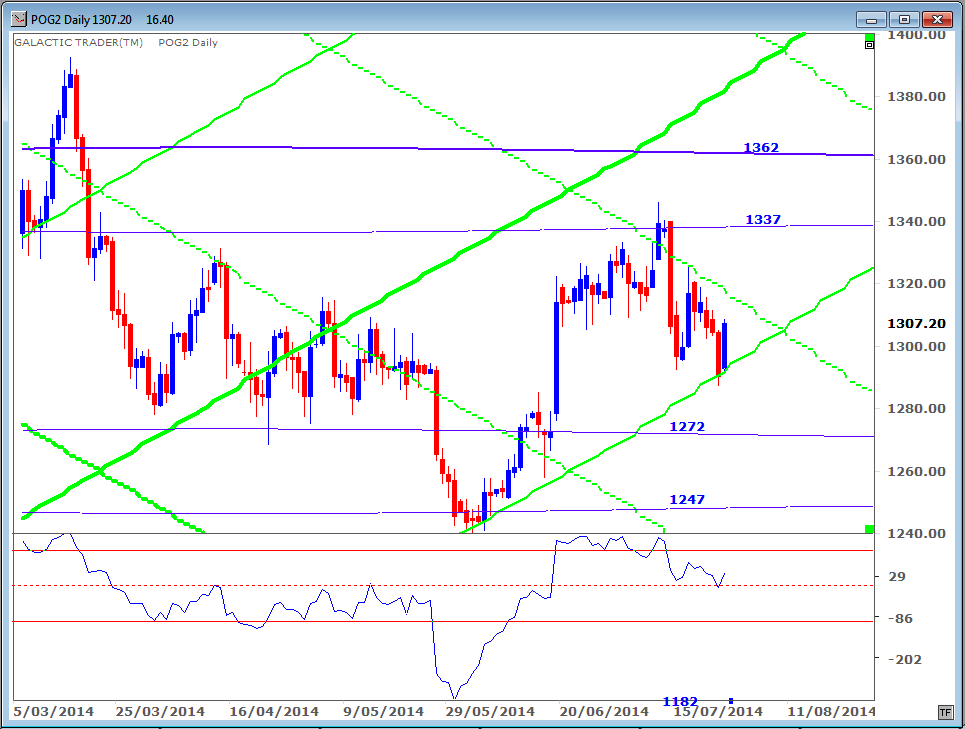

Now, if stocks are going down, gold should head north again. Again, check last weekend's edition for the overall picture if you missed it. There are two fairly clear signs that the gold Bear went back into hibernation with the double-bottom during 2013.

There was another attempt to drive gold lower last week, but it seems to have run out of steam with a false break of a rising Sun line.

This week and next should tell us whether it's a "false break" or the real thing. If it's a fake-out, there'll be a fast drop immediately ahead. If it's real, the negative period between New Moon and Full Moon should not cause major damage. You can check the major price levels on last weekend's chart in the Archives.

Now, if stocks are going down, gold should head north again. Again, check last weekend's edition for the overall picture if you missed it. There are two fairly clear signs that the gold Bear went back into hibernation with the double-bottom during 2013.

There was another attempt to drive gold lower last week, but it seems to have run out of steam with a false break of a rising Sun line.

If the optimistic scenario for gold is now in play, the take-off from here should be fast and it should blow past previous highs with very little hesitation until it hits the mid 1400s.

It's too early to say whether it's now certain we're entering correction mode for stock indices, or how deep the correction will be. But the Dow has fired a warning shot and the DAX looks as if it's in dive mode, so there is "clear and present danger".

It's too early to say whether it's now certain we're entering correction mode for stock indices, or how deep the correction will be. But the Dow has fired a warning shot and the DAX looks as if it's in dive mode, so there is "clear and present danger".