Germany joins the USA in all-time Highs

Week beginning December 8, 2014

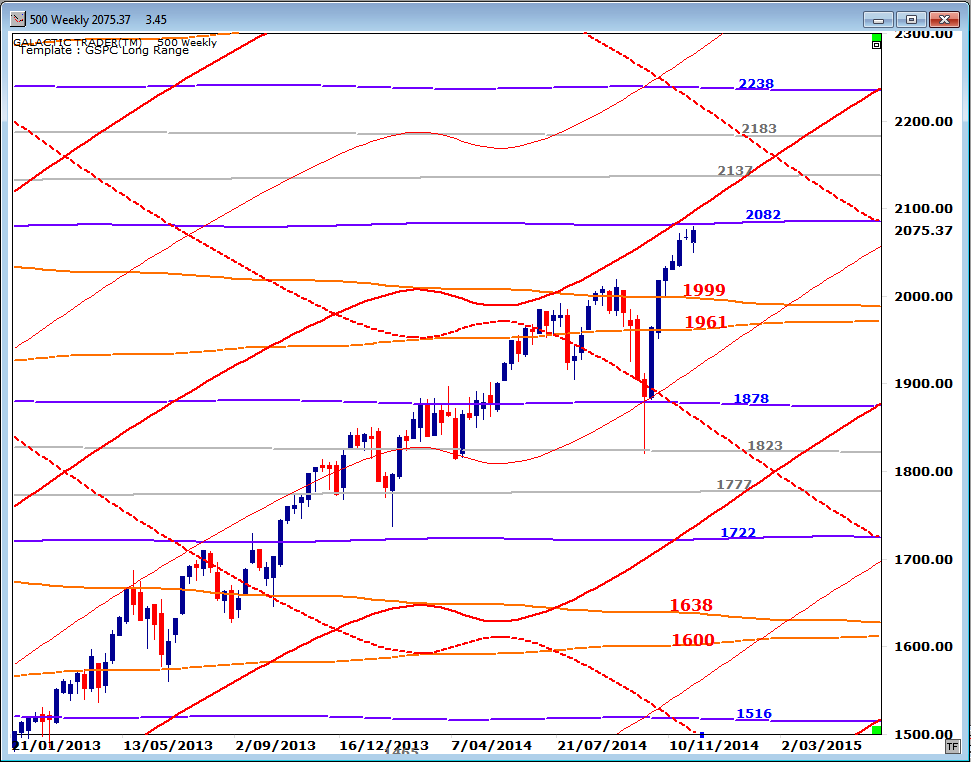

Wall Street continues to make marginal new Highs, though the SP 500 is still shy of touching a major planetary price barrier at 2082.

Copyright: Randall Ashbourne - 2011-2014

Europe, especially Germany, is now bouncing back from weakness earlier in the year. You might recall that some months ago we talked about the DAX running into long-range overhead planetary price resistance.

It was strong enough to send the DAX into a multi-month downfall. However, the pick-up in performance since the low in mid-October has lifted the German market back into the same territory.

European traders are hopeful that the ECB will now follow Japan, taking over monetary expansion from the US Federal Reserve.

We'll look at the key levels now.

It was strong enough to send the DAX into a multi-month downfall. However, the pick-up in performance since the low in mid-October has lifted the German market back into the same territory.

European traders are hopeful that the ECB will now follow Japan, taking over monetary expansion from the US Federal Reserve.

We'll look at the key levels now.

Trading on Wall Street was relatively subdued last week, despite some strong astrological aspects involving Jupiter and Uranus.

There are more of them to come, especially over the next week when Jupiter goes Retrograde, Venus moves to Capricorn, the Sun trines Jupiter ... and we get another exact hit of Uranus square Pluto.

There are more of them to come, especially over the next week when Jupiter goes Retrograde, Venus moves to Capricorn, the Sun trines Jupiter ... and we get another exact hit of Uranus square Pluto.

Safe trading - RA

(Disclaimer: This article is not advice or a recommendation to trade stocks; it is merely educational material.)

Below is the long-range planetary price chart for the DAX. Midway through 2014, the index ran into the Pluto barrier priced in the early 10,000s, prompting a strong correction.

The index is now making another attempt to breakout northwards. At this stage, the Bird Bird oscillator seems very dubious.

The index is now making another attempt to breakout northwards. At this stage, the Bird Bird oscillator seems very dubious.

The SP500 continues to fall just short of touching its overhead Pluto barrier in the early 2080s. It's entirely possible the resistance could be breached by a gap Open, opening potential targets in the 2100s.

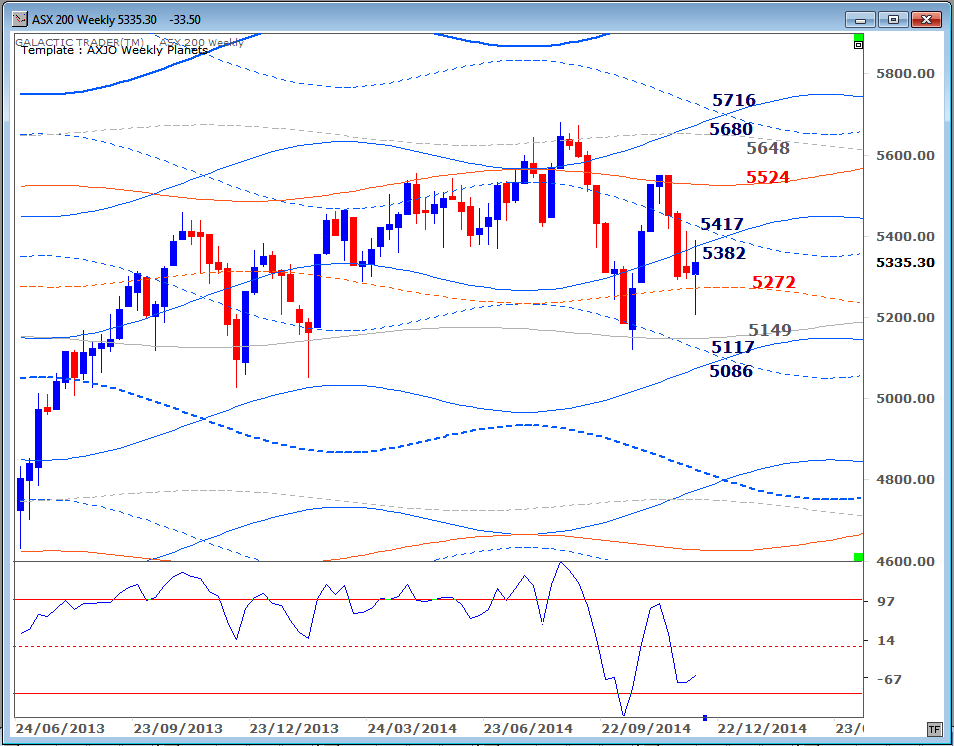

A couple of weeks ago, we discussed the under-performance of the ASX200 and I suggested a Uranus price line, then priced at 5270 could provide a stronger level of support.

The index had a one-day dive below the level last Monday, but recovered the following morning. The weekly resistance from Saturn lines around 5382 and 5417 need to be overcome before the index has a chance of challenging the August highs.

The index had a one-day dive below the level last Monday, but recovered the following morning. The weekly resistance from Saturn lines around 5382 and 5417 need to be overcome before the index has a chance of challenging the August highs.