One swallow does not a summer make

Week beginning April 7, 2014

And Friday's rather dramatic turnaround for Wall Street stocks ... and gold ... doesn't necessarily signal The Turn for either of them.

Copyright: Randall Ashbourne - 2011-2014

We have been discussing for some time, in the Eye and in Forecast 2014, the special danger posed by April ... and that danger has been growing because of the negative divergence building in the oscillators on weekly and monthly charts.

We'll concentrate this weekend on trying to work out whether this is just another part of the big boys' game, or whether the tide has finally turned.

Normally, I do not give too much weight to a single day's trading. But, if this one is a real "false break", it could be the start of a major downswing that could get very ugly for those caught unprepared.

We'll concentrate this weekend on trying to work out whether this is just another part of the big boys' game, or whether the tide has finally turned.

Normally, I do not give too much weight to a single day's trading. But, if this one is a real "false break", it could be the start of a major downswing that could get very ugly for those caught unprepared.

It is possible, for a whole range of reasons on both technical and astrological levels.

But we are dealing in both cases with markets that are heavily manipulated.

But we are dealing in both cases with markets that are heavily manipulated.

Safe trading - RA

(Disclaimer: This article is not advice or a recommendation to trade stocks; it is merely educational material.)

We'll deal firstly with something I warned about in Forecast 2014 and have discussed specifically a couple of times in the Eye this year, including only last weekend.

We looked last weekend at last week's Sun transits to Jupiter, Uranus and Pluto as a possible precursor to what might happen later in April when Mars, Jupiter, Uranus and Pluto align in a Cardinal Grand Square. You might want to refresh your memory by reading last weekend's edition again.

There is a chance that those Sun transits have acted as a "trigger". So, let's begin this weekend by looking at the bigger transits, the major component of which is Jupiter in Cancer opposing Pluto in Capricorn while squaring Uranus in Aries.

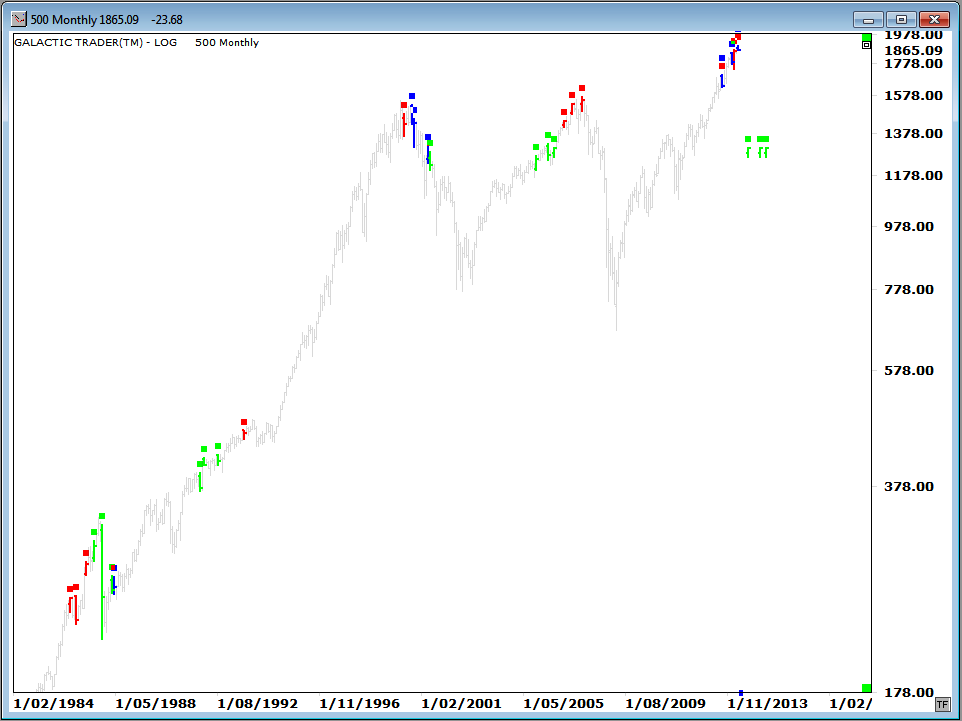

The first chart is a multi-decade view of the SP500 with Jupiter square Uranus marked in red bars, Jupiter trine Uranus marked in green bars, and Jupiter opposed Pluto in blue bars.

As I've indicated before ... these are dangerous. In one guise or another they were there leading into the 1987 flash crash and again at the two previous Bull market peaks.

We looked last weekend at last week's Sun transits to Jupiter, Uranus and Pluto as a possible precursor to what might happen later in April when Mars, Jupiter, Uranus and Pluto align in a Cardinal Grand Square. You might want to refresh your memory by reading last weekend's edition again.

There is a chance that those Sun transits have acted as a "trigger". So, let's begin this weekend by looking at the bigger transits, the major component of which is Jupiter in Cancer opposing Pluto in Capricorn while squaring Uranus in Aries.

The first chart is a multi-decade view of the SP500 with Jupiter square Uranus marked in red bars, Jupiter trine Uranus marked in green bars, and Jupiter opposed Pluto in blue bars.

As I've indicated before ... these are dangerous. In one guise or another they were there leading into the 1987 flash crash and again at the two previous Bull market peaks.

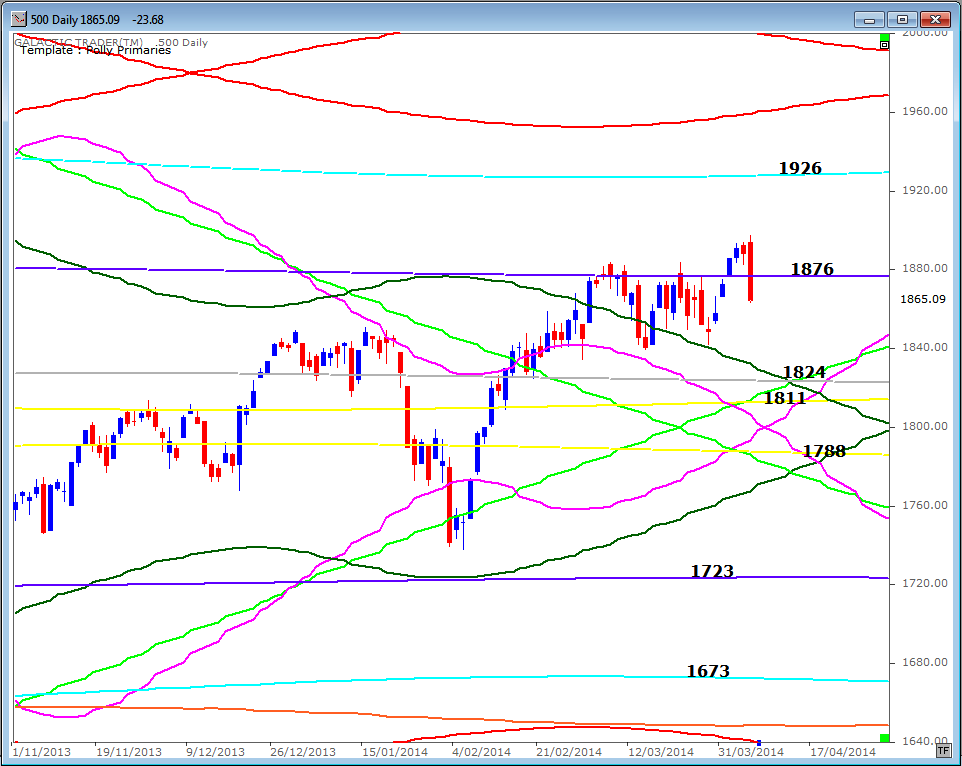

We can zero-in on the next chart to get a closer view. We are now in the month of Jupiter's third and final "hit" of squaring Uranus AND it concides with an opposition to Pluto. In 2000, the Bear had started to bite with the red square to Uranus and then the real mauling began with the first of the blue oppositions to Pluto.

The third hit of the square to Uranus in 2007 brought the Bull top and a rapid Bear mauling. Now we have the same aspects again.

The third hit of the square to Uranus in 2007 brought the Bull top and a rapid Bear mauling. Now we have the same aspects again.

NEW:

Forecast 2014 is now available for sale and download.

Click the button on the right for more details.

Click the button on the right for more details.

On top of those omens, we have what might be a "false break". This is when price temporarily breaks through an important barrier and goes into a sudden and largely unexpected reversal. False breaks always provoke very fast moves in the opposite direction. A number of times this year we've discussed the real trouble Pollyanna was having trying to break free of an overhead primary Pluto barrier on her daily charts.

Last Tuesday, the overnight computers went to work - forcing a gap Open on the index to get it above that barrier. But, it didn't last.

Last Tuesday, the overnight computers went to work - forcing a gap Open on the index to get it above that barrier. But, it didn't last.

And that's what makes Friday's action ... a new, all-time High, followed by a fast and dramatic reversal ... so dangerous. Because, that Pluto line is an important long-range barrier, not just a daily hurdle.

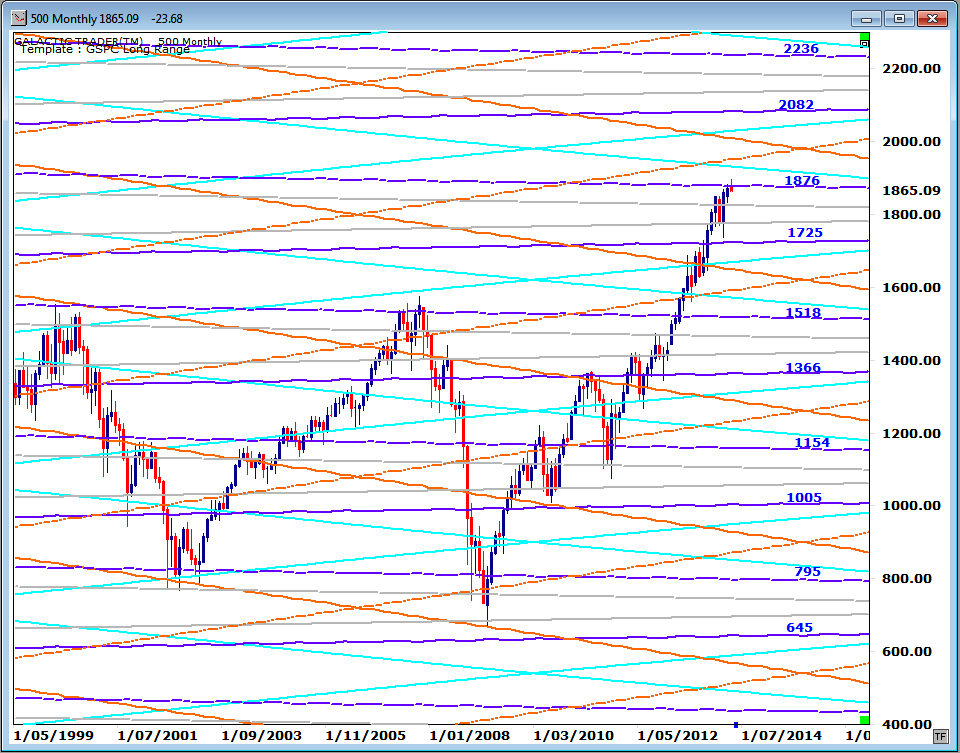

The two previous Bull peaks also occurred at a long-range Pluto line. Trace backwards the one marked with the $1518 price tag and you'll see what I mean.

The two previous Bull peaks also occurred at a long-range Pluto line. Trace backwards the one marked with the $1518 price tag and you'll see what I mean.

The upshot of all this is basically what I said in last weekend's headline ... April may be "it". Let's not get married to the idea to the exclusion of all else.

It is, so far, just a single day's trade. But, if this is a real false break, the stock markets could turn really ugly, really fast.

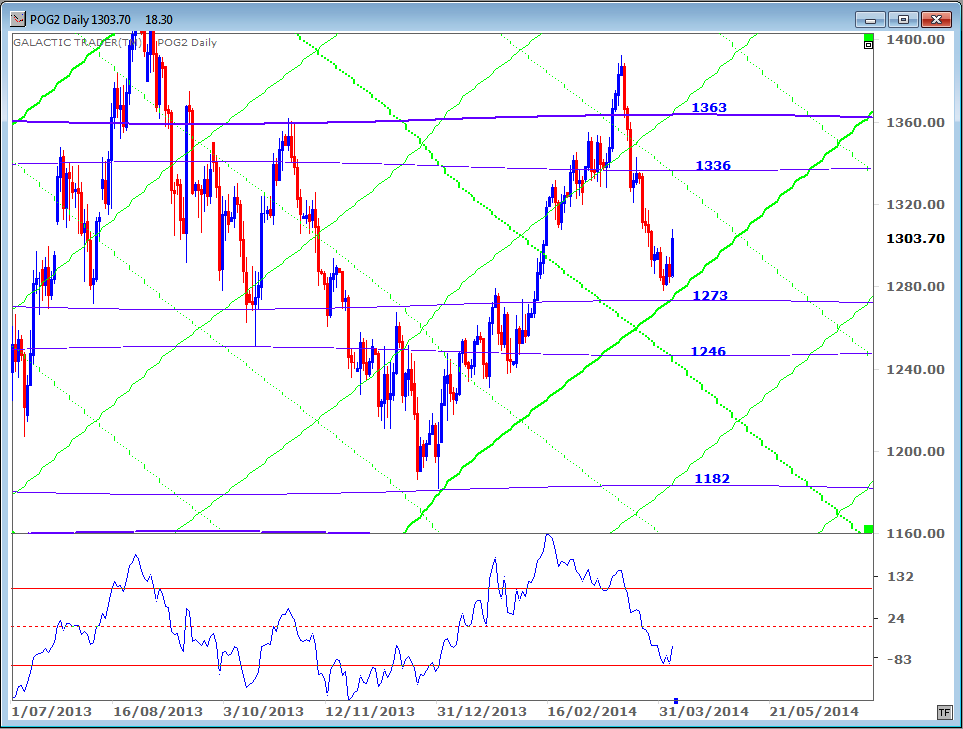

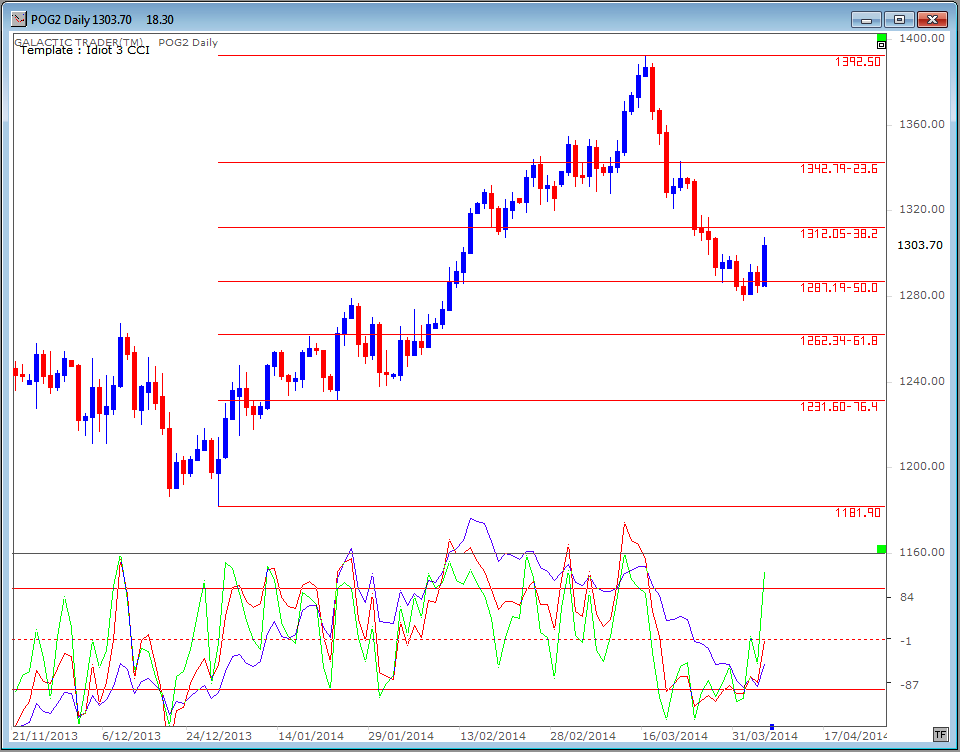

On the flip side, gold has turned northwards within the fairly narrow price range we anticipated should bring about a bounce. All of the big picture stuff is in the special gold report I sent out a couple of weeks ago.

You know I was expecting a down move to retest the validity of the rising primary Sun line - and that, too, is in last weekend's edition.

Here is the update.

It is, so far, just a single day's trade. But, if this is a real false break, the stock markets could turn really ugly, really fast.

On the flip side, gold has turned northwards within the fairly narrow price range we anticipated should bring about a bounce. All of the big picture stuff is in the special gold report I sent out a couple of weeks ago.

You know I was expecting a down move to retest the validity of the rising primary Sun line - and that, too, is in last weekend's edition.

Here is the update.

We talked about a potential hit of the $1273 level, the intersection of a secondary Pluto horizontal with the rising Sun line. And I also said: "There is no guarantee it will be hit, however, since Friday bounced from another "obvious" level - the 50% retracement marker of the post-December rally. This could be an important level, and if it can hold, leaves gold in a position to mount another strong rally leg."

And here's what happened.

And here's what happened.

The 50% retracement level was broken by only a small amount and only relatively briefly. It is another example of what happens with a "false break".

As I said last weekend, the 3 Birds in the oscillator panel were signalling a potential turnaround in the gold price and that the Birds were already stacked in approaching rally mode for a lot of individual gold mining stocks. And now they're stacked that way for gold itself.

It's too early to say with any real degree of certainty that the long-range tides have turned for both stocks and gold. But the evidence for exactly that scenario has been building for quite some time - and much moreso on stock indices other than those on Wall Street.

Individually, we need now to check the charts - monthly, weekly and daily - on all the stocks we are holding.

And we need to remember the very first rule of survival: Always protect your capital.

As I said last weekend, the 3 Birds in the oscillator panel were signalling a potential turnaround in the gold price and that the Birds were already stacked in approaching rally mode for a lot of individual gold mining stocks. And now they're stacked that way for gold itself.

It's too early to say with any real degree of certainty that the long-range tides have turned for both stocks and gold. But the evidence for exactly that scenario has been building for quite some time - and much moreso on stock indices other than those on Wall Street.

Individually, we need now to check the charts - monthly, weekly and daily - on all the stocks we are holding.

And we need to remember the very first rule of survival: Always protect your capital.